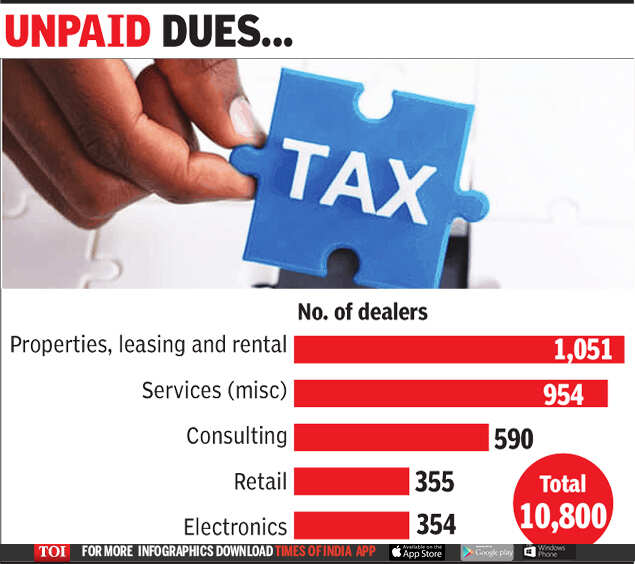

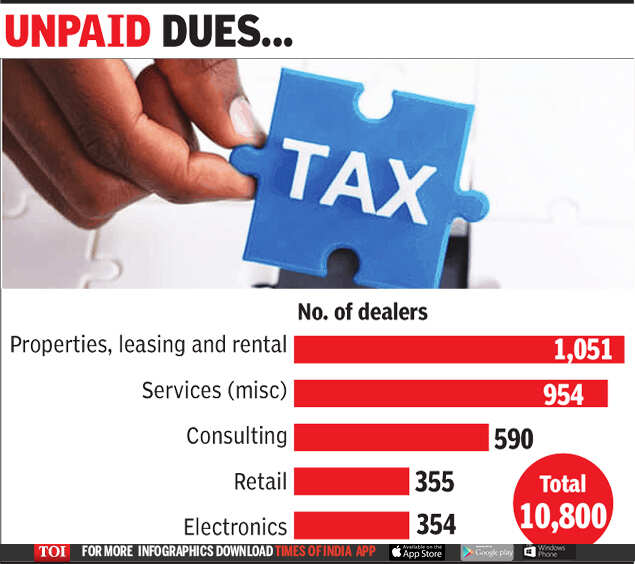

NEW DELHI: Around 10,800 companies either defaulted or paid less tax to Delhi government from January to March this year, which resulted in funding of the Covid-19 fight and public welfare works getting hampered. Deputy chief minister Manish Sisodia on Tuesday appealed to all companies to immediately deposit their taxes and warned that stringent action would be taken against defaulters.

Till now, the trade and taxes department has evaluated 15,000 companies, but scrutiny of all 7 lakh companies registered under GST would be done soon. The department was able to recover Rs 10 crore from two defaulting companies in the last one week.

Sisodia said the companies had collected money from the public, but hadn’t deposited it with the government. “This will affect development work, including the fight against the pandemic. Delhi government will take stringent action against companies that fail to deposit the full amount of tax,” he added.

Notices have been issued to 111 liquor companies for not paying VAT from January to March. Last week, three major search operations were conducted against defaulters, including marble and granite companies and bulk taxpayers. Tax amounting to Rs 20.7 lakh was collected from them. In one caseḤ, the company’s office was sealed. In another case, the company’s papers were confiscated.

Action was also taken against firms moving goods without carrying e-way bills. Since June 23, around 140 vehicles have been detained and Rs 1 crore collected from them as taxes and penalty.

From January to March, Delhi government received Rs 2,015 crore less tax compared with last year. In 2019, around Rs 5,792 crore was collected as tax, but this year it was only Rs 3,777 crore. The state’s budget has more than doubled over the past five years owing to plugging the leaks in tax collection. Since the government is staring at a revenue crisis, it has become far more important now to curb it.

An analysis of 15,000 high turnover taxpayers revealed that nearly 970 of them registered under GST of both the Centre and state hadn’t filed returns for the fourth quarter of 2019-20 and first quarter of 2020-21. The extended period granted for filing of GST returns for the first quarter of 2020-21 got over in July 2020.

The analysis was started to catch defaulters. Taking cognisance of the findings, a list of defaulters has been prepared by Delhi government. The department is also analysing the payment profile of such taxpayers from the returns filed in the previous quarters.

The department has started issuing notices under Form 3A to the defaulting 10,800 taxpayers for filing late returns. In case they fail to file their returns within the prescribed time of 15 days, further action would be taken against them.

Till now, the trade and taxes department has evaluated 15,000 companies, but scrutiny of all 7 lakh companies registered under GST would be done soon. The department was able to recover Rs 10 crore from two defaulting companies in the last one week.

Sisodia said the companies had collected money from the public, but hadn’t deposited it with the government. “This will affect development work, including the fight against the pandemic. Delhi government will take stringent action against companies that fail to deposit the full amount of tax,” he added.

Notices have been issued to 111 liquor companies for not paying VAT from January to March. Last week, three major search operations were conducted against defaulters, including marble and granite companies and bulk taxpayers. Tax amounting to Rs 20.7 lakh was collected from them. In one caseḤ, the company’s office was sealed. In another case, the company’s papers were confiscated.

Action was also taken against firms moving goods without carrying e-way bills. Since June 23, around 140 vehicles have been detained and Rs 1 crore collected from them as taxes and penalty.

From January to March, Delhi government received Rs 2,015 crore less tax compared with last year. In 2019, around Rs 5,792 crore was collected as tax, but this year it was only Rs 3,777 crore. The state’s budget has more than doubled over the past five years owing to plugging the leaks in tax collection. Since the government is staring at a revenue crisis, it has become far more important now to curb it.

An analysis of 15,000 high turnover taxpayers revealed that nearly 970 of them registered under GST of both the Centre and state hadn’t filed returns for the fourth quarter of 2019-20 and first quarter of 2020-21. The extended period granted for filing of GST returns for the first quarter of 2020-21 got over in July 2020.

The analysis was started to catch defaulters. Taking cognisance of the findings, a list of defaulters has been prepared by Delhi government. The department is also analysing the payment profile of such taxpayers from the returns filed in the previous quarters.

The department has started issuing notices under Form 3A to the defaulting 10,800 taxpayers for filing late returns. In case they fail to file their returns within the prescribed time of 15 days, further action would be taken against them.

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

Watch: CM Yogi lights earthen lamps at residence as part of 'deepotsav'

Watch: CM Yogi lights earthen lamps at residence as part of 'deepotsav'  'Wanted to teach Hindus a lesson' using political power, ex-AAP councillor Tahir Hussain confesses

'Wanted to teach Hindus a lesson' using political power, ex-AAP councillor Tahir Hussain confesses  48-hour countdown to Ram Mandir Bhumi Pujan in Ayodhya; invitation cards sent

48-hour countdown to Ram Mandir Bhumi Pujan in Ayodhya; invitation cards sent  UP CM Yogi Adityanath takes stock of preparations in Ayodhya ahead of Ram Temple bhumi pujan ceremony

UP CM Yogi Adityanath takes stock of preparations in Ayodhya ahead of Ram Temple bhumi pujan ceremony

More from TOI

Navbharat Times

Featured Today in Travel

Get the app