Citi has maintained a buy call on the stock with a target of Rs 230 per share. The positive stance is predicated on an increase in demand for replacement batteries.

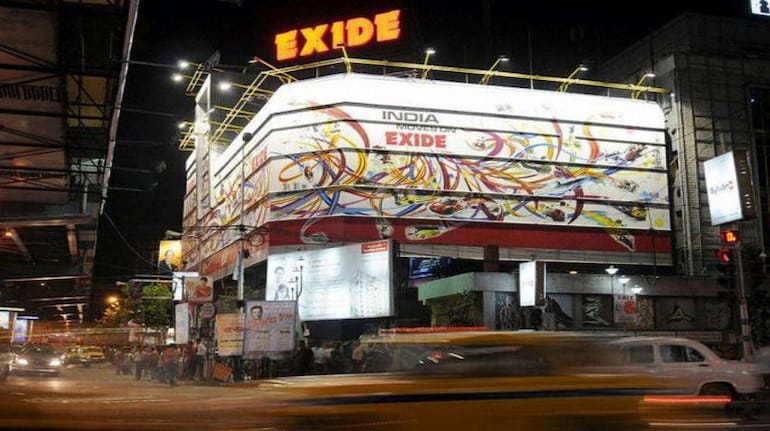

Battery maker Exide Industries share price jumped over 4 percent intraday on August 4 after Citi maintained a 'buy' call on the stock.

The company reported a consolidated net loss of Rs 13.56 crore in the quarter ended June 30, 2020 due to disruptions caused by the coronavirus pandemic. It had posted a net profit of Rs 161.58 crore in the corresponding quarter a year ago.

Total income during the quarter stood at Rs 2,537.55 crore as against Rs 3,691.33 crore in the quarter ended June 30, 2019, Exide Industries said in a BSE filing.

Global research firm Citi has maintained a buy call on the stock with the target of Rs 230 per share. It is of the view that a positive stance is predicated on increased demand for replacement batteries, CNBC-TV18 reported.

The research firm values the company's core business at 18X FY22E EPS which translates to Rs 185 against Rs 170 earlier, the report added.

The stock price was trading at Rs 160.35, up Rs 5.85, or 3.79 percent. It has touched an intraday high of Rs 165.20 and an intraday low of Rs 154. It was trading with volumes of 246,850 shares, compared to its five-day average of 143,622 shares, an increase of 71.88 percent.