Of the targeted Rs 3 lakh crore, the cumulative sanctions by PSBs is around 24 percent while that by private banks is around 20 percent, the report added.

Banks have sanctioned around 44 percent of the targeted amount of liquidity support to micro, small and medium enterprises (MSMEs) under the government's Emergency Credit Line Guarantee Scheme (ECLGS), as per a report by CARE Ratings.

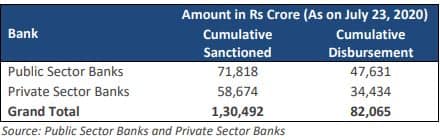

The report noted that as on July 23, public and private sectors banks had sanctioned Rs 1,30,492 crore (in 38.19 lakh accounts) and disbursed Rs 82,065 crore (in 20.16 lakh accounts) to MSMEs under the ECLGS scheme. The cumulative sanctions by banks total around 44 percent of the targeted Rs 3 lakh crore.

The ECLGS was announced by Finance Minister Nirmala Sitharaman earlier this year under the Centre's Atmanirbhar Bharat package and was aimed to provide liquidity support to MSMEs.

Public sector banks (PSB) lead in terms of their share in the loans sanctioned and disbursed, as per the report. Of the total loan amount sanctioned and disbursed as on July 23, PSBs' share stood at 55 percent and 58 percent respectively. Meanwhile, private banks had sanctioned and disbursed around 45 percent and 42 percent of the amount, respectively.

Of the targeted Rs 3 lakh crore, the cumulative sanctions by PSBs are around 24 percent while that by private banks is around 20 percent, the report added.

Image: CARE Ratings Report

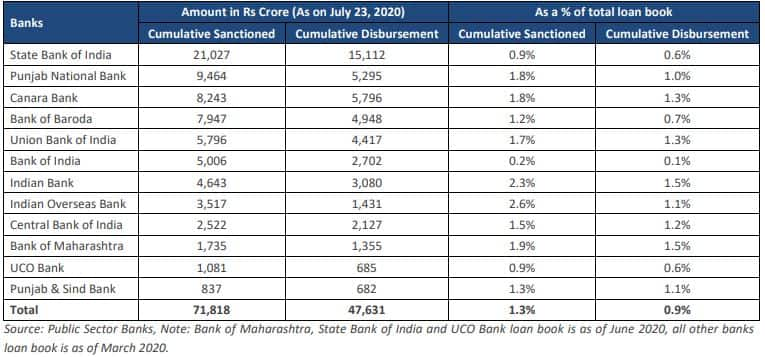

Image: CARE Ratings Report

"State Bank of India (SBI) has recorded the maximum cumulative sanctions and disbursements of Rs 21,027 crore and Rs 15,112 crore respectively (refer figure 2), which is 0.9% and 0.6% of their total loan book," the report said.

It added that Punjab National Bank (PNB) has recorded the second-largest cumulative sanctions at Rs 9,464 crore (which is 1.8 percent of its total loan book).

Image: CARE Ratings Report

Image: CARE Ratings Report