An investor has to be patient and undertake the necessary research before zeroing in on the schemes to invest – either lumpsum or via SIP.

Tejas Khoday

In the normal course of life, everything comes in pairs – true and false, left and right, light and darkness, yin and yang. When one element exists, the other doesn't find a place at the same time.

But, in the world of investments, risk and return are an odd pair. Both elements need to co-exist, to provide opportunities for investors to generate wealth. Higher the return expectations, higher is the risk needed to achieve it. A good understanding and analysis of the variables generating the risk is an essentiality for achieving targeted returns.

Till a few years ago, every investment adviser had a theory about hierarchy of risks associated with each financial product. Even though the returns generated would be low, holding cash in the bank, or investing in fixed deposits, money market mutual funds were expected to be the safest avenues for conservative investors.

The financial investment hierarchy ascended with corporate bonds, debt mutual funds, equity mutual funds, direct equity, crypto currencies and so on, while gold and real estate remained traditional choices of physical investments.

In recent times, the risks accompanying financial instruments continued to witness enhanced volatility. At the lower end of the hierarchy, higher inflation and falling interest rates returned negative effective return rates.

With rising NPAs, commercial paper defaults, banks, debt mutual funds weren't the preferred choice and investors stepped up to seek higher returns, opting for equity mutual funds and direct equity. This change over is clearly visible from the Assets under Management (AUM), scheme offerings of the 40 odd Asset Management Companies (AMCs) operating in India.

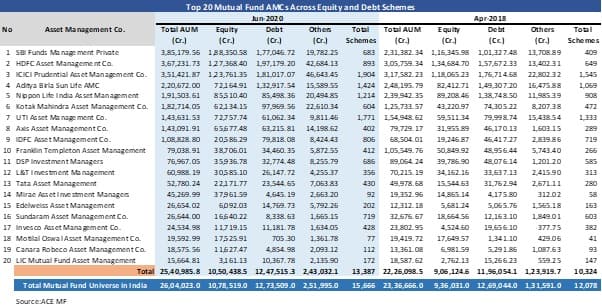

Of them, the top 20 AMCs account for the bulk of AUM, of which, top 10 account for 83 percent of total AUM. Between April 2018 – June 2020, AUM increased by 11.1 percent, with a major contribution to equity schemes. The number of scheme offerings has increased by around 30 percent.

Equity mutual funds have underlying assets as stocks, which are subject to various risks. Every company has a large number of risks affecting its business from time-to-time. These may include and are not limited to customer segmentation risk, supply chain risk, currency risk, human resource risk, financial risk, geographical risk, management risk, credit risk, interest rate risk, inflation risk, liquidity risk etc.

To mitigate these risks, a diversified holding of companies or financial instruments under a portfolio umbrella is a reliable option. At a portfolio holding level, all risks are bifurcated as systematic or unsystematic risks. Systematic risks affect the entire system in general and are non-diversifiable in nature. In short, we have to live with them.

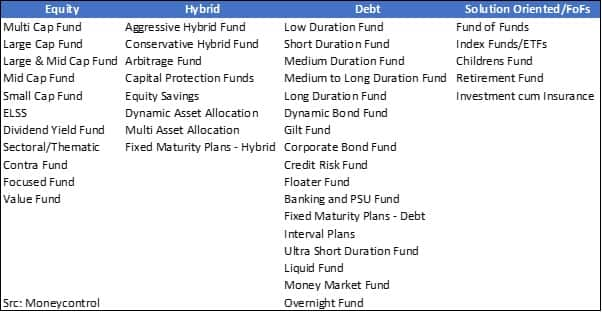

Whereas, unsystematic risks are linked with a specific sector or a company, and adequate diversification can help in mitigating these risks while expecting better returns. Mutual fund managers are tasked with the objectives of creating and offering various equity, debt and combination portfolios based on risks and return profiles.

Investors, depending on their risk profile, financial capabilities, returns expectations coupled with investment horizon, need to make the right choices. This is where the famous disclaimer, "Mutual fund investments are subject to market risks. Please read the offer documents carefully before investing" comes into force.

An investor has to be patient and undertake the necessary research before zeroing in on the schemes to invest – either lumpsum or via SIP. While taxation rules are different for equity and debt funds, the focus should be more on investing in the appropriate scheme, which can deliver better than benchmark returns over the time horizon chosen by the investor.

It is a mandatory exercise to be undertaken by an investor, to peruse through the scheme documents, which highlight investment objective and policies, asset allocation pattern, fee structure, liquidity provisions, risk factors and mitigation mechanisms.

A fund manager's performance track record plays a key role in selection of the scheme, along with risk ratios like standard deviation, beta, r-squared, Treynor, Fama, Sharpe, Jensen’s alpha, Sortino, capture – downside & upside. A quick look through these ratios can aid in scheme selection.

•> Standard deviation: measures the risk of investment, calculated based on volatility in returns, lower the better.•> Beta: a measure of volatility in relation to the benchmark, lower (less than 1) the better.

•> R- Squared: a measure of reliability of beta, varies between 0 and 1, closer to 1 is better.

•> Treynor: measures the excess return generated for each unit of risk, a higher ratio is better.

•> Fama: measures the extra return obtained with a specific risk in relation to the extra return that could have been obtained with a similar systematic risk.

•> Sharpe: a measure of a portfolio's return versus a risk-free return, higher the better.

•> Jensen’s alpha: measures the risk adjusted return, a positive alpha is better.

•> Sortino: measure of risk adjusted returns similar to Sharpe ratio but for a portfolio with high volatility.

•> Downside capture: measures the under performance of the portfolio in relation to the benchmark, lower the better.

•> Upside capture: measures the out performance of the portfolio in relation to the benchmark, higher the better.

Even after a decent research and investment, scope does exist for under performance of the selected scheme – a change in fund manager or size of the fund, market conditions, regulations (like SEBI recategorization), specific company or sector under performance etc. Hence, it is imperative that investors review their investments periodically, to understand the changes in the scheme. As per SEBI mandate, all AMCs send a monthly portfolio update to investors. A few minutes of review can help in course correction and taking the right decisions.

Risk is an inevitable part of life, even in investments. A true investor is not the one who is willing to take risks, anyone can do that. But the ones who improve their capabilities to understand and mitigate them ahead of time, are real investors.

The author is Co-Founder & CEO at FYERS.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.