RIL beat D-Street estimates in what according to most analysts was a tough quarter. Jio, Retail, and oil-to-chemical (O2C) all contributed to fighting COVID induced slowdown.

India's largest company in terms of market-capitalisation, Reliance Industries (RIL) reported a consolidated profit of Rs 13,248 crore for the first quarter of FY21 with Jio's ARPU growth of 7.4 percent QoQ at Rs 140.3 beating Street expectations.

RIL beat D-Street estimates in what according to most analysts was a tough quarter. Jio, Retail, and oil-to-chemical (O2C) all contributed to fighting COVID induced slowdown.

Consolidated revenue from operations for the quarter stood at Rs 1,00,929 crore while EBITDA was at Rs 21, 585 crore.

Here are the top 8 highlights of the company's Q1 scorecard:

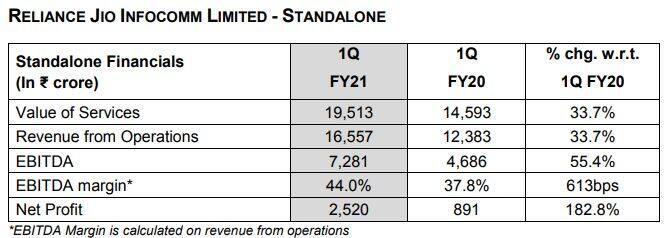

Jio segment

Jio's net profit jumped to Rs 2,520 crore in Q1 FY21 against Rs 891 crore in Q1FY20, a YoY jump of 182.8 percent.

Standalone revenue from operations, including access revenues, of Rs 16,557 crore, grew by 33.7 percent YoY.

Standalone EBITDA margin stood at 44 percent, up from 37.8 percent in Q1FY20. ARPU during the quarter stood at Rs 140.3 per subscriber per month.

Total wireless data traffic during the quarter came at 1,420 crore GB (30.2 percent YoY growth) with strong customer engagement and best-in-class network performance.

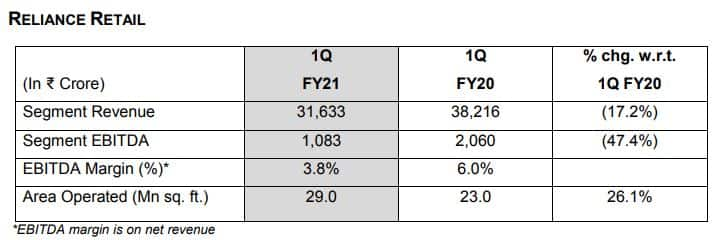

Retail

Against the backdrop of a challenging environment, where store functioning and digital commerce fulfillment was severely impacted by lockdown and restrictions (50 percent stores were fully shut, 29 percent partially operated), Reliance Retail clocked significant revenues of Rs 31,633 crore and EBITDA of Rs 1,083 crore in the quarter. The performance whilst muted by the operating context, was well ahead of market.

The June quarter saw 21 percent growth year on year across the operational businesses of grocery and connectivity.

EBITDA was positive and resilient despite the limitations in the quarter, with cost management initiatives leading to fixed cost savings, which helped cushion the impact of lower profits from lower sales, said the company.

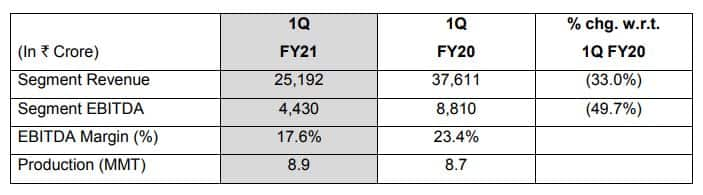

Petrochemicals

The segment's revenue for Q1FY21 declined by 33 percent YoY to Rs 25,192 crore primarily due to lower price realisations with disruptions in local and regional markets amid the COVID-19 outbreak.

Segment's EBITDA for the quarter declined 49.7percent YoY to Rs 4,430 crore. Weak domestic demand and a higher share of exports impacted margins as compared to regional benchmarks, said the company. The impact of lower realisation was partially offset by cost optimization and integration benefits.

Reliance’s operating rates remained more than 90 percent, significantly ahead of industry peers, while ensuring the utmost safety and care of employees and their families.

The company said it inverted its business model from 20 percent/80 percent (exports/domestic) to 80 percent/20 percent within the first 10 days of the lockdown, including exports from sites typically serving only domestic markets.

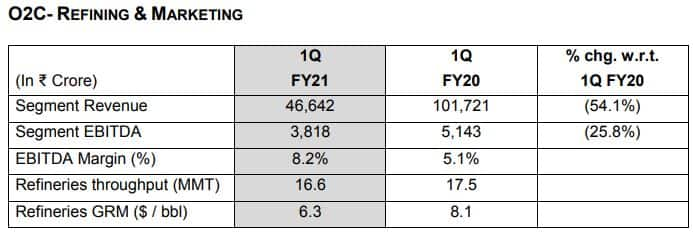

Refining & marketing

Segment's revenues for Q1FY21 declined by 54.1 percent YoY to Rs 46,642 crore due to lower crude oil prices and lower throughput.

Brent crude price averaged at $29.2/bbl during the quarter against $68.8/bbl in Q1FY20, down 57.6 percent YoY.

Segment EBITDA declined to Rs 3,818 crore (down 25.8 percent YoY) due to a weak margin environment and lower throughput.

Global oil demand for the quarter is estimated to have contracted sharply by 16.4 mb/d due to lockdowns and travel restrictions globally, said the company.

India's oil product demand also declined sharply by 25.8 percent YoY during the quarter, led by ATF (down 80.3 percent), MS (down 35.9 percent) and HSD (down 33.3 percent).

Global destruction of demand for transportation fuels impacted cracks for gasoline, gasoil and jet-kero.

June’20 crossed 90 percent of pre-COVID throughput.

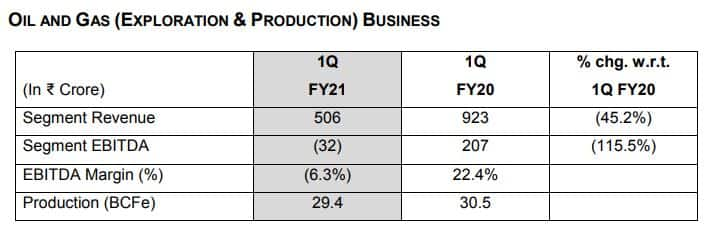

Oil & Gas

Segment's revenues for Q1FY21 declined by 45.2 percent YoY to Rs 506 crore, primarily due to lower production in domestic business post-closure of Panna Mukta and D1D3 fields and lower prices.

EBITDA for the quarter turned negative at Rs 32 crore with lower volumes and weak realisations.

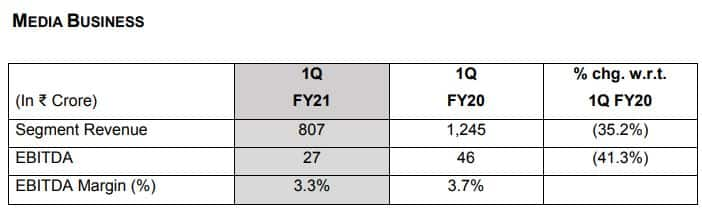

Media business

Segment's revenues for declined by 35.2 percent YoY to Rs 807 crore primarily due to the COVID-19 linked clampdown on spending by advertisers, particularly in the entertainment segment.

EBITDA decreased to Rs 27 crore due to dip on account of the revenue drag.

RIL reaped the benefits of the endurance of its oil business, the increasing popularity of its digital services and the strong growth of its retail unit to ride out a tough quarter with better-than-expected earnings.

Management commentary

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited said: “I am humbled and inspired by the exemplary commitment and empathy of the Reliance family during the COVID-19 pandemic."

"The severe demand destruction due to global lockdowns impacted our hydrocarbons business but the flexibility in our operations enabled us to operate at near-normal levels and deliver industry-leading results."

"Our consumer-facing businesses became the life-line for individuals and businesses with our Retail and Jio teams working hard to ensure millions got essential goods and services through the lockdown.

"We completed the largest fundraise in Indian corporate history in this quarter. I thank the millions of individual investors who supported our rights issue and welcome all our new partners to an exciting new phase of growth at Reliance.”

Miscellaneous

Jio Platforms Limited, a wholly-owned subsidiary of Reliance Industries, raised Rs 152,056 crore from leading global investors including Facebook, Google, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, PIF, Intel Capital and Qualcomm Ventures in just three months.

BP invested Rs 7,629 crore for a 49 percent stake in the company’s fuel retailing business.

BP and Reliance announced their new Indian fuels and mobility joint venture “Reliance BP Mobility Limited (RBML)” after receipt of regulatory and other customary approvals.

Operating under the “Jio-bp” brand, the joint venture aims to become a leading player in India’s fuels and mobility markets.

Reliance Foundation led the philanthropic mission against the coronavirus pandemic by launching Mission Anna Seva, the world’s largest feeding programme by a corporate Foundation, producing 1 lakh PPEs and masks daily, setting up India’s first exclusive COVID-19 hospital in Mumbai along with BMC and donating Rs 556 crore to various relief funds.

The company successfully completed India’s largest-ever rights issue of Rs 53,124 crore which was oversubscribed by 1.59 times. It was the world’s largest by a Non-Financing Institution in the last ten years.