The private sector bank posted a net loss of Rs 3,800.84 crore for April-June 2019-20. In the preceding March quarter, the bank logged a profit of Rs 135.39 crore.

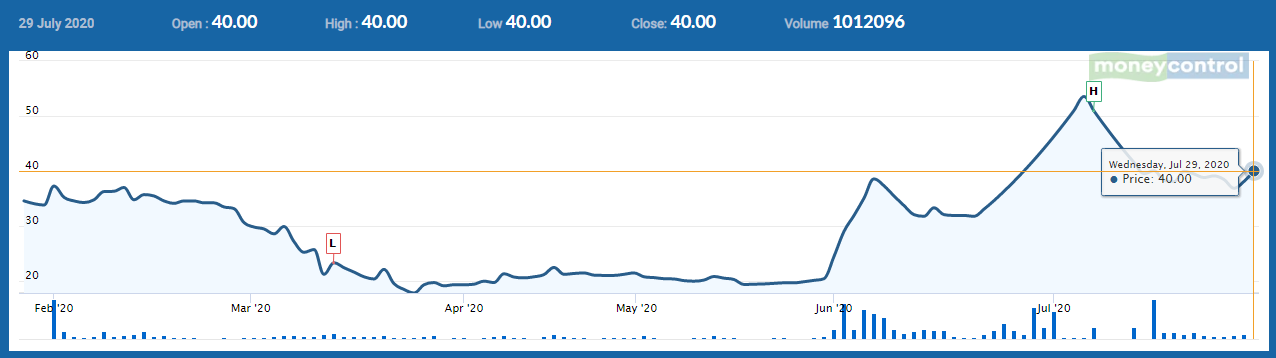

IDBI Bank share price jumped 5 percent at open on July 29, hitting upper circuit of Rs 40.15 per share on BSE after the company declared its June quarter numbers.

IDBI Bank on July 28 reported a standalone net profit of Rs 144.43 crore for June quarter of 2020-21 financial year. The private sector bank posted a net loss of Rs 3,800.84 crore for April-June 2019-20. In the preceding March quarter, the bank logged a profit of Rs 135.39 crore.

Total income fell slightly to Rs 5,901.02 crore in April-June 2020-21 from Rs 5,923.93 crore in the same quarter of the last fiscal, IDBI Bank said in a regulatory filing.

The bank's asset quality improved with gross non-performing assets (NPAs) falling to 26.81 percent of the gross advances as at June 30, 2020 from 29.12 percent by June 2019. Net NPAs or bad loans came down to 3.55 percent from 8.02 percent.

The stock price jumped 90 percent in the last 3 months and was trading at Rs 40.15, up Rs 1.90, or 4.97 percent. There were pending buy orders of 435,234 shares, with no sellers available.

According to Moneycontrol SWOT Analysis powered by Trendlyne, IDBI Bank has zero promoter pledge with growth in quarterly net profit with increasing profit margin (YoY).

Moneycontrol technical rating is bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.