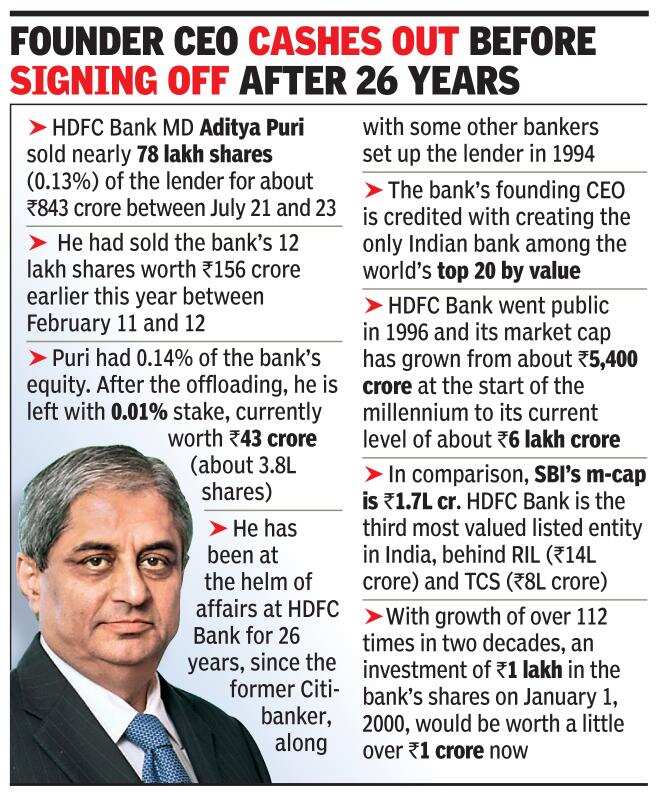

MUMBAI: Aditya Puri, HDFC Bank’s managing director who’s slotted to retire in about three months, last week sold about 74 lakh shares of the bank worth about Rs 843 crore, exchange disclosures showed. This is the second instance of Puri selling HDFC Bank shares this year. Between February 11 and February 12, Puri had sold 12.5 lakh shares of the bank for about Rs 156 crore.

Puri, who quit his job as head of Citibank Malaysia to launch HDFC Bank in 1994, has created the country’s second-largest lender and most valuable bank with a market cap of about Rs 6 lakh crore. Under his leadership, the bank has given 20% growth with a consistency that analysts began to describe as “boring”. The bank is now the third most valued listed entity in India, behind Reliance Industries (Rs 14 lakh crore) and TCS (Rs 8 lakh crore).

Puri had 0.14% of the bank’s equity. After the offloading, which was equivalent to 0.13%, he is left with 0.01% stake, currently worth Rs 43 crore (about 3.8 lakh shares), according to BSE disclosure.

According to the bank’s filing with the BSE so far this month, 39 of HDFC Bank’s executives who are designated ‘insiders’ under Sebi rules, have sold the bank’s shares aggregating Rs 884 crore. This includes sales by Puri and Ashok Khanna, who recently quit as the head of the lender’s auto loan business.

Market analysts and fund managers around the world usually keep a close watch on insider transactions, for a cue about the future course of the business of the entity and its stock price. Generally, it is believed that insider selling indicates a likely slide in the stock price while insider buying points to a spurt in stock price. From falling to a year-low level of Rs 739 on March 23, so far HDFC Bank’s stock price has rallied 53% to its current close at Rs 1,131 on the BSE.

On Sunday, HDFC Bank said that the shares that Puri sold were allotted to him “at different times and at different price points” and were not allotted at par. “Therefore, the net amount realized by Puri is not Rs 843 crore as stated. The acquisition cost of shares and the tax payable on the transaction has to be accounted for,” it said.

After being set up in mid-1994, HDFC Bank went public in 1996. In the last 20 years, for which data is available, the bank’s market cap has grown from about Rs 5,400 crore at the start of the millennium to its current level of above Rs 6 lakh crore: That’s a growth of over 112 times in two decades. Seen another way, an investment of Rs 1 lakh in the bank’s shares on January 1, 2000, would be worth a little over Rs 1 crore now. In addition, the bank has also paid dividends over this period, which is outside of the stock return.

Puri, who quit his job as head of Citibank Malaysia to launch HDFC Bank in 1994, has created the country’s second-largest lender and most valuable bank with a market cap of about Rs 6 lakh crore. Under his leadership, the bank has given 20% growth with a consistency that analysts began to describe as “boring”. The bank is now the third most valued listed entity in India, behind Reliance Industries (Rs 14 lakh crore) and TCS (Rs 8 lakh crore).

Puri had 0.14% of the bank’s equity. After the offloading, which was equivalent to 0.13%, he is left with 0.01% stake, currently worth Rs 43 crore (about 3.8 lakh shares), according to BSE disclosure.

According to the bank’s filing with the BSE so far this month, 39 of HDFC Bank’s executives who are designated ‘insiders’ under Sebi rules, have sold the bank’s shares aggregating Rs 884 crore. This includes sales by Puri and Ashok Khanna, who recently quit as the head of the lender’s auto loan business.

Market analysts and fund managers around the world usually keep a close watch on insider transactions, for a cue about the future course of the business of the entity and its stock price. Generally, it is believed that insider selling indicates a likely slide in the stock price while insider buying points to a spurt in stock price. From falling to a year-low level of Rs 739 on March 23, so far HDFC Bank’s stock price has rallied 53% to its current close at Rs 1,131 on the BSE.

On Sunday, HDFC Bank said that the shares that Puri sold were allotted to him “at different times and at different price points” and were not allotted at par. “Therefore, the net amount realized by Puri is not Rs 843 crore as stated. The acquisition cost of shares and the tax payable on the transaction has to be accounted for,” it said.

After being set up in mid-1994, HDFC Bank went public in 1996. In the last 20 years, for which data is available, the bank’s market cap has grown from about Rs 5,400 crore at the start of the millennium to its current level of above Rs 6 lakh crore: That’s a growth of over 112 times in two decades. Seen another way, an investment of Rs 1 lakh in the bank’s shares on January 1, 2000, would be worth a little over Rs 1 crore now. In addition, the bank has also paid dividends over this period, which is outside of the stock return.

Download

The Times of India News App for Latest Business News

more from times of india business

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app