The S&P BSE Sensex closed 3% higher while the Nifty50 rose 2.6% for the week ended July 24 compared to 1.4% rise seen in the Small-cap index, and about 1.2% gain seen in the S&P BSE Mid-cap index.

A strong week for Indian markets as bulls remained in control in four out of five sessions. The S&P BSE closed above 38,000 while the Nifty ended just a shade below 11,200 levels.

The S&P BSE Sensex closed 3 percent higher while the Nifty50 rose 2.6 percent for the week ended July 24 compared to 1.4 percent rise seen in the S&P BSE Smallcap index, and about 1.2 percent gain seen in the S&P BSE Midcap index in the same period.

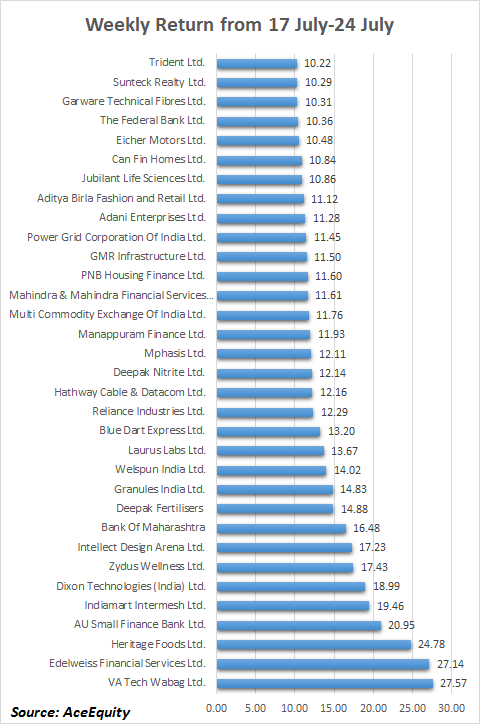

As 33 stocks in the S&P BSE 500 index rose 10-30 percent. These include names like Trident, The Federal Bank, RIL, Eicher Motors, Mphasis, Granules India, AU Small Finance Bank, and VA Tech Wabag.

The Nifty50 closed in the green for the sixth consecutive week in a row largely tracking strong trend seen in the global markets as well as strong earnings from India Inc, but rise in COVID-19 cases, and US-China tensions, as well as July F&O expiry, could cap the upside for markets in the coming week, suggest experts.

The market will also track earnings announcements from top tier companies such as RIL, SBI, IOC, Bharti Airtel, among others.

“In the coming week, schedule derivatives expiry of July month contracts combined with the on-going earnings season would keep the volatility high. A long list of prominent names like Kotak Bank, Tech Mahindra, Bharti Airtel, Ultratech Cement, Dr Reddy, Maruti, HDFC, RIL, IOC and SBI will be announcing their numbers during the week along with several others,” Ajit Mishra, VP Research, Religare Broking told Moneycontrol.

“Apart from the above events, global cues and updates related to the COVID-19 will also be on the participants’ radar,” he said.

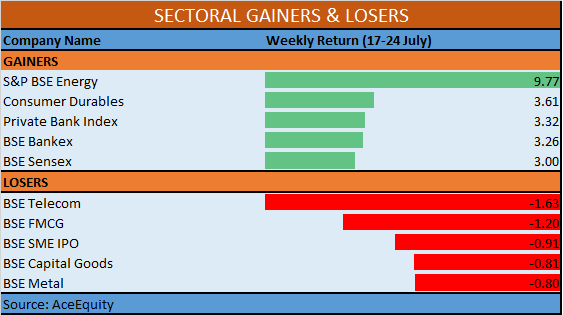

In terms of sectoral performers – the S&P BSE Energy index rallied more than 9 percent followed by Consumer Durable and Banking stocks.

Among losers, the S&P BSE Telecom index was down by 1.6 percent, followed by FMCG which fell 1.2 percent.

Banking and financial services stock which is a major part of Nifty was partly responsible for the one-way rally which we saw in markets in the week gone by. Strong results from HDFC Bank and Axis Bank helped the sentiment while management commentary on moratorium also aided sentiment.

The Nifty50 is trading near its crucial resistance levels; hence some consolidation or profit taking cannot be ruled out. The immediate target for the index is around 11,400 levels and dips if any should be used to buy as long as Nifty holds above 11,000-10,900.

“We maintain our positive stance with a target of 11,400. Whereas we expect midcap and smallcap space to catch up and outperform the benchmark in the coming weeks,” Dharmesh Shah, Head – Technical, ICICI direct told Moneycontrol.

“We believe, Nifty has formed a higher base around 10,900 mark and we expect it to hold it in the coming week. We expect a catch-up activity to be seen in the broader market as constant improvement has been observed in market breadth,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.