BENGALURU: The investigation report into Coffee Day Enterprises’s (CDEL) troubles is expected to be made public on Friday, and sources say it will red-flag the unusual spike in related-party transactions in 2018-19 between CDEL and Mysore Amalgamated Coffee Estates (MACEL), a private firm of late VG Siddhartha.

The report by the former DIG of CBI, Ashok Kumar Malhotra, is expected to open a Pandora’s box. The spotlight will be on the Rs 2,600 crore gaping hole in CDEL’s balance sheet, sources told TOI.

The company had appointed Malhotra to investigate the circumstances leading to certain statements made in a letter written by Siddhartha just before he took his life, and to scrutinise the books of accounts of the parent company and companies in which Siddhartha had beneficial interest.

CDEL’s 2019 annual report shows that loans or advances given to MACEL jumped to Rs 2,226 crore in that fiscal, from just Rs 724 crore in the year before. About Rs 1,450 crore was also recovered, and the same was disclosed in the report.

“What’s surprising is loans in MACEL’s balance sheet, as per annual returns filed for the year ended March 31, 2019, as from related parties (unsecured) is only Rs 553.6 crore. CDEL’s account showed that net receivable advance from MACEL was Rs 777.6 crore and advance for capital purchase of land and supply of goods and services were Rs 789.3 crore and Rs 64.8 crore respectively. So, what happened to the difference? Given that CDEL is a public company, one would have to rely on these numbers and the difference needs explanation,” says KR Girish, founder of tax advisory firm KR Girish & Associates.

MACEL is neither a subsidiary nor an associate company of CDEL, in the absence of direct shareholding. The ownership was with Siddhartha and his late father Gangaiah Hegde. MACEL was incorporated in 1944 and is into coffee trading.

What could draw further scrutiny is MACEL’s unsecured loans, which stood at Rs 384 crore on its authorised capital of just Rs 15 lakh and paid up capital of Rs 9.9 lakh. CDEL made no reference to MACEL’s deteriorating financial health in its reports, though the latter’s auditor had warned of the situation. MACEL’s financial statement showed that a Chikmagalur-based local auditor had put a qualification on the huge losses and simply referred to the management’s comment. The management had said, “The company is confident that accumulated losses will be turned positive and wipe out all cash losses.”

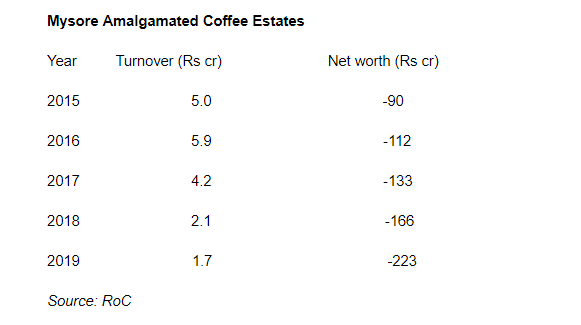

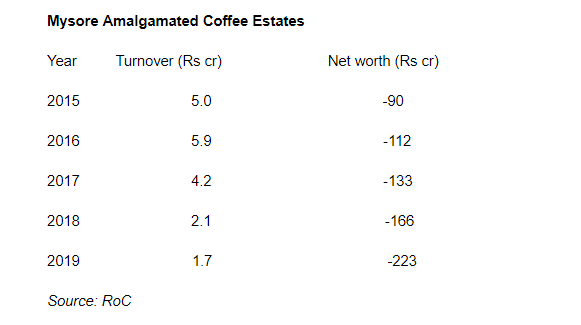

This, despite MACEL reporting an ever-increasing erosion of its net worth in the last five years and turnover shrinking in the same period. Between 2015 and 2019, the company saw its negative net worth balloon to Rs 223 crore, from Rs 90 crore. Turnover shrunk to Rs 1.7 crore from Rs 5 crore.

Last week, CDEL’s auditor, BSR & Associates, resigned saying the numbers provided by subsidiaries were not enough to base its opinion on the accounts presented by the management. BSR also said that since the investigation into the letter signed by Siddhartha was yet to conclude, it was unable to verify if there are any adjustments or disclosures required to be made to the statement.

TOI reported in March that Siddhartha’s family has put most of their personal assets, including 10,000 acres of plantation, for sale to repay lenders. CDEL has also sold its technology park – Global Village, in Bengaluru – for Rs 2,700 crore, as part of an effort to bring down its debt.

The report by the former DIG of CBI, Ashok Kumar Malhotra, is expected to open a Pandora’s box. The spotlight will be on the Rs 2,600 crore gaping hole in CDEL’s balance sheet, sources told TOI.

The company had appointed Malhotra to investigate the circumstances leading to certain statements made in a letter written by Siddhartha just before he took his life, and to scrutinise the books of accounts of the parent company and companies in which Siddhartha had beneficial interest.

CDEL’s 2019 annual report shows that loans or advances given to MACEL jumped to Rs 2,226 crore in that fiscal, from just Rs 724 crore in the year before. About Rs 1,450 crore was also recovered, and the same was disclosed in the report.

“What’s surprising is loans in MACEL’s balance sheet, as per annual returns filed for the year ended March 31, 2019, as from related parties (unsecured) is only Rs 553.6 crore. CDEL’s account showed that net receivable advance from MACEL was Rs 777.6 crore and advance for capital purchase of land and supply of goods and services were Rs 789.3 crore and Rs 64.8 crore respectively. So, what happened to the difference? Given that CDEL is a public company, one would have to rely on these numbers and the difference needs explanation,” says KR Girish, founder of tax advisory firm KR Girish & Associates.

MACEL is neither a subsidiary nor an associate company of CDEL, in the absence of direct shareholding. The ownership was with Siddhartha and his late father Gangaiah Hegde. MACEL was incorporated in 1944 and is into coffee trading.

What could draw further scrutiny is MACEL’s unsecured loans, which stood at Rs 384 crore on its authorised capital of just Rs 15 lakh and paid up capital of Rs 9.9 lakh. CDEL made no reference to MACEL’s deteriorating financial health in its reports, though the latter’s auditor had warned of the situation. MACEL’s financial statement showed that a Chikmagalur-based local auditor had put a qualification on the huge losses and simply referred to the management’s comment. The management had said, “The company is confident that accumulated losses will be turned positive and wipe out all cash losses.”

This, despite MACEL reporting an ever-increasing erosion of its net worth in the last five years and turnover shrinking in the same period. Between 2015 and 2019, the company saw its negative net worth balloon to Rs 223 crore, from Rs 90 crore. Turnover shrunk to Rs 1.7 crore from Rs 5 crore.

Last week, CDEL’s auditor, BSR & Associates, resigned saying the numbers provided by subsidiaries were not enough to base its opinion on the accounts presented by the management. BSR also said that since the investigation into the letter signed by Siddhartha was yet to conclude, it was unable to verify if there are any adjustments or disclosures required to be made to the statement.

TOI reported in March that Siddhartha’s family has put most of their personal assets, including 10,000 acres of plantation, for sale to repay lenders. CDEL has also sold its technology park – Global Village, in Bengaluru – for Rs 2,700 crore, as part of an effort to bring down its debt.

Download

The Times of India News App for Latest Business News

more from times of india business

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app