Out of 23 stocks from agri and fertiliser space, 11 have rallied 10-100% in 2020 so far. Agriculture remains a strong play, but experts feel agro-chemical stocks may be running out of steam.

The government has been highlighting the importance of ‘Make in India’, and it is about time investors take note of the same.

With the outbreak of coronavirus, the government initiated lockdown across the country in March halting most economic activities. With that, businesses across sectors took a hit and it reflected in the stock performances as well.

Most sectors in the market saw deep cuts, but one of the themes that remained resilient was agriculture or rural economy theme.

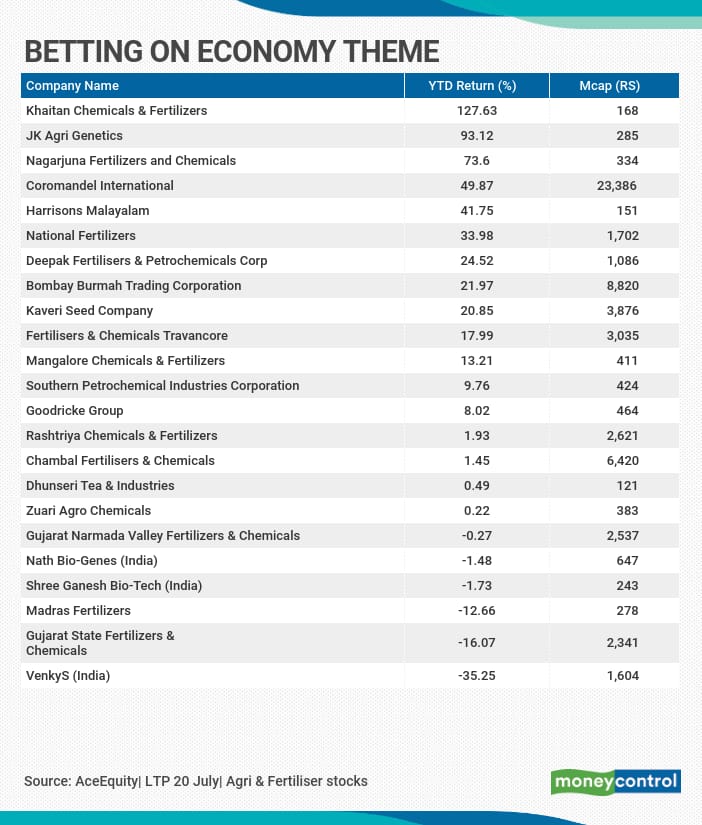

Stocks that are related to agriculture or rural focus theme have done well as compared to other sectors such as manufacturing or capital goods, etc. Out of 23 stocks from agri and fertiliser space, as many as 11 stocks have rallied 10-100% so far in 2020.

These include Mangalore Chemicals, Kaveri Seed, Bombay Burmah, Deepak Fertilisers, National Fertilisers, Coromandel International, JK Agri, and Khaitan Chemicals & Fertilizers Ltd.

With monsoon expected to be normal this year, experts say much of the rally is already in the price. Hence, investors should avoid allocating fresh capital.

Money-making opportunity is available in tractor, two-wheeler, and select FMCG players related to rural consumption which could outperform the index, suggest experts.

This year Monsoon has been progressing very well. The area sown under Kharif crop till 17th July is 21 percent higher than the area covered during the corresponding period of last year.

“Typically, during monsoon season if the rains are above normal agrochemical and fertilizer stocks rise on hopes of improved results. This time as many economy driven businesses will get severely impacted investors are focussing on sectors that will be more resilient,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“In FY21, we expect average earnings growth of agro chemical companies to go be ~17-18%, which is seen as a very healthy sign in these times. After the sharp run-up in agro chemical stocks we have turned negative on most names,” he said.

Oza is of the view that some of the FMCG companies having higher penetration in rural areas like HUL, Colgate, ITC, and Britannia are good quasi proxy plays in the Agri space.

“We have already mentioned about tractors above. Some of the auto companies like Maruti Suzuki and Hero Motocorp have a higher presence in rural areas but we are negative on both the stocks due to earnings de-growth and higher valuations,” he added.

Agriculture-related theme has largely remained resilient during the current time of crisis. This is primarily because of the economic package announced by the government which benefitted the rural economy, expectations of normal monsoon which in turn would boost rural consumption, and large scale reverse migration of Labourers.

“While rural consumption has increased there are a lot of factors to look into it. Some of the migrant labours who have gone back to villages have been deployed in agriculture as it coincided with the sowing season. The govt. also created higher jobs through the MGNREGA program,” Paras Bothra, President of Equity Research, Ashika Stock Broking told Moneycontrol.

“However, going ahead, farmland related work is expected to dry up and it needs to be seen how far MGNREGA alone supports rural consumption. Tractors could however continue to remain a strong play,” he said.

Where to put money now?

Agriculture remains a strong play, but experts feel that Agro Chemical space might be running out of steam, and rural consumption play could create the next set of leaders.

“Monsoon, still, plays a very vital role for the agriculture economy and any rainfall which is in line with the normal or just above normal is always good news for the sectors and market takes it very positively,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“Addition of Agri-stocks should be done with limited exposure to the overall portfolio. Investors should add Tractor theme as it has the potential to generate good returns in the mid to long term,” he said.

Domestic tractor sales in June stood at 10,623, registering a growth of 22.8 percent against 8,648 tractors sold in the same month previous year.

Garg also likes Rallis India, BASF, and Coromandel Internationals are my most favored picks in Agri space. However, I would not like to allocate more than 5 percent of my total portfolio to this sector.

These companies are leading vendors in genetically modified seeds along with the use of chemical pesticides and herbicides which is expected to increase due to good south-west monsoon.

Oza of Kotak Securities like tractors as well as rural consumption. Some of the FMCG companies having higher penetration in rural areas like HUL, Colgate, ITC, and Britannia are good quasi proxy plays in the Agri space.

“Some of the auto companies like Maruti and Hero Motocorp have a higher presence in rural areas but we are negative on both the stocks due to earnings de-growth and higher valuations,” added Oza.

Tractors have been an outlier in Q1FY21 with higher volumes when the auto companies have reported lower numbers. “In tractors both Escorts and M&M have done well in terms of stock price performance. There is still some upside left in both of them. The best quasi play on rural consumption is FMCG and home appliances,” highlights Oza.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.