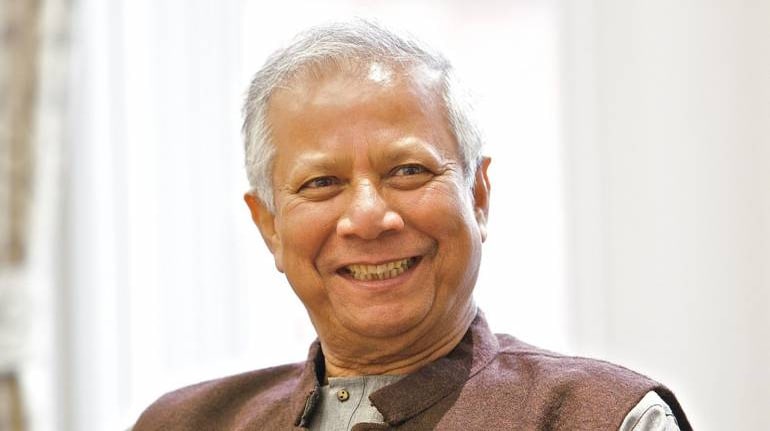

Muhammad Yunus could work with the Niti Aayog to frame a proposal for making funds more accessible to the poor

Nitin Gadkari, the minister of road transport and highways, has asked Nobel Prize awardee and entrepreneur Muhammad Yunus to work with the Niti Aayog to frame a proposal that will make finance become more accessible to the poor.

Speaking at PanIIT Alumni Reach for India Foundation (PARFI) online conclave on 'Re-imagining - MSME & Livelihoods' Gadkari said that a rural-centric lending policy is needed to help the poor get access to funds for starting a business. The conclave was hosted by R Gopalkrishnan, former director Tata Sons.

“We need to frame an independent policy for the underprivileged because when there is mixing (lending to everyone) it is very difficult to implement. Separate policy for the poor, socially, economically and educationally backward people; those who have skill and are talented but don’t have capital. With small capital they can start something of their own. I am confident that this will solve the problem of economic inequality. With this the purchasing power will improve besides generating employment,” said Gadkari.

Presently microfinance institutions (MFI) which are majorly focused on the rural areas are disallowed from taking deposits forcing them to depend on large banks for finance. As certain sections of the banking industry appeal to the government to allow MFIs to accept deposits Yunus said that this will help MFIs become independent and build the rural economy.

“Why should the poor man’s deposit be sent to fund the needs of the rich of the urban? Rural deposits should be used to fund the rural economy. Just allow the MFIs to accept deposits. The government just needs to bring a change to the policy, nothing more. Not a rupee is needed from the government to bring about the change in the rural economy if this is implemented,” Yunus said.

Yunus is a Bangladeshi banker and economist who founded Grameen Bank, which championed the concept of microcredit and microfinance.

“You start a brainstorming session on this subject with Niti Aayog. Prepare the proposal and give it to me and I will take it to the cabinet and Prime Minister and Finance Minister for approval. I am very keen to take this forward. The more people you involve the more red-tapism will there be. This model should not have any government control because only then we will be able to avoid complications,” added Gadkari addressing Yunus.

Gadkari highlighted the example of battery powered or biofuel powered two-wheelers to be allowed to run for commercial purposes as a way to generate self employment.

“Electric three-wheelers have been a great success. We can allow these bikes which are priced less than Rs 3 lakh to be run as taxis. We can have this system of transport just like Ola and Uber. This can create 50-60 lakh jobs in India.”

There are multiple MFIs operating in India providing loans to entrepreneurs too poor to qualify for traditional banks loans.

“Our banking system is very good but to get loans for the underprivileged is a difficult task in India. Those who have money do not worry about getting finance. But it is the poor who are good pay masters. They have the talent but nobody is ready finance them. We are trying to make schemes for supporting pheriwala and pani puriwala,” added Gadkari.

Gadkari further advocated the need to manage the lending system under this method by creating a rating system wherein the top performers can be allowed to increase the deposit limit.

“For the controlling authority, my suggestion is, we put a Class 1 Chartered Accountant for the affairs. We can provide guidelines about how much deposit they can take and after achieving that limit we can provide them with a credit rating and accordingly we can increase the deposit limit. A few investors can come together to create a pool of a few crores which will then provide finance to the poor. They can charge interest rates on par with banks,” added Gadkari.