We advise investors to be cautious in medium term and rebalance their portfolio to safe product categories.

We advise our investors to invest in underlying sectors and business models from a futuristic perspective rather than classifying them on the basis of largecaps or midcaps. If the underlying sector does well, then there are higher chances of these midcaps companies to become largecap and vice versa, Amit Jain, Co-founder & CEO at Ashika Wealth Advisors said in an interview to Moneycontrol's Sunil Shankar Matkar.

edited excerpts:

Q) Given the rally across equity segments so far and challenges going ahead, where would you invest your incremental money now?

A) The market has already bounced almost 40 percent from March 2020 lows, hence I shall wait before I take a fresh position in the market. I am rather lightening my positions in the market. As of now, we are a seeing disconnect in Global GDP & stock market performance. However, this disconnect may end soon.

Whenever I take fresh positions in the market, I will focus more on underlying sectors rather than classifying my investments on the basis of largecaps or midcaps. This classification in largecap & midcaps is an old school of thoughts & I don't personally believe in this categorisation.

If you observe there are a lot of stocks which were largecap in 2007 but they are almost like midcap today e.g. Vodafone Idea, BHEL, ONGC, DLF etc, as the underlying sector did not perform well in the last thirteen years. In fact, there are some largecap stocks of 2007 which even do not exist today for e.g. Jaiprakash Associates, Unitech, Reliance Communications, Suzlon Energy.

You will find most of these stocks are in Infrastructure, Real Estate, Telecom & Power sectors as post financial crisis of 2008 all "Asset Heavy Business Model" had gone for toss due to higher loan restructuring.

So, as a new school of thought, we advise our investors to invest in underlying sectors & business models from a futuristic perspective rather than classifying them on the basis of largecap or midcap. If the underlying sector does well, then there are higher chances of these midcaps companies to become largecaps and vice versa.

Q) With the strong recovery from March lows, some experts now feel that we are in a bull phase. What is your take?

A) This global market rally is more liquidity-driven due to excessive money printing by the US Federal Reserve in light of the coronavirus pandemic. The Fed has infused almost $3 trillion in the US Economy and promised to purchase stressed assets without any cap. Hence, we can say the US central bank is driving this hope driven rally in global markets.

Just to put a number to this $3 trillion, it is equivalent to India's annual GDP, which is the sixth-largest economy in the world. This amount of money was printed by the US Fed in just four months, or in lighter mode, I can say the US Fed has created another India in a very short span.

I am sure there is no bull run in global economies as we shall be having negative GDP growth rate globally, however, any further run in the stock market cannot be ruled out as the Fed has unlimited power to print money. This can only end when there are further escalations in the US-China conflict.

Q) What sectors appear more resilient in terms of growth and will you be investing in them?

A) Sectors which seem to be more resilient from A medium-term perspective are:a) IT companies which focus on artificial intelligence & automation processes;

b) Personal mobility space particularly two-wheeler & affordable four-wheelers;

c) Healthcare;

d) Telecom.

However, entry in these sectors should be at the right price point, for which investors need to wait as most of these sectors have given return on investment (RoI) of 30 percent to 70 percent since recent lows. We had advised our investors to invest in these sectors on March 27, 2020. But, now we are advising them to lighten positions for better entry points in a couple of months.

Q) Benchmark indices, as well as broader markets, seem to be going hand in hand in the rally. What is the market pricing right now at a time when most experts believe that the first half of FY21 is going to be bad in terms of earnings and economic growth and also COVID-19 cases are rising day by day?

A) This liquidity-driven global market rally is pricing in 'V' shaped recovery in the US economy due to the largest ever stimulus support by the US government.

The US government has supported the economy with three times the money that the US Fed took 100 years to create post its establishment in 1913 and that too in the first four months of the pandemic. This clearly shows there is too much liquidity in the stock market. This liquidity was created by the US Fed, to be infused in the economy, but in the short-term, this liquidity is driving global stock markets.

Just to share an example of a 100-year old US company called Hertz, which filed bankruptcy on May 24, 2020, and within 15 days of the bankruptcy filing, the share price got doubled, which is beyond any logic. Hence, even a layman can also infer this is a liquidity-driven rally, which is way beyond any fundamental strength of the global economy.

Q) India Ratings believes that there could be an additional Rs 1.6 lakh crore of debt turning delinquent between FY21-FY22 which is over and above the Rs 2.54 lakh crore anticipated prior to the onset of the pandemic, taking the cumulative quantum to Rs 4.21 lakh crore. Yet banks have been one of the better returners recently; what is driving this rally?

A) The Indian banking system had a combined Rs 97 lakh crore loan book till 2019. If you analyse this loan book sector-wise, then in our view, we can have overall NPAs of banks to the tune of Rs 12-14 lakh crore. Most of the sectors which will create these NPAs shall be from 'Asset Heavy Business Models'. We had advised our clients to exit from banking stocks on January 16, 2020, and we still believe it is not a great bet to favour banks.

Real delinquencies in the banking sector will start reflecting the post moratorium period. It may be scary for some of the banks which are not well capitalized yet. This short term rally in banking stocks is due to an oversold position in March 2020. Just to substantiate with example IndusInd Bank was trading close to Rs 1,900 in January 2020 and today it is trading around Rs 500. Is this bull run in banking stocks?

Hence, we advise investors to be cautious in medium-term and rebalance their portfolio to safe product categories.

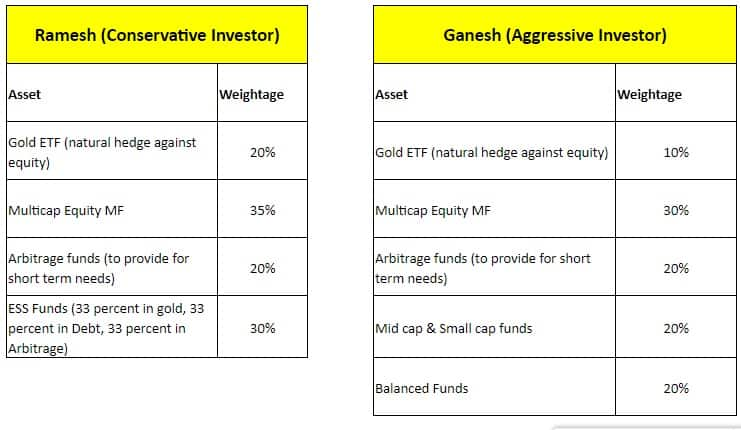

Q: Ganesh (35 years) and Ramesh (35 years) are having Rs 10 lakh each and want to make their own balanced portfolio. How should they go about and what would be the asset allocation. Note: Ganesh is an aggressive investor and Ramesh is a conservative investor.

A) As the investors are in their mid 30's & wish to have a balanced approach of portfolio allocation, then the asset class mix can be as follows keeping at least the next five years in mind.

These allocations should be changed after 5 years. Once both of them cross 40 years of age.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.