Wealth managers typically advise having 10-15 per cent allocation to gold and up to 10 per cent to international equities

A lot has been written about asset allocation and diversification. Most advisors including me recommend dividing investments among equities, bonds, gold, and real estate funds, so as to spread the portfolio risk. Having asset classes which are not correlated help during volatile times.

Real estate has been the preferred asset class for decades. But, being an illiquid investment, we will focus only on the liquid assets. Wealth managers typically advise 10-15 per cent allocation to gold and up to 10 per cent to international equities.

Does this allocation reduce volatility significantly?

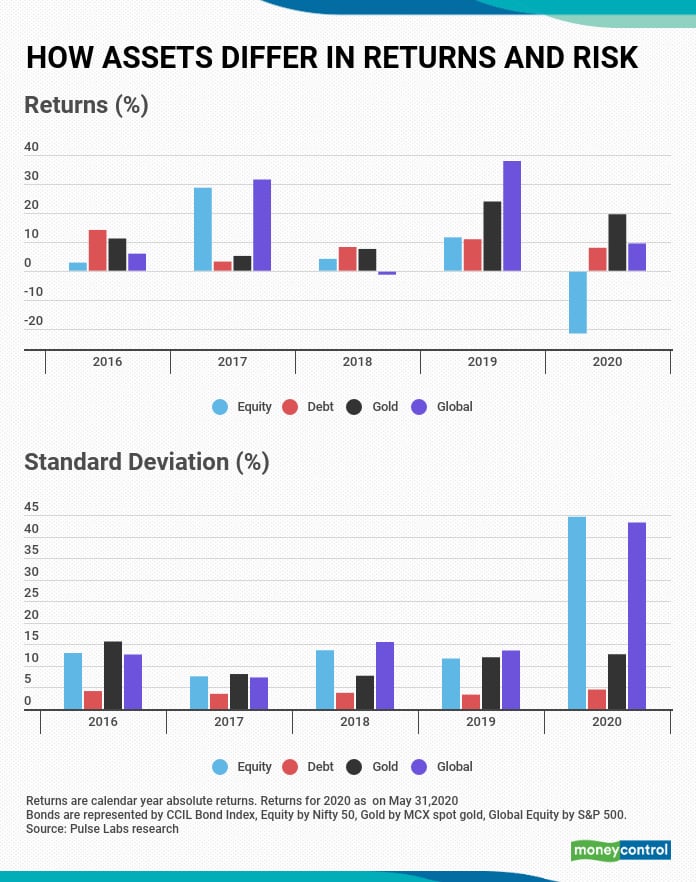

Let us consider the absolute returns and volatility measured by standard deviation on various asset classes.

Comparing the returns and volatility of equities, gold and global equities, does not yield any definitive trend. Each year, some asset classes perform, and others underperform. There are years when volatility in gold has been higher than in equities.

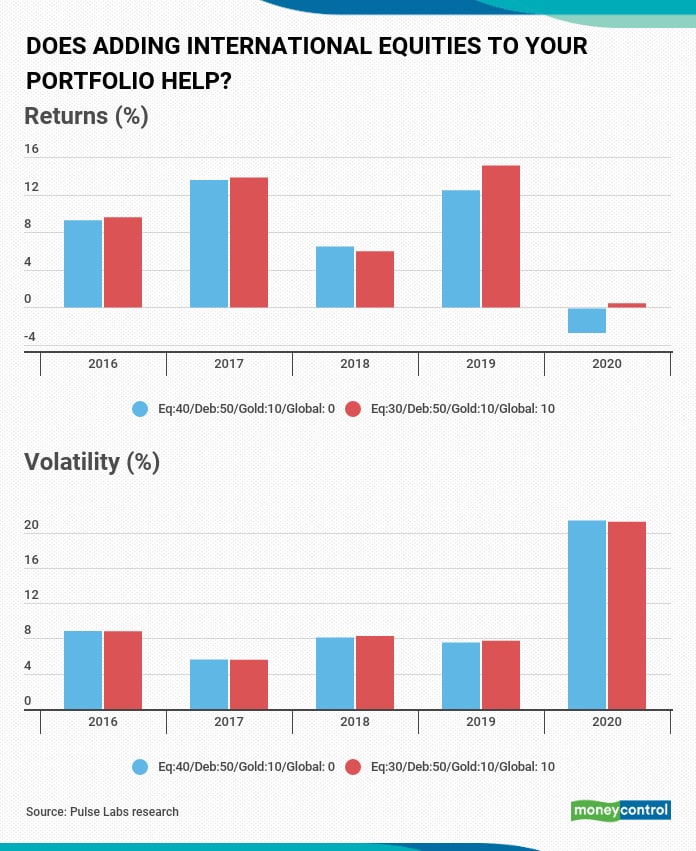

Now, let us consider two different allocations:

- 40 per cent equity, 50 per cent bonds, 10 per cent gold

- 30 per cent equity, 50 per cent bonds, 10 per cent gold, 10 per cent global equity

Replacing 10 per cent of the equity allocation with international equities to a portfolio and keeping gold and debt weightage constant shows us that returns are wavering each year. Hence, additional of international equities will work in years that those markets perform well and the level of outperformance varies.

International equities, specifically US equities, have been suggested due to a great run in the S&P 500 since 2010, as well as the existence of more opportunities for Indian investors to invest in these markets. But, let us not forget the lost decade from 2000-2009, when the S&P 500 gave a -9 per cent return

Adding global equities and gold in the right proportion

Back-of-the-envelope calculations of returns and volatility of two portfolios that had a 10 per cent and 20 per cent allocation to gold, but no international equities show that an increase in the allocation to gold certainly betters returns in the years in which gold has done well and also increases the portfolio volatility. Gold has traditionally been considered a safe haven and a hedge to equity markets. Gold tends to do well during poor macroeconomic scenarios, as it is considered secure. But there are long periods when gold has underperformed. From 2013 to 2018, gold gave no returns and in calendar years 2013, 2014 and 2015, it gave negative returns.

Essentially, every asset class performs in spurts and that’s why there is no set allocation that works every year.

What is the right allocation?

There is no right allocation. Over the last decade, the Nifty has grown by almost 100 per cent, but an investor who had came onboard in 2010 would have had -25 per cent returns in 2011. Not many investors can take those sorts of losses within a year of investing. This behaviour is not seen in gold as the yellow metal is considered as a security for bad times. Further, the thought of exiting gold, when it is underperforming, is unthinkable for investors as they always believe it will do well in the future.

Diversifying portfolios is important to contain extremes in portfolio performance as volatility leads to investors making panic exit from equities.

Your asset allocation is entirely dependent on your risk-taking ability, outlook of the asset class and ability to stay invested through bad phases.

At an overall level, would you be comfortable having 30 per cent, 40 per cent or 50 per cent of your portfolio in equities? In other words, what portion of your portfolio are you willing to expose to volatility? That should be the guiding factor to decide the asset allocation.

The 10-year return on a portfolio with 10 per cent global equity certainly gave higher returns with lower volatility in most of the years. But, the choice of diversification to international equities is based on your outlook on global markets. If you believe taking only your own country’s risk is better, then you can stick with that. A 10 per cent exposure will anyway not be able to make that significant an impact on the portfolio.

Finally, you should decide your allocation based on your attitude to large drawdowns. Are you prepared to remain invested if markets crash by 40 per cent? If not, then it’s better to go with other instruments that are less volatile. However, you may have to invest larger amounts for your goals.

Asset allocation alone won’t work if you do not diversify within the asset class into different categories and chose funds/securities judiciously. Further, regular rebalancing is required to make asset allocation work.