The lender's interest income rose to Rs 3,444.15 crore in the June quarter compared with Rs 3,229.30 crore a year ago.

Federal Bank share price jumped 4 percent in the morning trade on July 16 after the lender reported its June quarter numbers.

Federal Bank reported a marginal 4.3 percent rise in its standalone net profit to Rs 400.77 crore for the first quarter ended June. The bank had posted a net profit of Rs 384.21 crore during the corresponding quarter of 2019-20.

The stock, which has gained over a percent in the last three months, was trading at Rs 52.10, up Rs 2.25, or 4.51 percent at 0917 hours. It has touched an intraday high of Rs 52.10 and an intraday low of Rs 51.50.

The bank's total income during April-June 2020 increased to Rs 3,932.52 crore as compared with Rs 3,620.82 crore in the year-ago period, Federal Bank said in a regulatory filing.

The lender's interest income rose to Rs 3,444.15 crore, compared with Rs 3,229.30 crore a year ago. However, income from other sources jumped to Rs 488.37 crore in the June 2020 quarter from Rs 391.52 crore.

Gross non-performing assets (NPAs), or bad loans, as proportion to gross advances, fell marginally to 2.96 percent compared with 2.99 percent at the end of June 2019.

Global research firm Citi has a 'buy' call on the stock, with the target at Rs 70 per share. It is of the view that liability traction remains strong, which should support NIM, according to a report by CNBC-TV18.

Slippage from moratorium is key to watch out for. The firm has also raised FY21-22 earnings by 1-2 percent.

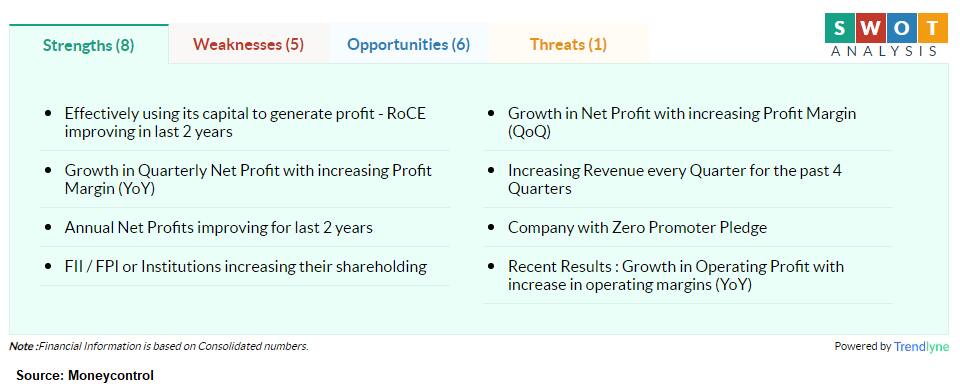

According to Moneycontrol SWOT Analysis powered by Trendlyne, Federal Bank has zero promoter pledge with FII / FPI or institutions increasing their shareholding.

However, Moneycontrol technical rating is bearish, with moving averages being bearish and technical indicators being neutral.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.