The BSE Smallcap index has rallied about 44 percent and the BSE Midcap index 35 percent since March 24. The Sensex has risen 37 percent and the Nifty 38 percent during the period.

Unwanted and ignored for two years, they have become the darling of the market over the last three months. The S&P BSE Smallcap index has vaulted 44 percent since March 24, when the benchmark indices hit their intermediate bottom, and more than 100 stocks have rallied over 100-800 percent during the period.

The rally in the smallcap space has been fast and furious. While many have stayed on the sidelines, several millennials as well as institutional investors have taken advantage of the volatility.

The S&P BSE Smallcap index has rallied by about 44 percent compared to 35 percent rally seen in the S&P BSE Midcap index. The S&P BSE Sensex has risen 37 percent while the Nifty50 is up 38 percent from March 24 lows.

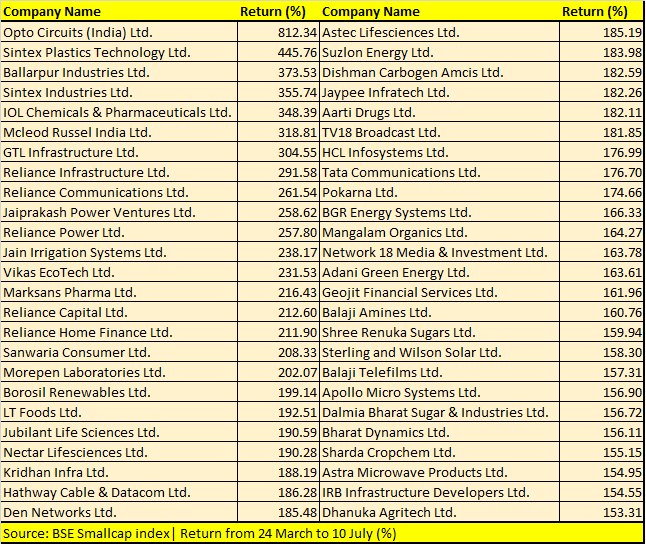

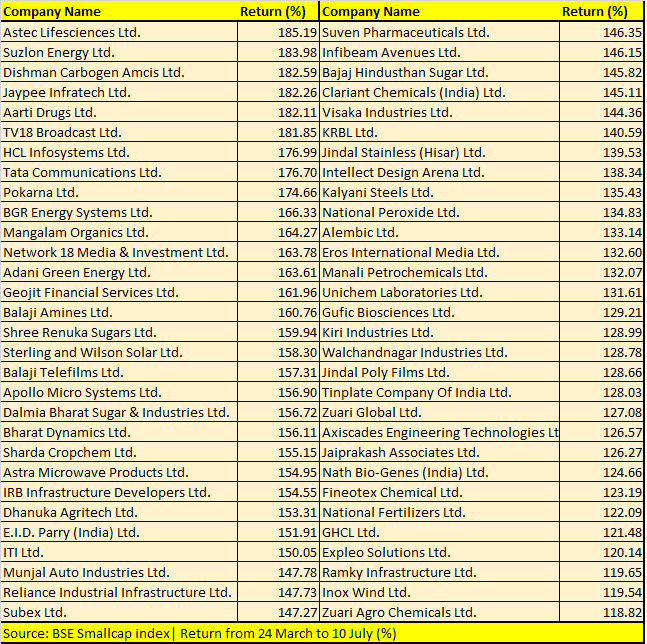

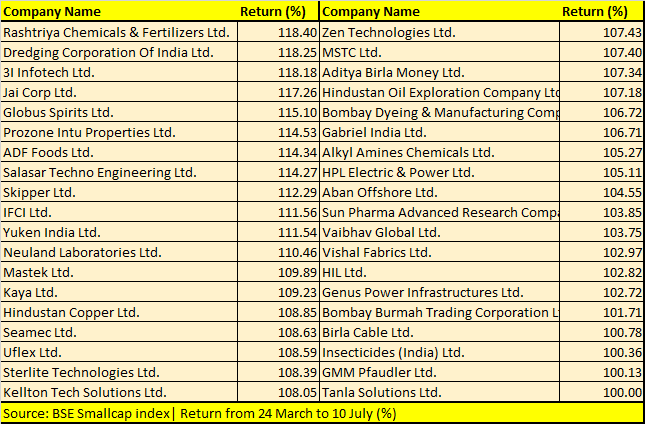

Opto Circuits, Sintex Plastics, Reliance Power, IOL Chemicals, GTL Infrastructure and Reliance Home Finance are among 123 BSE Smallcap index stocks that have more than doubled investors’ money during the period.

“We believe that the rally in the broader markets is a function of both institutional and retail interest. Given that the economy is on a mend, we are seeing increased investor interest in mid and smallcaps, given the beaten-down valuations that are driving the rally in broader markets,” Jyoti Roy, DVP Equity Strategist, Angel Broking Ltd, told Moneycontrol.

“While the rally so far has been driven by improving economic activity and liquidity, there one can build a case that the FOMO factor could be creeping into the markets, which may drive markets higher from current levels if global markets remain supportive,” he said, referring to the acronym for “fear of losing out”.

The mid and smallcaps have been in a correction since January 2018, when both the Nifty Midcap 100 and the Smallcap100 indices hit lifetime highs.

Since then, the midcap index has plunged 30 percent and the smallcap 50 percent as compared to the Nifty, which is trading lower in a single digit from its January 2018 levels.

“If you see, the smallcap index had a great 2017 and then everybody went into 2018 expecting a repeat. We all know how terrible 2018 turned out to be for smallcaps. Even 2019 was a poor year and then came 2020 March. At the lows of March 2020, the smallcap index had fallen nearly 50 percent from its highs of 2017,” said Shankar Sharma, co-founder, and vice-chairman, First Global.

“When and the index falls so much then you can take a reasonably calculated bet that it is going to outperform for the next few months, which is exactly what is happening.

What also happened in the last three years is that any number of smallcap companies became extremely undervalued. Most had been delivering decent performance but the market was not interested,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.