The fund-raising through the second tranche of Bharat Bond ETF issue will help CPSEs in their capex programmes.

The second tranche of Bharat Bond exchange-traded fund (ETF) will open for subscription on July 14, with two new series having maturities of April 2025 and April 2031, catering to both short and long-term investment needs.

The government aims to raise Rs 3,000 crore, the base issue size, through Bharat Bond ETF, with a green-shoe option of Rs 11,000 crore.

The 25 percent of the issue is reserved for retail investors and the remaining 75 percent is available for subscription by retirement funds, QIBs and non-institutional investors. The minimum investment by retail investors is Rs 1,001 and in multiples of Re 1 thereafter. The issue, which closes on July 17, is managed by Edelweiss AMC.

ALSO READ: Rossari Biotech IPO, Bharat Bond ETF & Yes Bank FPO: Where should investors put their money?

Investors, who are in for long term and are risk-averse, can subscribe to the ETF but it is not advisable for investors who want to hold it for less than a year, analysts say, adding there is a certainty of returns and capital is safe.

"These products are good investable products to consider if investors have an investment horizon matching the maturity dates of the ETF funds. But if one has a 6 to 12-month horizon shorter period; these funds will not be suitable for a retail investor, as the returns will be volatile depending on short-term interest rate movement," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

He said Bharat Bond ETF is an efficient debt product that provides easy access to retail investors to invest in bond markets and adequate liquidity on exchange with low bid-ask spreads that will eventually encourage investors to participate in the bond market, which is still at a nascent stage.

Also Read: Bharat Bond ETF - Should you invest?

Bharat Bond ETFs provide a higher degree of certainty of returns (if held-to-maturity), with a higher safety of capital as it invests in government-owned AAA-rated public sector bonds, Sachin Jain of ICICI Securities said.

"With the prevailing low-interest rate regime that is likely to continue, a small allocation could be considered by investors looking to lock in safe and predictable returns. In the current environment, the 11-year ETF is better placed as it offers a higher and safe return for a longer period," he added.

Edelweiss Mutual Fund (on behalf of the government) proposes to raise an initial amount of Rs 2,000 crore with a green-shoe option of Rs 6,000 crore in 2025 maturity and an initial amount of Rs 1,000 crore with a green-shoe option of Rs 5,000 crore in 2031 maturity based on market demand.

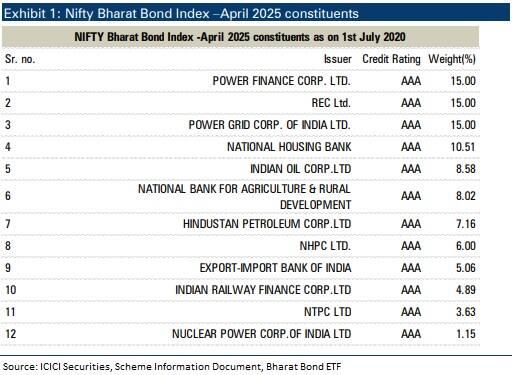

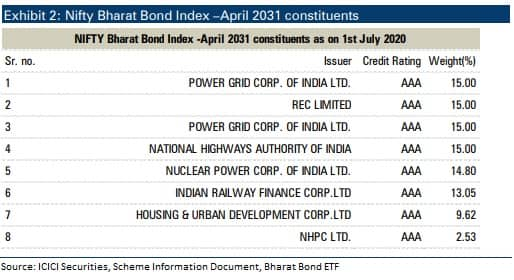

The ETF will invest in constituents of the Nifty Bharat Bond Indices, consisting of AAA rated public sector companies. Bharat Bond Fund of Funds (FOF) with similar maturities will also be launched for investors, who do not have demat accounts.

Also Read: Bharat Bond ETF-Series II: A Safe option, but should you invest?

Analysts say investors can also add this Bharat Bond ETF in their portfolio as it is safe in terms of return on maturity and capital.

"It is advisable for risk-averse investors, especially for short to medium-term holding periods like one to three years. The returns are more predictable when held till maturity. This ETF can form a part of the total portfolio but please note that this may not always generate inflation-beating real rate of returns," Vinod Nair, Head of Research at Geojit Financial Services, said.

"We can expect 6.5 percent to 8.5 percent returns based on the movement of interest rate in the country."

The indicative yield of the five-year Bharat Bond ETF April 2025 is 5.6 percent and that of the 11-year April 2031 version is 6.7 percent, Jain said. The bond ETF will enjoy tax advantage in the form of indexation benefit similar to debt mutual funds (20 percent with indexation).

"While the actual tax implication depends on future inflation index, tentative after-tax yield could be around 5 percent for five-year ETF and 6.2 percent for 11-year ETF," he said.

The fund-raising through the second tranche of Bharat Bond ETF issue will help CPSEs in their capex programmes.

With this, Bharat Bond ETFs will have four maturity points on the yield curve–2023, 2025, 2030 and 2031.

The first tranche was launched in December 2019. The initial issue size of Rs 7,000 crore, which was oversubscribed nearly 1.8 times.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.