It was trading with volumes of 214,254 shares, compared to its five day average of 180,725 shares, an increase of 18.55 percent.

Sadbhav Engineering share price hit 5 percent upper circuit on July 13 after foreign brokerage CLSA gave a buy call on the stock with a target of Rs 120 per share.

The stock price zoomed over 94 percent in the last 3 months and was trading at Rs 51.20, up Rs 2.40, or 4.92 percent. There were pending buy orders of 22,216 shares, with no sellers available.

It was trading with volumes of 214,254 shares, compared to its five day average of 180,725 shares, an increase of 18.55 percent.

CLSA believes that after deleveraging, the focus on the company is now on growth. It rated the stock as buy given its focus on roads, according to a report by CNBC-TV18.

It is a play on the $384 billion national infrastructure pipeline, CLSA added.

Sadbhav Engineering reported a net profit of Rs 886.63 crore in the quarter ended March 2020 as against a net loss of Rs 27.03 crore in Q4 FY19. Sales declined 57.23 percent to Rs 629.47 crore in the quarter ended March 2020 as against Rs 1471.91 crore.

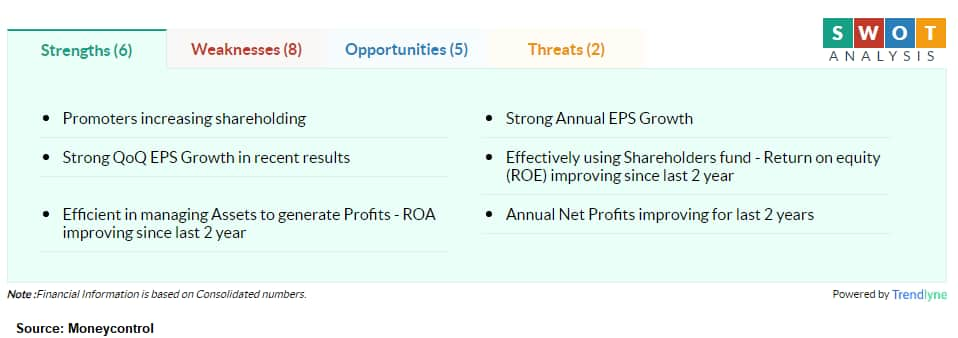

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company's promoters have been increasing shareholding with efficiency in managing assets to generate profits - ROA improving since last 2 years.

Moneycontrol technical rating is bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.