The company's near-term visibility is weak but with the US truck orders recovering, the stock's 3.1 times FY21E PB is attractive, the brokerage says.

The shares of Bharat Forge jumped more than 6 percent in morning trade on BSE on July 13 after Jefferies said it has a 'buy' call on the stock.

CNBC-TV18 reported that global brokerage had a 'buy' call on Bharat Forge, with a target price of Rs 425, nearly 20 percent upside from the previous session's closing of the stock at Rs 354.55.

Jefferies underscored that the company's near-term visibility is indeed weak but with the US truck orders recovering, the stock's 3.1 times FY21E PB is attractive.

As per Jefferies, the stock bottomed three-six months before the trough of earnings in the two of the last three cycles.

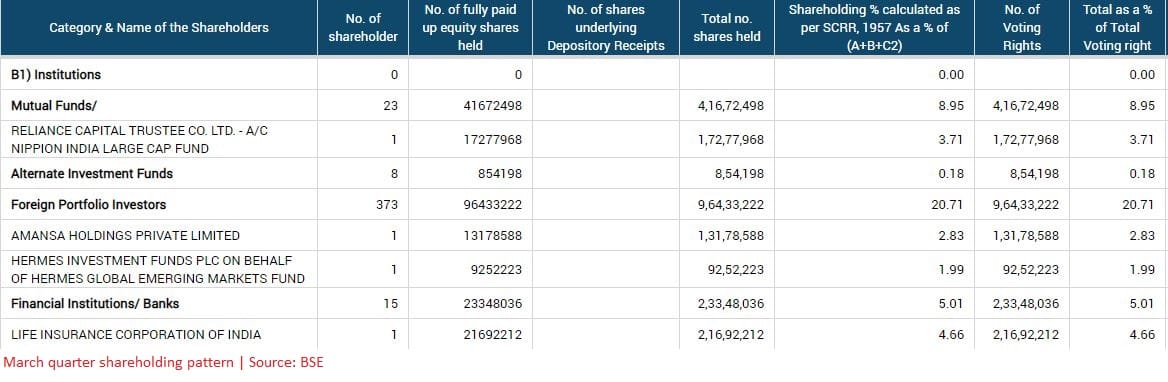

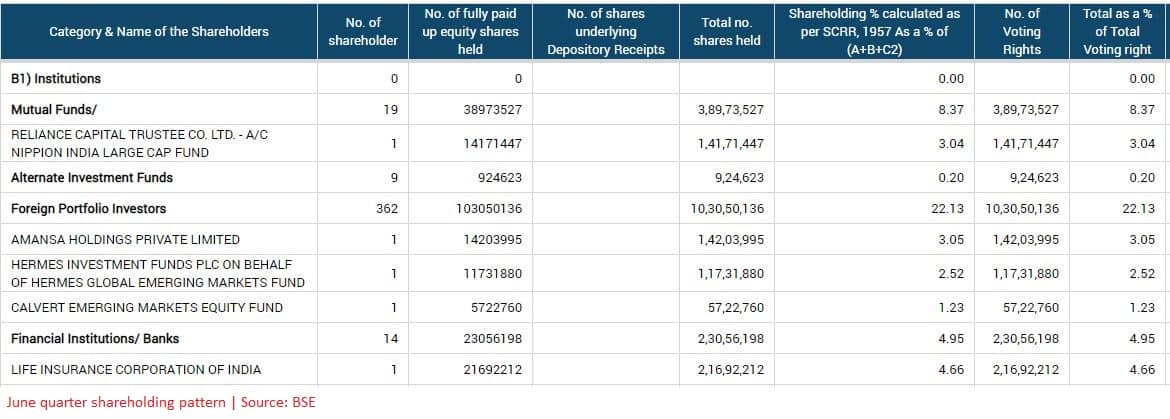

Besides, the company released its June quarter shareholding pattern on July 11 which showed foreign portfolio investors (FPIs) raised their stake during the quarter.

As per available data with BSE, FPIs raised their stake in the company to 10,30,50,136 shares in the June quarter against 9,64,33,222 shares they held in the March quarter.

For the fourth quarter of FY20, the company reported a net loss of Rs 73.3 crore against a profit of Rs 299.5 crore in Q4FY19. Revenue went down 47.2 percent at Rs 881.1 crore against Rs 1,668.6 crore.

Bharat Forge's consolidated net sales were down 34.78 percent in Q4 FY20 at Rs 1741.92 crore from Rs 2670.78 crore in Q4 FY19.

EBITDA was down 78.7 percent at Rs 110.3 crore against Rs 517.3 crore in the year-ago period. EBITDA margin stood at 12.5 percent against 31 percent.

At 1040 hours, Bharat Forge shares were trading 5.30 percent up at Rs 373.35 on BSE.