SGBs are government securities, denominated in grams of gold, and are substitutes for holding physical gold.

The fourth tranche of sovereign gold bonds (SGBs), issued by the Reserve Bank of India on behalf of the government, opened for subscription from July 6 with the issuance date of July 14. The subscription closes on July 10.

SGBs are government securities, denominated in grams of gold, and are substitutes for holding physical gold.

These bonds, which have a tenor of eight years, are redeemed in cash after the maturity period ends but there is an option to exit after the fifth year, which can be exercised only on the interest payment dates.

A unique opportunity to invest in gold

Experts are of the view that SGBs offer a unique opportunity to invest in gold, considering the fact that gold prices have been moving up for the last one year in response to the uncertainties in economic growth faced by all the major economies of the world.

"SGBs have presented a unique opportunity to invest in gold. The first distinctive feature of this is that on the face value of the investment, the investor earns 2.50 percent interest per annum during the term of the investment, which is eight years. Second, this obviates the need to hold or invest in physical gold. Third, the investment, as well as the redemption, will be at the prevailing market rates relevant to the specific time periods," said Joseph Thomas, Head of Research- Emkay Wealth Management.

"It is an instrument issued and serviced by the RBI on behalf of the GOI. These astounding features make the SGBs a really unique avenue to invest for those who would like to invest for a longer term."

Ravindra Rao, VP-Head Commodity Research, Kotak Securities, also said SGB was a good opportunity to invest in gold.

"Definitely yes. If the purpose is a long-term investment, which could be for 5-10 years, then gold bonds make sense as they have a lock-in period," Rao said.

But if the investment was to take the opportunity of a short to medium-term rise in gold then gold ETF or fund of funds would be better, he said. "So, depending on the liquidity preference of an investor, sovereign gold bonds or ETF can be chosen," Rao said.

Prathamesh Mallya, AVP - Research Non-Agri Commodities and Currencies, Angel Broking, too, see SGBs as a good long-term investment.

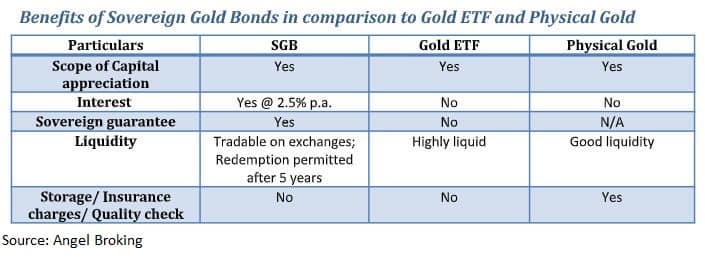

The benefits of investing in SGBs include a fixed rate of interest of 2.5 percent per annum which would be credited semi-annually to the bank account of the investors while the last interest would be payable on maturity along with the principal, he said.

"At the time of redemption or pre-redemption, the investor receives the current market price for gold, ensuring that the value of gold is protected. Besides, bonds are superior to holding gold in physical form due to no additional risk or cost of storage and it is free from issues like making charges and purity," Mallya said.

Gold is likely to remain in the upward trajectory for short to medium term because of the uncertainty in the equity markets.

Apart from physical gold and SGBs, another tool for investment in gold is Gold ETFs. For trading purposes, there is an F&O platform. There are Gold Accumulation Plans also where one can buy the metal online via mobile wallets such as Paytm and under the Gold Rush plan of Stock Holding Corporation of India.

Depending on the purpose of investment, one can pick the channel of investment.

Gold likely to add more glitter

Gold has rallied sharply amid virus concerns and despite persisting strength in equity markets and signs of weaker consumer demand.

Gold market players have been optimistic about the metal ever since the coronavirus pandemic broke out and central banks started taking aggressive measures with most expecting new highs to be set soon.

Mallya of Angel Broking is of the view that with the global output set to contract and the economies in a deep recession, gold as an asset class is a safe bet.

"Although, the physical demand has declined drastically due to the restrictions and lockdowns, the activity of global central banks and their net purchases of gold signal that uncertainty will continue for most of 2020. We see gold prices in the international markets to move higher towards $1,900 by the end of 2020, while MCX gold prices might move higher towards Rs 51,000 per 10 grams mark in the same time frame," Mallya said.

Thomas of Emkay Wealth Management said the uncertainty surrounding economic growth and employment continued to sweep all the major economies, as the virus was spreading unchecked and trials for a drug or a vaccine to contain the coronavirus were still on.

"Because of uncertainties surrounding economic growth, gold prices are likely to fund support at higher levels. While in all standard asset allocation models, a 5 percent allocation to gold as an asset class is suggested with the intention of providing stability to the portfolio and as a hedge against inflation, a higher allocation may be contemplated based on portfolio size and other portfolio peculiarities," Thomas said.

Rao of Kotak Securities said gold’s positive correlation with equity markets was not unusual as the flush of liquidity in financial markets, pushed in by central banks to support their economies, was chasing all asset classes.

However, he said, it was unlikely that this would continue for long.

"Currently, market players are focusing on virus-related developments. Global cases have been rising but lately, we have seen a resurgence in cases in countries like the US, China, Australia, etc. The jump in virus cases has caused some countries to put restrictive measures while some US states have rolled back reopening plans. If the situation continues to worsen, countries may be forced to take restrictive measures which may hamper the nascent economic recovery and force central banks and governments to intensify stimulus measures. This is the major reason which has kept gold prices underpinned," Rao said.

"However, the general strength in equity markets shows that market players are hopeful that countries may want to avoid severe restrictions to keep economic activity ticking. Once this conundrum is broken, we may get more clarity on price direction for gold," Rao added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.