Total advances grew 3 percent QoQ and 18 percent YoY to Rs74,325 crore in June, the private lender has said.

Bandhan Bank share price gained over 2 percent intraday on July 7, a day after the private lender reported a deposit growth of 6 percent on a quarter-on-quarter basis to Rs 60,602 crore as on June 30. Year on year, deposits grew by 35 percent, the bank told stock exchanges.

The stock, which has surged over 118 percent in the last 3 months, was trading at Rs 365.65, up Rs 8.70, or 2.44 percent at 1152 hours. It has touched an intraday high of Rs 376.75 and an intraday low of Rs 362.20.

Total advances grew 3 percent QoQ and 18 percent YoY to Rs74,325 crore in June, it said. The share of micro-banking deposits to total deposits stood at 5 percent on June 30 against 5.7 percent on March 31.

Subsequent to Unlock 1.0, collection in the micro-banking loan vertical had shown positive traction from June 1, the bank said. “There has been a steady improvement in collection efficiency (in value terms) during June. It ended with -68 percent as on June 30” the management said.

For non-micro banking advances, collection efficiency for June stands at 84 percent (resulting in an effective moratorium of -16 percent), it added.

Bandhan Bank was one of the most active stocks on NSE in terms of value with 1,73,92,468 shares being traded.

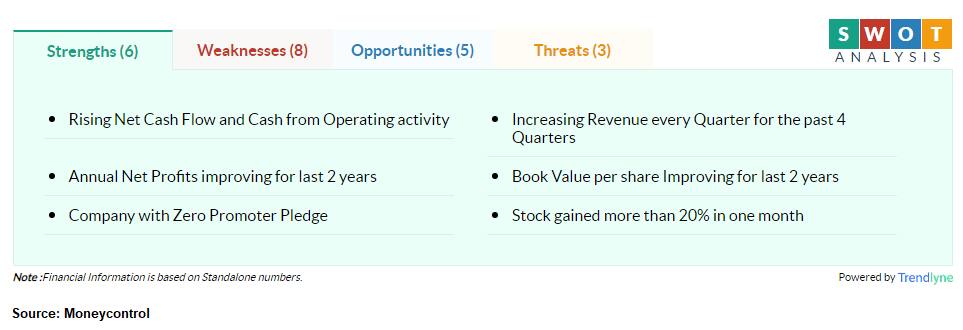

According to Moneycontrol SWOT Analysis powered by Trendlyne, Bandhan Bank's book value per share has been improving for the last two years, with the company having zero promoter pledge.

Based on moving averages and technical indicators, Moneycontrol is bullish on the stock.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.