The bank said that its advances had grown 21 percent year-on-year (YoY) in the April-June quarter to Rs 10,04,500 crore, compared to Rs 8,29,700 crore in the year-ago period. In Q4 FY2o advances stood at Rs 9,93,700 crore.

HDFC Bank share price jumped over 3 percent intraday on July 6 after the private banking major said on July 4 that its advances grew 21 percent year-on-year (YoY) in the April-June quarter to Rs 10,04,500 crore, compared to Rs 8,29,700 crore in the year-ago period. In Q4 FY2o advances stood at Rs 9,93,700 crore.

In an exchange filing, the bank said that its deposits increased 25 percent to Rs 11,89,500 crore in Q1 FY21 versus Rs 9,54,600 crore in Q1 FY20. In the January-March quarter, deposits stood at Rs 11,47,500 crore.

The stock price gained over 36 percent in the last 3 months and was trading at Rs 1,111.30, up Rs 37.10, or 3.45 percent at 12:14 hours. It has touched an intraday high of Rs 1,116.85 and an intraday low of Rs 1,100. It was also one of the most active stocks on NSE in terms of value with 1,02,36,615 shares being traded.

The Bank’s CASA ratio stood at around 40 percent as of June 30, 2020, as compared to 39.7 percent in the year-ago and 42.2 percent at the end of March 2020.

During Q1 FY21, HDFC Bank purchased loans worth Rs 1,376 crore via the direct assignment route under the home loan agreement with parent Housing Development Finance Corporation (HDFC).

Global research firm CLSA has maintained a buy call on HDFC Bank with target at Rs 1,250 per share. It is of the view that positive loan growth in Q1 comes as a surprise and feels that low risk-weight consumption indicates lending to best Private/PSU credit, according to a report by CNBC-TV18.

Morgan Stanley has an overweight call on HDFC Bank with target at Rs 1,285 per share adding that strong growth implies further acceleration in corporate banking.

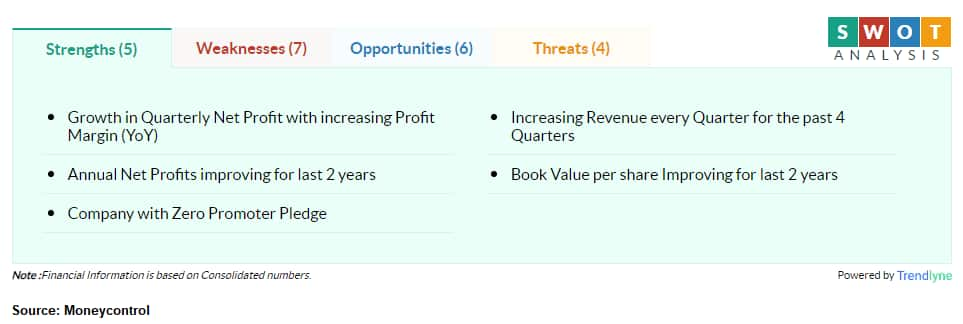

According to Moneycontrol SWOT Analysis powered by Trendlyne, HDFC Bank has zero promoter pledge with the book value per share has been improving for last 2 years.

Moneycontrol technical rating is very bullish with moving averages and technival indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.