The strategy will enable traders to trade with decent risk-reward of more than 1:3 and provide constant profit even if prices trade below the lowest strike price PE.

Chhitij Jain

Strategy setup

The Bank Nifty remained sideways in the week gone by with slightly positive bias but could not go past the previous week high. The Bearish Engulfing pattern that emerged on the daily chart on June 24 still holds importance and could lead to a mild short-term correction in prices.

The banking index is trading near important resistance levels and at this juncture, we need a trading strategy that can fetch high returns with decent risk-reward. Setup indicates that prices are likely to retrace from current levels as it is quite difficult for the index to give breakout in a single attempt without retracing. Hence, traders can trade in the expected mild retracement by deploying a 'Broken Wing Put Butterfly' where ATM Put option can be bought and OTM Put option can be sold in the ratio of 1:2.

To establish the low risk and high reward in the strategy, the Put option of lower strike can be bought but the gap in this deep OTM Put option will be slightly lower as compared to the gap between the former Long Put and Short Put. This change in the gap will ensure a constant profit in the strategy even if the banking index trades below 21,100 and will represent the 'broken wing' part of the strategy.

Option Chain analysis

Considering the closing of 21,852.40, the immediate higher and lower strike price in Call and Put options, respectively will play an important role in understanding the current scenario.

The overhead resistance in the banking index is visible in the Options Chain also, where the fresh open interest addition in the 21,900 Put option is of only 2,469 contracts, the fresh open interest addition in the 22,000 Call option is more than 8,800 contracts.

The scenario suggests that the bulls are cautious and a mild correction can be expected in the coming trading sessions. The level of 22,500 is emerging as an immediate short-term resistance as CE of the same strike price holds second-highest cumulative open interest after 23,000 CE strike price.

On the downside, the first support is emerging at 21,500, where the PE holds a decent total open interest of 18,590 contracts while the major base in the coming days can be expected at 21,000 levels where the PE of the same strike price holds a maximum cumulative open interest of more than 30,300 contracts. To put things into perspective, the option chain signifies the trading range of 22,500 to 21,500, with slightly negative bias.

Technical structure

The index is trading with a positive bias since May 2020 but the higher top and higher bottom cycle has not established yet. Prices are trading near the short-term resistance zone and are expected to correct mildly. However, the medium-term moving averages curve is suggesting that a breakout in the coming days but prices are likely to go through a mild retracement before it.

The banking index is likely to retrace to its 10-day exponential moving average placed at 21,581 as momentum indicators are trading near resistance zone and prices are trading below the 20-period moving average on hourly and 15 minutes timeframe.

Trading strategy

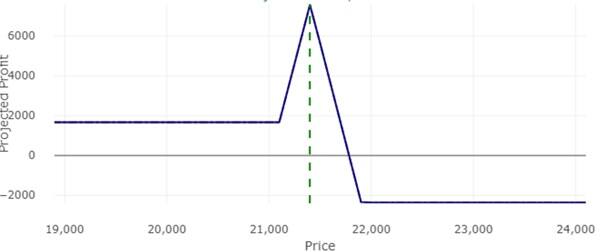

It seems prudent to opt for a trading strategy that can fetch a decent return in the phase of mild retracement and also provide minimum gains even if the correction extends. The 'Broken Wing Put Butterfly' will enable traders to trade the current setup. In view of the expected limited correction, the PE of 21,900 can be bought and to hedge the positions, build short positions in 21,400 PE in the ratio of 1:2. To ensure the minimum return in case of extended correction and to establish a high risk-reward, the PE of 21,100 can be bought.

Buy Bank Nifty 21,900 PE @ 425.05Sell Bank Nifty 21,400 PE @ 226.40 (2 lots)

Buy Bank Nifty 21,100 PE @ 146

Maximum profit - 381.75 (at 21,400)

Maximum loss - 118.25 points

Uniform profit of 81.75 points if index trades below 21,100

The strategy will enable traders to trade with decent risk-reward of more than 1:3 and provide constant profit even if prices trade below the lowest strike price PE. Payoff chart as per expiry

Payoff chart as per expiry

Note: Option premium resembles the last trading price as on July 3, 2020 for July 9 contract.

(The author is Head - Derivatives at Rudra Shares & Stock Brokers.)

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.