Global research firm CLSA has maintained an outperform call on the stock with target at Rs 252 per share while Jefferies has a buy rating on the stock with target of Rs 306 per share.

Sobha share price jumped over 4 percent in early trade on July 6 after the company clocked a 70 percent jump sales volume during Q1 FY21 as compared to Q4 FY20.

The stock price jumped over 44 percent in the last 3 months and was trading at Rs 232.10, up Rs 9.25, or 4.15 percent. It has touched an intraday high of Rs 233.85 and an intraday low of Rs 227.

Sobha posted its highest-ever income, sales volume and collections during FY20 despite challenges thrown by COVID-19 during last fortnight of the fourth quarter. It was able to clock 70 percent of sales volume during Q1 FY21 as compared to Q4 FY20. Demand remained consistent despite pandemic-related uncertainties. The company managed to reduce net debt and average interest cost of borrowing during the quarter, it said in a filing to the exchanges.

The company has reported a 5 percent decline in its consolidated net profit at Rs 281.5 crore for the last fiscal despite higher income and achieved strong sales bookings of Rs 2,881 crore. Its net profit stood at Rs 297.1 crore in the financial year 2018-19.

Total income, however, rose to Rs 3,825.7 crore in 2019-20 from Rs 3,515.6 crore in the preceding fiscal.

Global research firm CLSA has maintained an outperform call on the stock with a target of Rs 252 per share. It is of the view that consolidation led to monthly sales reverting to pre-COVID levels.

The company's average monthly presales run-rate for May-June was at 0.33 msf. The performance was aided by industry consolidation and digital marketing strategy, the research firm said. Sobha has generated a cash flow surplus for the second consecutive quarter with its cash conservation strategy resulting in a net debt reduction, it added.

Research firm Jefferies has a buy rating on the stock with a target of Rs 306 per share. It is of the view that pre-sales decline of 39 percent YoY is a good outcome for lockdown quarter. It sees positive read-through from its performance for other companies adding that Bengaluru and some NRI markets did well.

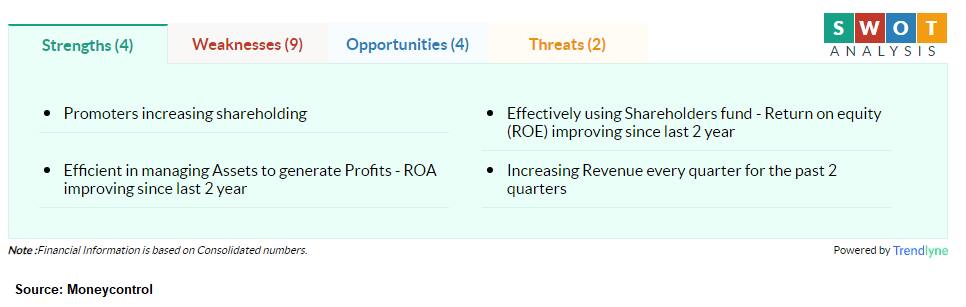

According to Moneycontrol SWOT Analysis powered by Trendlyne, Sobha has been increasing revenue every quarter for the past two quarters with return on equity (ROE) improving since last two years.

However, Moneycontrol technical rating is bearish with moving averages being bearish and technival indicators being neutral.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.