Key support level for the Nifty is placed at 10,569.57, followed by 10,531.83. If the index moves up, the key resistance levels to watch out for are 10,638.17 and 10,669.03.

Equity markets ended the week with strong gains on the back of better than expected economic data globally and reports of a potential COVID-19 vaccine.

The Nifty50 recorded its third consecutive week of gains. The index closed with gains of 2.1 percent while the S&P BSE Sensex rose 2.4 percent for the week ended July 3.

"In spite of improving economic data, markets are still largely moving on hope rather than on any real change in the ground realities. With intra-day volatility increasing, investors are advised to remain cautious," said Vinod Nair, Head of Research at Geojit Financial Services.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance levels for the NiftyAccording to pivot charts, the key support level for the Nifty is placed at 10,569.57, followed by 10,531.83. If the index moves up, the key resistance levels to watch out for are 10,638.17 and 10,669.03.

Nifty BankThe Nifty Bank index ended 0.46 percent lower at 21,852.40 on July 3. The important pivot level, which will act as crucial support for the index, is placed at 21,703.5, followed by 21,554.6. On the upside, key resistance levels are placed at 22,065.8 and 22,279.2.

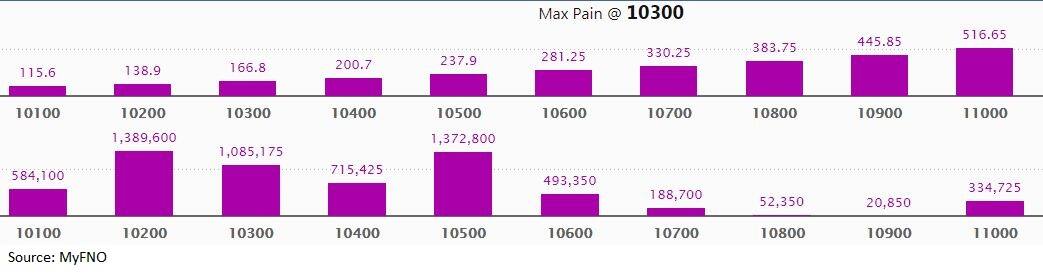

Call option dataMaximum call OI of 22.82 lakh contracts was seen at 11,000 strike, which will act as crucial resistance in the July series.

This is followed by 10,500, which holds 14.28 lakh contracts, and 10,600 strikes, which has accumulated 7.79 lakh contracts.

Significant call writing was seen at 10,600, which added 1.39 lakh contracts, followed by 11,000 strikes, which added 58,425 contracts.

Call unwinding was witnessed at 10,300, which shed 76,500 contracts, followed by 10,500, which shed 55,650 contracts.

Maximum put OI of 13.9 lakh contracts was seen at 10,200 strike, which will act as crucial support in the July series.

This is followed by 10,500, which holds 13.73 lakh contracts, and 10,300 strikes, which has accumulated 10.85 lakh contracts.

Significant put writing was seen at 10,400, which added 1.3 lakh contracts, followed by 10,600 strikes, which also added nearly 1.3 lakh contracts.

Put unwinding was seen at 11,100 strike and 10,900 strike, shedding 75 contracts each.

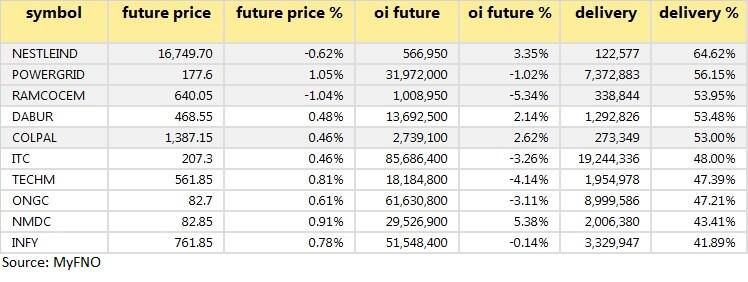

A high delivery percentage suggests that investors are showing interest in these stocks.

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

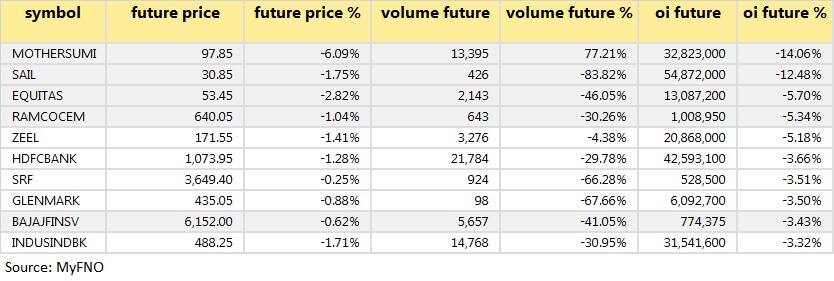

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

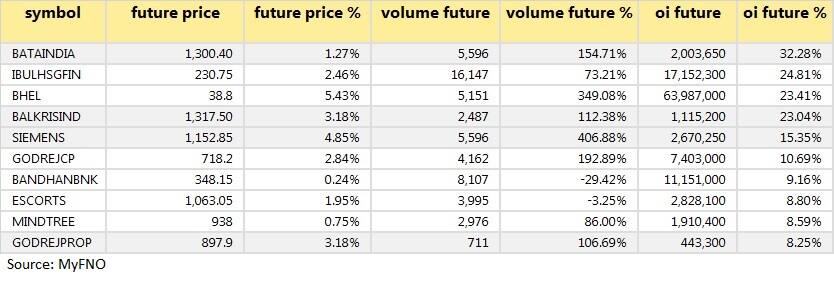

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Alpha Leon Enterprises sold 8,54,566 shares of McLeod Russel India at an average price of Rs 8.05 per share in a bulk deal on NSE on July 3.

Nexpact bought 5,81,767 shares of Authum Investment & Infrastructure at an average price of Rs 82.45 per share in a bulk deal on BSE on July 3.

(For more bulk deals, click here)

Results on July 6

NBCC (India), Sadbhav Infrastructure Project, BCL Industries, BMW Industries, Bodal Chemicals, DCW, Dynamic Industries, IFB Agro Industries, IFB Industries, JMD Ventures, Nyssa Corporation, Welcure Drugs & Pharmaceuticals.

Stocks in the news

DJ Mediaprint & Logistics: Government company IREL (India) selected DJ Mediaprint for designing and printing of their Veral Darpan, Magazine.

Hindustan Oil Exploration: Operations at PY-1 field are temporarily suspended in Tamil Nadu.

Ajanta Pharma: Promoter Aayush M Agrawal, Trustee Aayush Agrawal Trust created a pledge on an additional 2 lakh shares (0.23% stake) for loans taken for personal business purpose.

Adani Ports and Special Economic Zone: Company achieved a throughput of 41.5 MMT across its nine operating ports in India in Q1FY21.

Marico: Revenues declined in double-digit in Q1FY21, but there would be margin expansion YoY.

National Fertilizers: NFL achieved highest-ever fertilizer sale of 12.85 lakh MT in Q1FY21, up about 21.5% YoY.

Crest Ventures: Company acquired approximately 10% stake in CMS IT Services for Rs 6.47 crore.

Dynamatic Technologies Q4: Profit at Rs 15.82 cr versus Rs 7.58 cr, revenue at Rs 318.23 cr versus Rs 384.86 cr YoY.

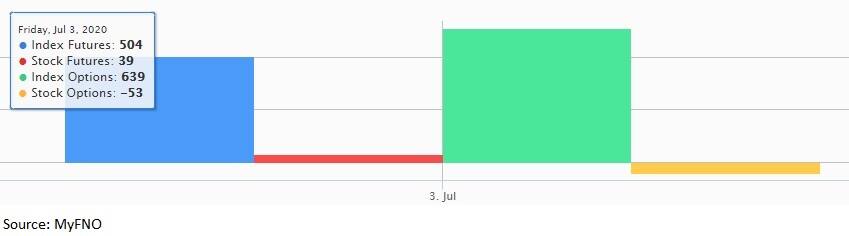

Fund flow

Foreign institutional investors (FIIs) bought shares worth Rs 857.29 crore, while domestic institutional investors (DIIs) sold shares worth Rs 331.96 crore in the Indian equity market on July 3, provisional data available on the NSE showed.

Stock under F&O ban on NSEGlenmark Pharmaceuticals, Indiabulls Housing Finance, Vodafone Idea and SAIL are under the F&O ban for July 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.