Promoters of Aksh Optifibre, a Delhi-based company, accused of creating a byzantine collection of shell companies, entering into undisclosed related party deals, and carrying out gold-plated imports. Independent director shoots letters to finance ministry and board calling for forensic audit.

An independent director of a Delhi-based maker of optic fibres has written to the board and the finance ministry accusing its promoters of siphoning off at least Rs 600 crore through multiple related party transactions, faking investments in a byzantine collection of shell companies, over-invoicing overseas purchases and fudging company accounts over several years.

The actions of Kailash S Choudhari and co-promoter Popatlal Fulchand Sundesha, the promoters of Aksh Optifibre Ltd, caused losses to shareholders and bankers, according to a series of letters written by independent director Arvind Gupta.

Moneycontrol has reviewed a copy of the letters sent by Gupta, on June 26, 2020 in which he has called for a forensic audit of the company.

The revelations by Gupta, who is credited with exposing several corporate scams, notably the alleged ICICI-Videocon quid-pro-quo loan deal involving banker Chanda Kochhar, is arguably the first instance in which an independent director has attempted to blow the lid off a financial scam in a listed Indian company.

Moneycontrol sent a detailed questionnaire and reminders to Chaudhuri, Sundesha, the auditors and company secretary of Aksh Optifibre but did not receive comment.

“Related party private companies have been indiscriminately used for over invoicing, plant and machinery, procurement of cheap raw material, over billing other inputs and services to Aksh Optifibre in collusion with the chief financial partner, managing director and other directors on the board,” Gupta told Moneycontrol.

Aksh Optifibre manufactures optic fibre/optic fibre cables (OF/OFC) and optics lenses. The promoters own 27.95 percent of the company as on March, 2020 while the public holds 72.05 percent.

Many firms, same owner

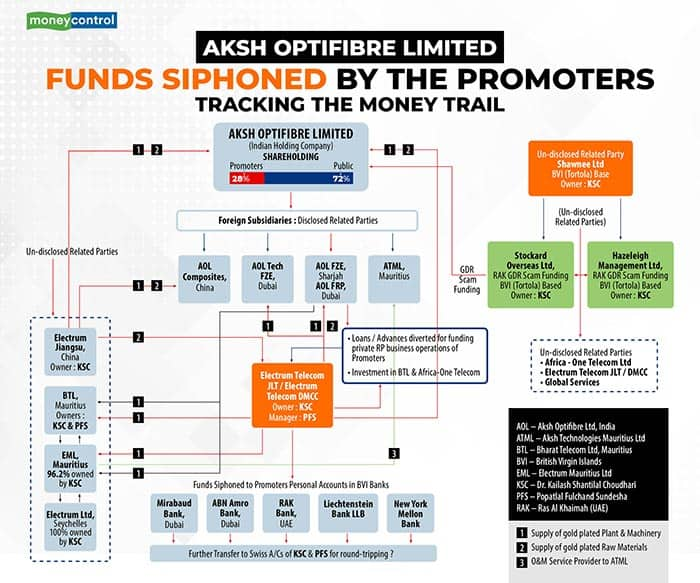

According to Gupta, Choudhari and Popatlal created a layer of at least 13 undisclosed related party entities (see chart). The final ownership in these entities based in Tortola (largest of the British Virgin Islands), Seychelles, Mauritius, China and United Arab Emirates lies with Choudhari himself, Gupta alleged.

Gupta, who was named independent director of Aksh Optifibre on February 13, 2020, said he has presented to authorities minutes of meetings, internal documents and letters as evidence of Chadhuri’s ownership links in these companies. One such example is a letter sent by Trident Trusts, a proxy ownership service provider based in British Virgin Islands, to Chaudhari on November 12, 2015 that confirms his ownership of Stockard Overseas Ltd and Hazeleigh Management Ltd through Shawnee Ltd.

Share certificates of a company named Africa One Telecom dated October 3, 2010 confirms Chaudahri as the owner through Stockard and Hazeleigh. Minutes of the directors meeting of Stockard Overseas Ltd on September 20, 2011 reveal Chaudhari agreeing to purchase global depository receipts (GDRs) issued by Aksh Optifibre. The GDRs were subscribed by Hazeleigh Management Ltd.

A certificate of incorporation of Electrum Mauritius Ltd on November 17, 2011 in Mauritius shows Chaudhari as owner.

Declaration of related party transactions is an obligation under section 184 and 188 of the companies Act, 2013. If a listed company is found flouting rules pertaining to related party transactions disclosures, directors can get up to one-year prison term or a fine of up to Rs 5 lakh or both.

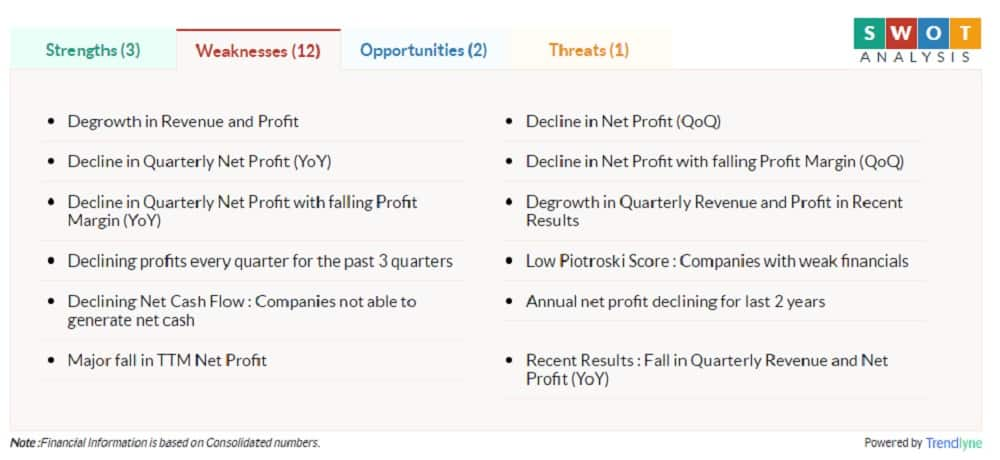

Three-decade-old Aksh Optifbre went public in 2000 and is listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The company posted a loss of Rs 237.82 crore in the January-March quarter compared with a profit of Rs 10.62 crore a year ago. Net sales at Rs 55.48 crore in March 2020 were down 27.13 percent.

[caption id="attachment_5508011" align="alignnone" width="1000"]

Weaknesses in Aksh Optifibre company analysis (Source: Moneycontrol)[/caption]

Weaknesses in Aksh Optifibre company analysis (Source: Moneycontrol)[/caption]Shares of Aksh Optifibre have been steadily dropping, trading at Rs 6.35 apiece at close on July 3 from Rs 157.50 in November 2000.

The Money Route

In his letter, Gupta also laid bare the flow of money. The biggest fraudulent transactions, he said, happened in 2010 when the promoters routed around Rs 128 crore raised from a GDR issue by Aksh Optifibre to Africa One Telecom Ltd, one of the many undisclosed subsidiaries. The money first went to a wholly-owned subsidiary named AOL FZE, which advanced money to Africa One Telecom, a company owned by Choudhari. But this money never changed hands to the parent company, Aksh Optifibre, or AOL FZE, a unit registered in Dubai.

This amount was later written off the books stating that the advances are unrecoverable and has been provided for fully, according to Gupta.

Misleading company statements

The promoters allegedly set off a chain of events to make this possible. In March 2010, Aksh Optifibre advanced Rs 128 crore to AOL FZE, which in turn was passed to Africa One Telecom, to expand business in the GSM telephony and data market in Africa, according to Gupta’s letter. The amount is irrecoverable now, the company deemed.

The explanation given was that AOL FZE could not make the remaining payment (to Africa One Telecom) because it was unable to raise money from the Indian parent due to unfavourable equity market conditions. “Non-payment of further installments by the company led to failure of the contract (in Africa). As considerable time has elapsed and company do not foresee recovery in near future, it has therefore decided to make provisions for upfront consideration paid of Rs 12833.77 lakhs,” company documents said.

Gupta alleged that PC Bindal & Co and Rakesh Jain, the auditors of Aksh Optifibre and AO FZE, respectively, have made misleading statements about which company made the advances to whom. The truth is that AOL FZE advanced money to Africa One Telecom Ltd without entering into any agreement, Gupta said.

Gupta said Africa One is owned by Aksh Optifibre promoter Choudhari and hence the money should be recovered from him. “The auditors and promoters are making misleading statements about the recovery of advances that have vanished into thin air,” Gupta said.

Jayant Thakur, a chartered accountant, said auditors are the first level of checks in such cases. “If auditors are in collusion with promoters, things become even more difficult.”

The promoter Choudhari draws a tax-free annual salary of Rs 5 crore from AOL FZE, and along with his co-promoter manages the private business based in Dubai, Gupta said in the letters.

Undisclosed related party deals

Among the undisclosed RTP companies, the Electrum Group of companies were used for most of the layers of related party transactions. Electrum Telecom DMCC, Dubai, a private special purpose vehicle, was used to manipulate procurement and distribution facilities for over-invoicing cheap Chinese plants and machinery, raw material and services to Aksh Optifibre at exorbitantly inflated prices, Gupta said in the letters. While these actions caused losses to Aksh Optifibre, the promoters pocketed “unjust illegal” profits, he said.

According to Gupta’s letter, the Electrum group of companies are owned by Choudhari himself through proxy firms based in the British Virgin Islands and owned by relatives, trusted funds and aides residing in Switzerland and other foreign countries. Electrum Telecom DMCC, for example, is managed by Mona Kailash Choudhari, the second wife of Choudhari. It is owned by Manoj Wadhwa, brother-in-law of Choudhari.

Choudhari has been providing advances to overseas companies secretly owned by him, and has purchased assets abroad and round-tripped money back to India to purchase shares as his company made losses, Gupta alleged. “In fact, the wholly-owned UAE subsidiary AOL FZE has never earned any profits and has been incurring losses in the past ten years. Yet the promoters keep on funding the expenses without any justification,” said Gupta adding that the entire group is run like a proprietary company.

Gold-plating of imports

Electrum Telecom DMCC, one of the companies clandestinely owned by the promoters, allegedly long acted as the central procurement agency for Aksh Optifibre for both India and overseas subsidiaries, according to the letter. Through this company, the promoters allegedly executed gold-plating of imports (overstating value of overseas purchases manifold to make illegal profits).

Another company, Bharat Telecom, Mauritius, too was used for gold-plating of imports. In all, Gupta has listed nine such transactions to illustrate the allegation of gold plating, including the sale of several machinery sold by Electrum Group of companies to Aksh Optifibre Group firms.

Subsidiaries of Aksh Fibre such as AOL FZE, UAE, AOL Composites (Jiangsu, China), which is a so-called step-down subsidiary of AOL FZE, UAE and Aksh Technologies, Mauritius are involved in over invoicing imports and transfer of money from India to overseas, Gupta said. Such transactions have been going on for at least nine years and have caused significant losses to Optifibre over several years, the letter alleged.

Call for probe

In his letter, Gupta has demanded a forensic audit of Aksh Optifibre’s accounts. He has raised several piercing questions: How did the auditors’ of the company miss related party transactions that have been continuing for the past nine years? How can a company make an advance to a foreign subsidiary and suddenly deem it as a loss after several years and make full provisions? Where did this money go?

For now, there are no answers to these questions.