Experts suggest that the markets will continue to be influenced by updates on the India-China border stand-off and the United States-China trade talks.

Momentum in the market continued for the second consecutive week with benchmark indices hitting three month-high during the week that ended on June 26. However, there was consolidation in the second part of the week.

Optimism over further reopening of economic activities starting from July, hopes of another fiscal stimulus package, positive management commentaries after March quarter earnings and liquidity support, helped the market gain 1.3 percent last week. Yet, the rising number of COVID-19 cases remain a concern for the market.

Experts feel, with 36 percent rally from March 23's low, the market seems to have priced in most of the positive news flow. Thus, there could be a consolidation in coming days. But the major upside/downside from here could largely depend on guidelines for the next phase of reopening of economic activities and liquidity.

"The possibility of upside and downside to Nifty50 target is evenly balanced today. The sensitivity of the scenario is widely open on both the side with huge positivity and negativity if we have vaccination or fall in virus threat and vice versa. Today, the market is working more towards the positive side," said Vinod Nair, Head of Research at Geojit Financial Services.

But Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote still feels that markets are still going to be significantly influenced by updates on the India-China border stand-off and United States-China trade talks.

"While these influences might only be sentimental but if FPIs start selling, markets can really fall from the cliff as they have already bounced back 38 percent which statistically is a good number for markets to start drifting lower. All the positives, if any, are discounted, however any negative surprises may take markets lower," he said.

Here are 10 key factors that will keep traders busy this week:

Unlock 2.0?

After phase one of the plan to reopening the economy in June, the market is closely watching any signs of the second phase. This could possibly start in July. News reports suggest that guidelines of phase two of the 'Unlock' campaign, could be released on June 3.

However, with the rapid rise in COVID-19 infections in major cities, fear of monsoon's impact on the spread of the virus and some states already extending their lockdown till July 31, the market is keenly watching as to which sectors or segments get to reopen.

Also read | Reopening India: Tracking the economic and business recovery after the coronavirus lockdown

The novel coronavirus pandemic

The risks linked to COVID-19 have been increasing day by day, even as the government has started reopening economy gradually. Some experts suggest that the entire economy may be reopened in during the July-September period.

India has been consistently registering well over 15,000 new COVID-19 cases on a daily basis for the last week. This is worrisome for investors and traders.

India's COVID-19 tally currently stands at 5,08,953 lakh cases, which includes 15,685 deaths. However, the recovery rate has also been increasing and is now around 58 percent.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

Globally, there have been over 99.8 lakh confirmed cases of COVID-19. More than 4.9 lakh people have died so far

Therefore, while experts feel that the market will continue to watch the novel coronavirus pandemic, the optimism of further reopening of economic activities from July may keep supporting the sentiment.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Earnings

We were supposed to end the March quarter earnings season by June 30. However, after requests from corporates, the Securities and Exchange Board of India (Sebi) recently extended the date for disclosing March quarter earnings till July 31.

Around 1,420 companies are expected to announce their quarterly earnings this week. Of these, 1,408 companies will declare earnings in the first two days of the week — June 29 and June 30. Most of these are midcaps, smallcaps and penny ones.

Key earnings to watch out for would be ONGC, Vodafone Idea, Bharat Forge, Bharat Electronics, Petronet LNG, Central Bank of India, MRF, Force Motors, GIC Housing Finance, GMR Infrastructure, Phoenix Mills, Raymond, Shree Renuka Sugars, Deepak Fertilisers, Dish TV, Future Consumer, Godfrey Phillips, HCC, ICRA, Mishra Dhatu Nigam, NBCC, New India Assurance Company, PC Jeweller, RITES, RPP Infra Projects and SAIL, among others.

June auto sales

After a washout in April, auto sales in May were mixed given the gradual reopening of the economy in all non-containment zones, though the numbers in comparison to a year ago or pre-pandemic levels were very poor.

Experts suggest that there could be further improvement in two-wheeler and tractor sales for June given the positive rural sentiment after good rabi season and expectations of good kharif season too, on the back of likely normal monsoon this year.

Entry level cars among passenger vehicles segment could see some increase in sales during June compared to May. But the replacement market is likely to remain weak. Commercial vehicle segment sales are expected to continue to be poor, experts suggest. Thus, Hero Motocorp, Maruti Suzuki, Escorts, M&M, Bajaj Auto, TVS Motor, Tata Motors, etc. will be closely watched on the first day of July.

Crude oil prices

The consolidation of oil prices around $40-41 a barrel remains a positive sign for India as it is one of the largest importers of crude. International benchmark Brent crude futures corrected around $2 per barrel to settle at $41 a barrel during last week due to rising COVID-19 cases and higher-than-expected inventory from the US.

Experts expect the oil to remain rangebound given the risk of coronavirus and likely further weakness in global economy.

"We believe the ongoing risk on rally will continue to support Brent on downsides. It may consolidate around $40 in the near term before finding any major directional move," ICICI Direct said.

Macro data

The data on fiscal deficit and infrastructure output for May will be released on June 30. Current account numbers for March quarter of FY20 will also be announced on same day.

Markit Manufacturing PMI for June will be declared on July 1, while on July 3, Markit Services PMI for June, foreign exchange reserves for week ended June 26, and deposit and bank loan growth for fortnight ended June 19 will be announced.

Manufacturing PMI had increased marginally to 30.8 in May (due to re-opening of some industries) against record low level of 27.4 seen in April when there was a complete nationwide lockdown, while Services PMI more than doubled to 12.6 in May from its record low level of 5.4 in April.

Technical view

The Nifty50 gained 1.35 percent for the week and 0.91 percent on June 26, forming Spinning Top on the weekly scale and Doji kind of pattern on the daily charts respectively.

Both formations show indecisiveness among bulls and bears, especially after crossing three-and-half-month high during the passing week, hence there could be further consolidation initially next week and then there could be some directional move on either side in later part of the week given the guidelines about Unlock 2.0, experts feel.

"We expect further consolidation in the Nifty index ahead and probable range could be 10,050-10,550. On the sectoral front, we are seeing rotational buying interest across the board thus traders should focus more on stock selection and prefer hedged positions until Nifty resumes the trend," Ajit Mishra, VP Research at Religare Broking told Moneycontrol.

F&O cues

The July series started off on a positive note. Option data suggests that 10,000 can be a good support while 10,500 may remain a key resistance area.

Maximum Call open interest of 15.86 lakh contracts was seen at 10,500 strike, followed by 11,000, which holds 15.10 lakh contracts, while maximum Put open interest of 19.21 lakh contracts was seen at 10,000 strike, followed by 9,800, which holds 12.23 lakh contracts.

Significant Call writing was seen at the 10,400, followed by 11,000 and 10,500 strikes, while Put writing was seen at 10,000, followed by 10,100 and 10,300 strikes.

"The Nifty broadly consolidated above 10,200 for the entire week. We believe this pattern will be followed in the coming week also. Positive consolidation should continue in the index," said Amit Gupta of ICICI Direct.

"The highest Put is now placed at the 10,000 strike, which should remain a positional support. The highest Call base for the series is placed at 10,500, which remains an intermediate hurdle," he added.

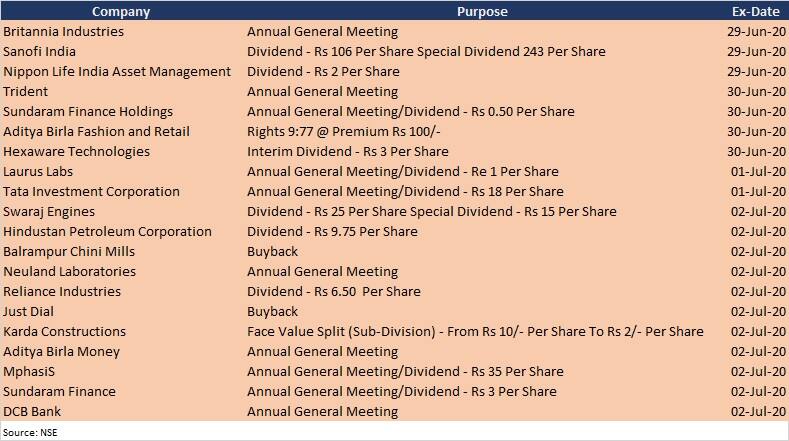

Corporate action

Here are key corporate actions taking place this week:

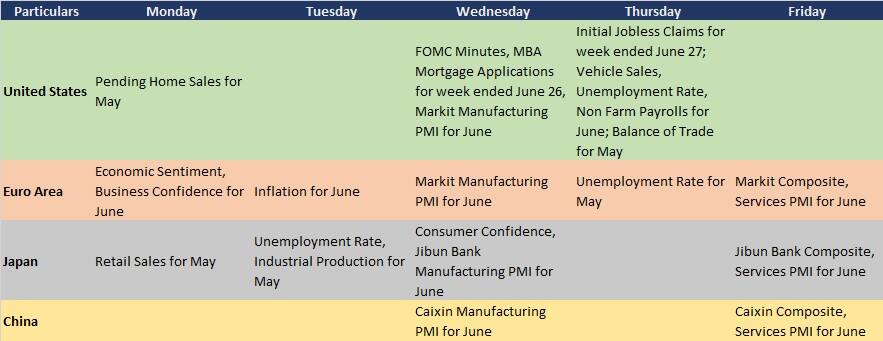

Global cues

Here are key global data points to watch out for this week: