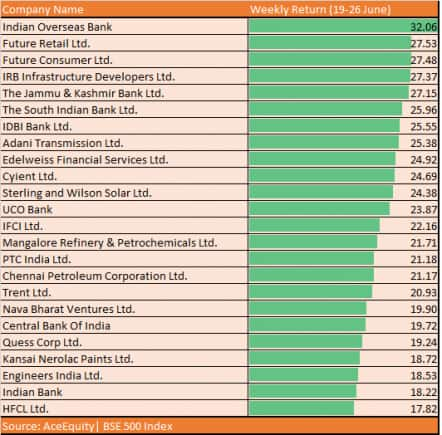

As many as 55 stocks in the S&P BSE 500 index rallied 10-30 percent in a week that includes names like Union Bank of India, SPARC, Hindustan Zinc, ABB India, Glenmark Pharma, etc. among others.

Indian markets which started off on a strong note witnessed some profit-taking towards the close of the week but still benchmark indices managed to close with gains of over 1 percent for the week ended June 26.

The S&P BSE Sensex rose 1.2 percent while the Nifty50 gained 1.3 percent for the week ended June 26 compared with 3.5 percent rally seen in the S&P BSE Mid-cap index, and the S&P BSE Small-cap index closed with gains of 2.8 percent in the same period.

As many as 55 stocks in the S&P BSE 500 index rallied 10-30 percent in a week that includes names like Union Bank of India, SPARC, Hindustan Zinc, ABB India, Glenmark Pharma, BHEL, Bandhan Bank, Adani Gas, Indian Bank, IDBI Bank, Future Consumer, and Indian Overseas Bank, etc. among others.

related news

-

Coronavirus treatment | Dexamethasone now part of govt's revised COVID-19 clinical management protocol

-

Coronavirus state-wise tally June 27: Maharashtra cases at 152,765, India sees record 24-hour spike of 18,000 cases

-

The weekly dossier: Words of wisdom from Morgan Housel, Shankar Sharma and other experts to give you cues about the market

Experts are of the view that small and mid-caps are playing catch-up, but investors should ignore the noise, and stay with quality. Despite the fact that buying is seen in many small and mid-caps, investors should not allocate more than 20 percent of their portfolio.

"Sheer underperformance and the oversold state of small and mid-cap stocks have resulted in outperformance when the market, in general, bounced back from lower levels. Cash market stocks in mid and small-cap space have always outperformed the indices after a major correction in their prices. So this time is no different," Umesh Mehta, Head of Research, Samco Securities told Moneycontrol.

"The small and mid-caps that made a top in 2018 followed by two to three years of major price cuts are now experiencing outperformance. However, long term investors should not get carried away by such outperformance and can have exposure to the extent of 20 percent in such small and mid-cap stocks with balance 80 percent in frontline large caps," he said.

Where are markets headed?

It was a roller coaster ride for investors in the week gone by, but the good part is that the S&P BSE Sensex closed above 35,000 while the Nfity50 reclaimed 10,300 levels.

Tracking positive global cues, rise in COVID-19 related cases, and geopolitical tension between India-China, the market climbed all wall of worries in the week gone by.

Investors should brace for more volatility as markets head into the July series. The rollover data suggests that long positions got rolled over that would keep the markets afloat, but a break above 10,553 (high of June 24) for the index to head towards 10,600-10,900 levels.

The Nifty formed a Doji kind of candle on Friday (June 26) and an indecisive formation on the weekly charts as well which suggests consolidation in the coming week.

“The Nifty on the weekly chart formed a high wave-type candle formation near the key upside resistance of 10,550-10,600 levels. Positive chart patterns like higher highs and higher lows continued as per weekly chart and Nifty is placed to form a new higher high of the sequence. But, still, there is no confirmation of any higher top reversal,” Nagaraj Shetti, Technical Research Analyst, HDFC Securities told Moneycontrol.

“The short term trend of Nifty has turned into positive, after the minor weakness from the highs. There is a possibility of further upside in the early next week and one may expect Nifty to retest the overhead resistance of 10,550-10,600 levels in the mid to later part of the coming week. Immediate support is placed at 10,280,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.