Sectors like auto, consumer durables, pharma and telecom are dependent on China in terms of sourcing

The recent border conflict with China in the Galwan Valley of Ladakh has heightened geopolitical tensions between Indian and China. Voices in India to boycott Chinese products across segments are growing louder.

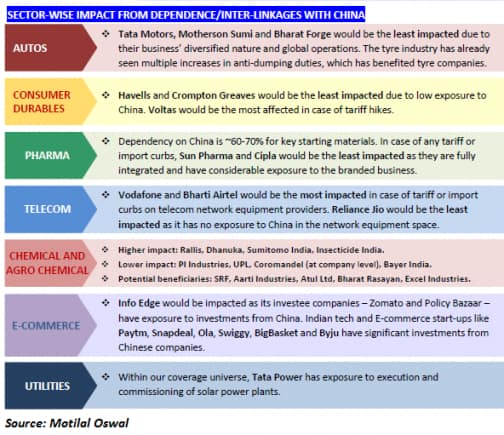

Sectors like auto, consumer durables, pharmaceuticals, telecom, chemicals and renewable power (solar) seem to be most dependent on China in terms of sourcing, said a Motilal Oswal report.

In many cases, alternative suppliers at the same scale or costs are lacking. While consumer durables is dependent on China for components, pharma is dependent on API sourcing.

Telecom is dependent on China for network equipment as well as for 4G smartphone handsets as China caters to more than 75% of the Indian handset demand.

In the telecom space, Vodafone and Bharti Airtel would be the most affected in case of tariff or import curbs on telecom network equipment providers.

Motilal Oswal is of the view that any potential escalation between the two nations could increase operational/supply-chain risks in the current economic backdrop, even as economies look to recover from the pandemic.

Overall, it would be difficult and expensive for Indian firms to immediately find alternative suppliers, it said.

In the Chemical space, higher impact could be seen on stocks like Rallis India, Dhanuka, Sumitomo India, and Insecticide India. A lower impact could be seen on PI Industries, UPL, Coromandel, and Bayer.

In the e-Commerce space, Info Edge would be impacted as its investee companies – Zomato and Policy Bazaar – have exposure to investments from China. Indian tech and e-commerce startups like Paytm, Snapdeal, Ola, Swiggy, BigBasket, and Byju have significant investments from Chinese companies, said the Motilal Oswal report.

In the utilities space, within our coverage universe, Tata Power has exposure to the execution and commissioning of solar power plants.

Trade between India & China:

Media reports suggest that the Indian government has asked the industry to prepare a list of products imported from China. Further, business contracts awarded to Chinese firms have been cancelled by some state governments (Maharashtra and Haryana).

“India-China border dispute is a decades-long tussle – it is an extremely important matter politically and may have wider ramifications on the geopolitics of the South Asian region in the long run,” Devarsh Vakil- Deputy Head of Research, HDFC Securities told Moneycontrol.

From barely any deficit in FY 2000, India ran a trade deficit of USD48.6b (1.7% of GDP) with China in FY20. India’s imports from China have risen steeply from just 2.6 percent of total imports in FY00 to an all-time high of 16.4% in FY18 before easing to 14% (USD65.3b) in FY20, a Motilal Oswal report showed.

Experts feel that the ongoing border tensions are likely to change the bilateral trade in future among both the countries. A major shift could happen in the post COVID world.

“The border standoff could lead to a change in bilateral trade in the future. India runs a big trade deficit with China and in most cases, the imports form a crucial part of the supply chain. Industries like Automobiles, Electronics, Bulk Drugs, chemicals and Engineering import from China,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“At the same time, China could also face the threat of reduced exports to India over time if we start developing alternatives within India or from other countries. Post Covid-19 there could be a change in the way global companies were outsourcing from China. Here, India has an opportunity to attract global companies to set-up their factories and attract more FDI,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

WEBINAR: Tune in on June 30 at 11am to find out how term insurance can provide risk protection during tough times. Register Now!