The funds would be used to consolidate and acquire the entire stake of the company's joint venture partners in Mexico and China.

Camlin Fine Sciences share price hit 10 percent upper circuit on June 26, a day after the board gave its nod to raise funds of up to Rs 180 crore.

The funds would be from Infinity Holdings and its affiliated entities, with Convergent Finance LLP acting as an investment adviser.

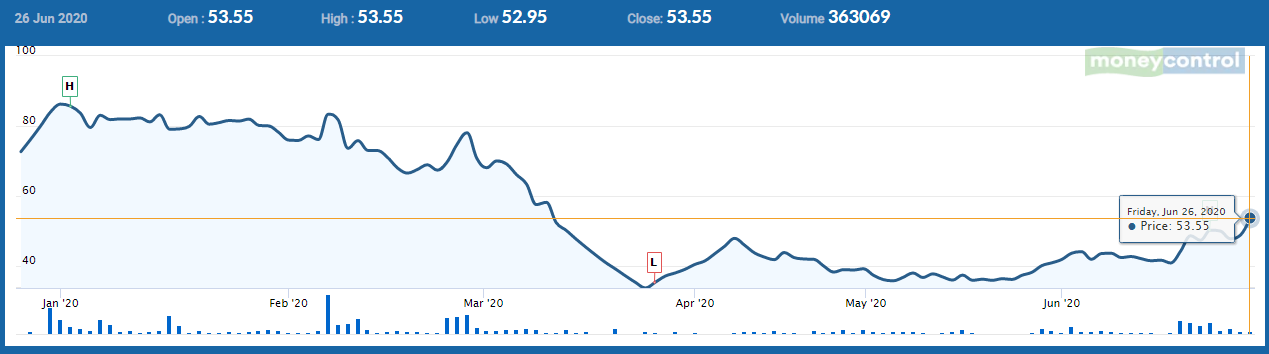

The stock, which has surged more than 57 percent in the last three months, was trading at Rs 53.35, up Rs 4.85, or 10.00 percent. It touched upper circuit of Rs 53.35 pers share on BSE. There were pending buy orders of 57,502 shares, with no sellers available. It was also one of the top BSE smallcap gainers.

"Structured as a subscription to equity warrants priced based on the prevailing market price and in accordance with applicable SEBI regulations, the investment will result in an approximately 22.65 percent ownership stake on a fully diluted basis," the company said in a filing to the exchanges.

The purpose of fund-raise would be to consolidate and acquire the entire stake of its joint venture partners in the company’s subsidiaries in Mexico and China, ie Dresen Quimica SAPl de CV and CFS Wanglong Flavours Ningbo Co Ltd, as well as to enhance the company’s portfolio in health and wellness segment by launching new products, the company added.

According to Moneycontrol SWOT Analysis powered by Trendlyne, Camlin Fine Sciences has shown strong annual EPS growth with FII/FPI or institutions increasing their shareholding.

Based on moving averages and technical indicators, Moneycontrol is bullish on the stock .

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.WEBINAR: Tune in on June 30 at 11am to find out how term insurance can provide risk protection during tough times. Register Now!