Net interest income of Canara Bank declined 5.2 percent year-on-year to Rs 3,318.52 crore in Q4FY20.

Canara Bank share price was down over 5 percent intraday on June 25 after the company declared its March quarter results.

The public sector lender on June 24 posted a loss of Rs 3,259.33 crore for the quarter ended March 2020. The bank had reported loss of Rs 551.53 crore in year-ago period.

Lower net interest income, pre-provision operating profit and elevated provisions affected the bank's performance.

The stock price has, however, gained over 31 percent in the last 1 month and was trading at Rs 103.50, down Rs 5.95, or 5.44 percent at 09:47 hours. It has touched an intraday high of Rs 105.25 and an intraday low of Rs 102.05.

Net interest income of Canara Bank declined 5.2 percent year-on-year to Rs 3,318.52 crore in Q4FY20. Canara Bank in its BSE filing said non-interest income (other income) increased 16.8 percent to Rs 2,174.85 crore compared to corresponding period last year.

In an interaction with Moneycontrol, Anuj Mathur, Managing Director & Chief Executive Officer, Canara HSBC Oriental Bank of Commerce Life Insurance said the company has seen advantages of the amalgamation. “We are a beneficiary of the PSU bank amalgamation. We have got access to 4,000 plus branches of Syndicate Bank (now merged with Canara Bank). We also continue to sell products through the 2,000 plus branches of Oriental Bank of Commerce,” he added.

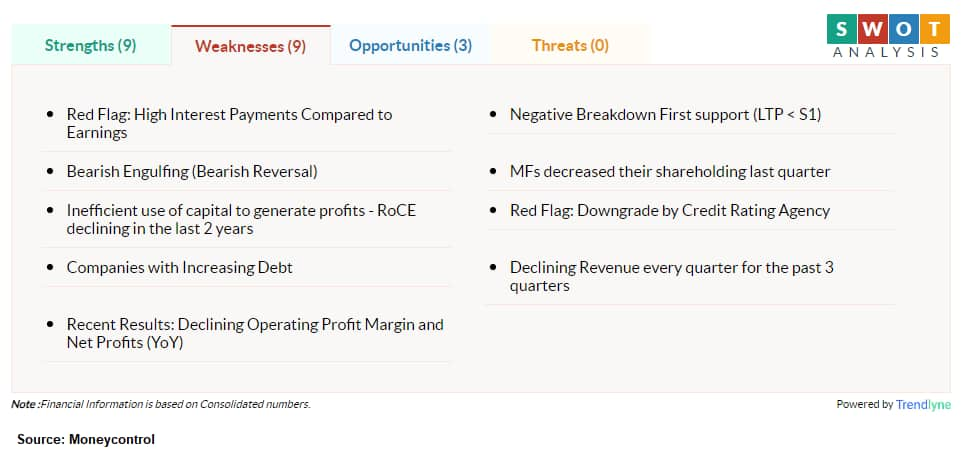

According to Moneycontrol SWOT Analysis powered by Trendlyne, Canara Bank has been posting decline in revenue every quarter for the past 3 quarters while MFs has decreased their shareholding last quarter. It has also been downgraded by credit rating agency.

Moneycontrol technical rating is neutral with moving averages being neutral and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.LIVE WEBINAR: Tune in to find out how term insurance can provide risk protection during tough times. Watch Now!