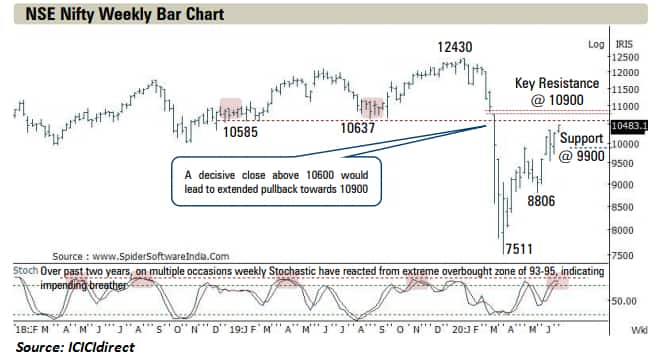

It has been observed that after a correction of more than 40 percent (seen in 2000-01 and 2008), the Nifty enters a volatile phase. At present, the index will complete its 44 percent pullback around the ballpark figure of 10,900.

After a muted May, June started off on a bullish note as the Sensex reclaimed 35,000 and the Nifty50 was back above 10,300, on course to challenge the immediate resistance at around 10,600. A close above this level can take the index towards 10,900.

The Nifty has had a roller-coaster ride. Despite global volatility and geo-political tensions, the index formed a higher base at 9,700 and surpassed the crucial 10,300-mark.

ICICIdirect Research expects the index to move higher and challenge the immediate resistance of 10,600. “We believe, a decisive break-out above 10,600 will pave the way for further acceleration of upward momentum towards 10,900 in the coming months, else consolidation amid stock-specific action,” the report added.

Data suggests that the index will be prone to bouts of temporary breather near 10,900, as the fierce upward momentum since June low of 9,544 (~10% rally) has already hauled the daily and weekly stochastic oscillators in overbought territory (placed at 94 and 90, respectively) and therefore, calls for some cool-off at higher levels would make the market healthy.

Any temporary breather from hereon should be capitalised as an incremental buying opportunity, as with a temporary breather expected to get anchored around key support threshold of 9,900, the report said.

Over the past two decades it has been observed that after a major correction of more than 40 percent (seen in 2000-01 and 2008), the Nifty enters a volatile phase.

In both historical instances, after a first sharp pullback (in CY01-02, the Nifty rallied 42 percent and in CY08-09 it rallied 44 percent) from major low, the index went through a corrective phase.

In the current scenario, the index will complete its 44 percent pullback around the ballpark figure of 10,900. “We expect the index to maintain the same rhythm as observed in historical instances and enter in a consolidation phase in the coming weeks,” said the report.

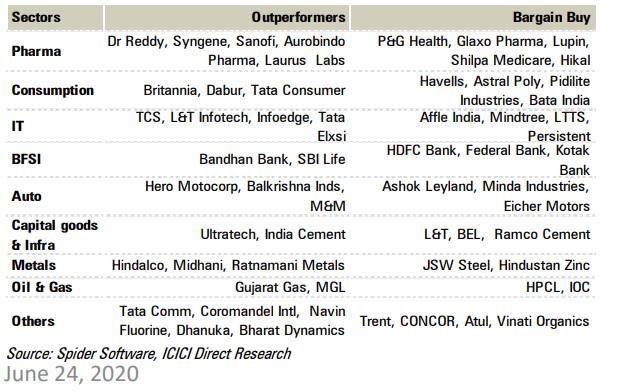

What to buy?

ICICIdirect lists out 29 stocks that are bargain buys at current levels across nine sectors.

WEBINAR: Tune in to find out how term insurance can provide risk protection during tough times. Register Now!