Ajit Mishra of Religare Broking expects volatility to remain high as traders would square-off and rollover their derivatives positions due to the scheduled expiry of June month contracts

The market snapped its four-day winning streak on June 24 ahead of June futures and options contracts expiry, with the benchmark indices falling 1.58 percent, dented by weak European cues and selling pressure across sectors barring FMCG.

The Sensex corrected 561.45 points to close at 34,868.98. The Nifty lost around 250 points from the day's high and closed with a loss of 165.70 points at 10,305.30, forming a bearish engulfing pattern on the daily charts.

"Normally, formation of a bearish engulfing patterns after a reasonable upside or near the hurdle could indicate possible reversal pattern. Hence, there is a possibility of follow-through weakness in the coming session," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short term trend on the Nifty is negative. One may expect further declines down to 10,200-10,150 levels in the next couple of sessions. Immediate resistance will be seen at 10,425 levels," he said.

The broader markets also corrected with the Nifty Midcap index falling 1.41 percent and Smallcap index down 1.8 percent.

"The move was on expected lines and we may see some consolidation before the next directional move. In the absence of any major event on the local front, participants should keep a close watch on the global markets for cues," Ajit Mishra, VP - Research at Religare Broking, said.

He expects volatility to remain high as traders would square-off and rollover their derivatives positions due to the scheduled expiry of June contracts.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance level for the NiftyAccording to pivot charts, the key support level for the Nifty is placed at 10,207.13, followed by 10,108.97. If the index moves up, the key resistance levels to watch out for are 10,478.33 and 10,651.37.Nifty Bank

The Nifty Bank closed at 21,426.80, down 838.10 points or 3.76 percent. The important pivot level, which will act as crucial support for the index, is placed at 21,015.53, followed by 20,604.27. On the upside, key resistance levels are placed at 22,158.83 and 22,890.87.Call option data

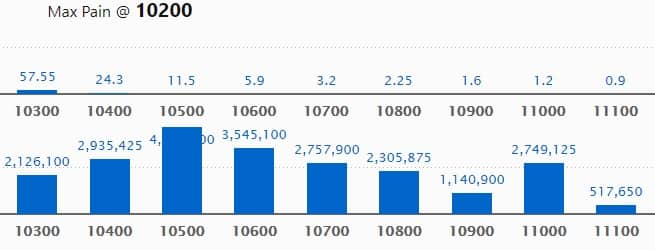

Maximum Call OI of 46.47 lakh contracts was seen at 10,500 strike, which will act as crucial resistance in the June series.

This is followed by 10,600, which holds 35.45 lakh contracts, and 10,400 strikes, which has accumulated 29.35 lakh contracts.

Significant call writing was seen at 10,400, which added 10.99 lakh contracts, followed by 10,500 that saw 10.30 lakh contracts being added and 10,600 strikes, which added 9.60 lakh contracts.

Call unwinding was witnessed at 11,000, which shed 3.47 lakh contracts, followed by 10,000, which shed 2.68 lakh contracts, and 10,100 strikes, which shed 1.47 lakh contracts.

Put option data

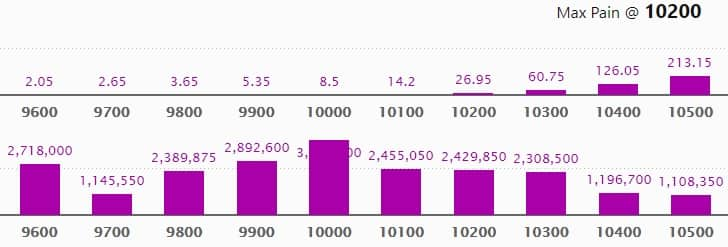

Maximum Put OI of 39.81 lakh contracts was seen at 10,000 strike, which will act as crucial support in the June series.

This is followed by 9,900, which holds 28.92 lakh contracts, and 9,600 strikes, which has accumulated 27.18 lakh contracts.

Significant put writing was seen at 10,100, which added 3.69 lakh contracts, followed by 10,600 strikes, which added 0.65 lakh contracts.

Put unwinding was seen at 9,700, which shed 11.57 lakh contracts, followed by 10,400, which shed 9.36 lakh contracts, and 9,800 strikes, which shed 8.78 lakh contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

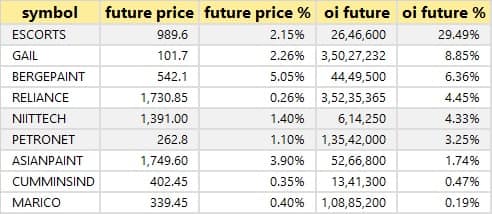

Based on the OI future percentage, here are those 9 stocks in which long build-up was seen.

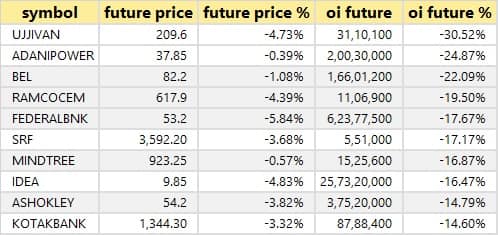

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions.

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bombay Dyeing: Nowrosjee Wadia and Sons sold 2.11 percent stake in company at Rs 76.90 per share. Sahara Investments, Heera Holdings and Leasing and Nidhivan Investments and Trading Company bought the entire stake.

McLeod Russel India: HUF Manoj Bagri sold 6,26,330 shares in company at Rs 9.5 per share.

Orient Green Power: Bessemer India Capital OGPL sold 60,50,352 shares in company at Rs 2.84 per share.

Sical Logistics: Prescient Wealth Management sold 13,50,000 shares in company at Rs 12.7 per share.

Sunteck Realty: Kotak Mahindra (International) bought 16,80,000 shares in company at Rs 180 per share. However, FGTEBP Fiam Emerging Markets Commingled Pool sold 10,71,267 shares at Rs 181.3 per share and Fidelity Investment Trust Fidelity Series Emerging Markets Fund sold 29,47,776 shares at Rs 181.3 per share.

Embassy Office Parks REIT: American Balanced Fund, Nomura India Investment Fund Mother Fund and Signature High Income Fund bought 2,01,67,000 units in company at Rs 341 per unit. However, India Alternate Property, BRE/Mauritius Investments and SG Indian Holding NQ CO I sold 3,30,04,400 units.

Metropolis Healthcare: Promoter Duru Sushil Shah sold 30,54,545 shares in company at Rs 1,383.44 per share. However, Aditya Birla Sun Life Mutual Fund acquired 3,12,224 shares at Rs 1,382.10 per share.

Goodyear: 2point2 Capital Advisors sold 1,29,731 shares in company at Rs 799.99 per share.

Sical Logistics: Prescient Wealth Management sold 3,50,000 shares in company at Rs 12.74 per share.

(For more bulk deals, click here)

Results on June 25Apollo Hospitals Enterprises, Ashok Leyland, Bank of India, Container Corporation of India, Endurance Technologies, Engineers India, Future Supply Chain Solutions, Galaxy Surfactants, Gravita India, Hindustan Aeronautics, Indiabulls Ventures, ICRA, IDFC, Indian Terrain Fashions, Insecticides India, Indian Overseas Bank, JB Chemicals, Lincoln Pharmaceuticals, Prince Pipes and Fittings, Sintex Industries, Somany Ceramics, Star Cement, TTK Prestige, V2 Retail, Varroc Engineering, Zuari Global, etc will announce their quarterly earnings on June 25.Stocks in the news

Astra Microwave Products: Q4 profit at Rs 10.26 crore versus Rs 7.94 crore, revenue at Rs 174.53 crore versus Rs 117.75 crore YoY.

Shriram EPC: Q4 loss at Rs 91.08 crore versus profit at Rs 3.15 crore, revenue at Rs 184 crore versus Rs 488.73 crore YoY.

Canara Bank: Q4 loss at Rs 3,259.33 crore versus loss Rs 551.53 crore, net interest income at Rs 3,318.52 crore versus Rs 3,500.15 crore YoY.

HG Infra Engineering: Q4 profit at Rs 54.32 crore versus Rs 38.58 crore, revenue at Rs 634.12 crore versus Rs 584.1 crore YoY.

Bharti Infratel: Company extended deadline for merger with Indus Towers until August 31.

Karur Vysya Bank: Q4 profit at Rs 83.70 crore versus Rs 60 crore, revenue at Rs 590.48 crore versus Rs 619.23 crore YoY.

Andhra Paper: Promoter International Paper Investments (Luxembourg) SARL to sell 10 percent shareholding in company via an offer for sale on June 25-26 with an option to sell additional 7.2 percent stake.

Fund flow FII and DII data

FII and DII dataForeign institutional investors (FIIs) net bought shares worth Rs 1,766.9 crore, while domestic institutional investors (DIIs) sold shares worth Rs 1,524.9 crore in the Indian equity market on June 24, provisional data available on the NSE showed.Stock under F&O ban on NSE

Three stocks -- Just Dial, Glenmark Pharma and Vodafone Idea -- are under the F&O ban for June 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

WEBINAR: Tune in to find out how term insurance can provide risk protection during tough times. Register Now!