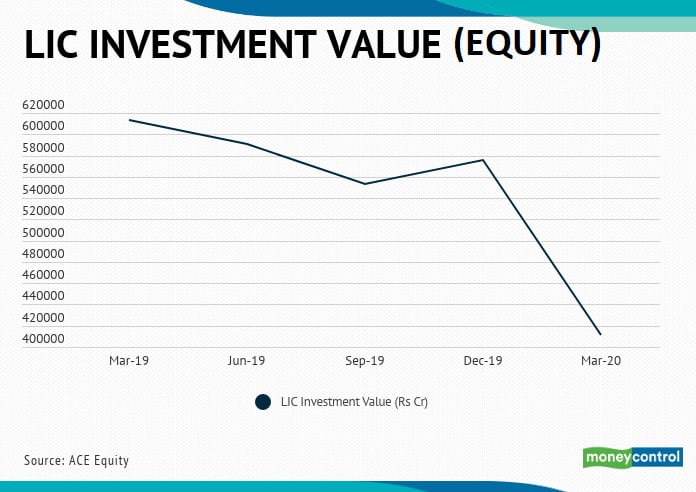

Life Insurance Corporation of India's equity holdings value in FY20 fell to Rs 4.1 lakh crore compared to Rs 6.13 lakh crore at the end of FY19 due to stock market volatility.

Life Insurance Corporation of India (LIC) saw a 33 percent decline in its equity holding value in FY20 to Rs 4.1 lakh crore. Data compiled by Moneycontrol showed that there was a sharp decline in the equity holding value of LIC between the December quarter (Q3) and March quarter (Q4) of FY20, as Coronavirus-linked market volatility impacted stock prices.

This data comprises of all companies where LIC has a stake more than 1 percent. Equity holdings below 1 percent is not reflected in the stock exchange data. LIC had ended FY19 with an equity holding value of Rs 6.13 lakh crore.

At the end of Q3, LIC equity holding value stood at Rs 5.76 lakh crore. This value declined by 28.7 percent by the end of Q4FY20 to Rs 4.1 lakh crore.

Infographic: Ritesh Presswala

Infographic: Ritesh Presswala

While investing in the equity markets, LIC follows a 'contrarian' investment strategy, which is 'sell' when the sentiment is bullish and 'buy' when the mood is bearish.

LIC did not respond to a query sent by Moneycontrol.

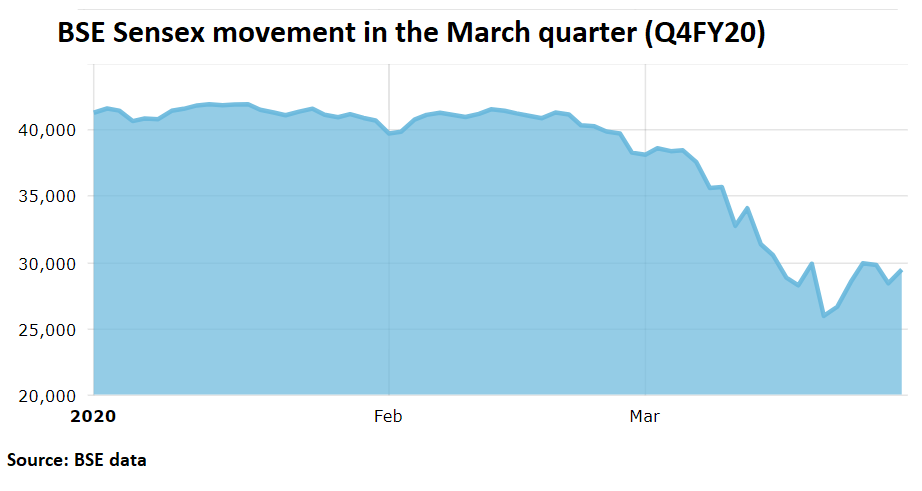

Ever since February 2020, fears of a widespread COVID-19 pandemic in India had started building in the country. This had impacted the stock market indices as well.

BSE Sensex plunged to 29,468.49 by March end compared to 41,306.02 on January 1, 2020. The sharpest dip was seen on March 23 when Sensex lost as much as 3,934.72 points to close at 25,981.24.

This was just a day ahead of Prime Minister Narendra Modi’s nationwide lockdown announcement which came into effect from March 25.

How did COVID-19 lockdown impact LIC?

After the lockdown was announced in March, there was a rising concern about economic slowdown due to major establishments, in both manufacturing and services sectors, being shut.

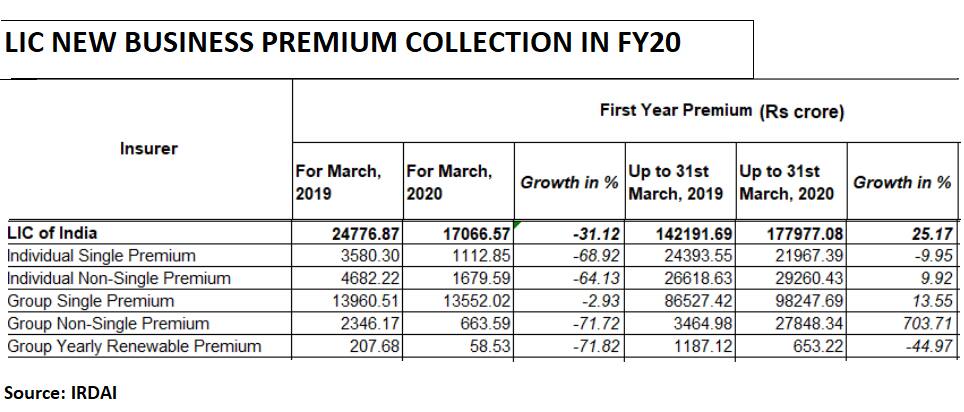

Life insurance companies saw a 32.2 percent year-on-year (YoY) decrease in new premium collection to Rs 25,409.30 crore in March 2020. Here, LIC saw a 31.1 percent decline in first year premiums to Rs 17,066.57 crore.

However, the country’s largest insurer saw a 25.2 percent growth in new premium to Rs 1.78 lakh crore for the full financial year (FY20).

For FY20, while LIC had set an equity investment target of Rs 86,000 crore, the insurer is said to have achieved about 80 percent of that number.

However, LIC was able to meet the profits from equity target of Rs 24,700 crore.

Continuing the March 2020 trend in FY21, LIC has seen a decline in new premium collections in April and May. Data from IRDAI shows that LIC first year premiums saw a 26.5 percent YoY decline to Rs 13,793.18 crore for the April 1-May 31 period.

Also Read: Government invites bids for advisors for LIC IPO

The policyholder funds of LIC are invested into both equity and debt instruments. Being a long-term business, a larger portion of the funds are invested into government securities and other guaranteed instruments.

So, when there is a decline in premium collections, equity investments also get impacted. In FY21, LIC has invested about Rs 12,100 crore in the equity market so far.

However, LIC is not a stranger to volatility in the stock markets. During the 2008 stock market crash, LIC saw more than 45 percent erosion in equity holding value. However, it recovered within a year by churning its portfolio and selling stocks.

The market value of LIC's investment as at the end of FY19 stood at around Rs 28.7 lakh crore, growing YoY by 8.6 percent. The insurer's total assets had touched an all-time high of Rs 31 lakh crore in FY19, which was a 9.4 percent rise. Consolidated data for FY20 is not yet available.

Why are LIC’s investments important?

LIC is the largest institutional investor in the equity markets. Hence, the life insurer’s investment patterns are closely watched by other stock market participants including foreign institutional investors.

Also Read: LIC IPO: A listing everyone is waiting for

Right now, ahead of the proposed initial public offering of LIC, its equity investments are under closer scrutiny. The future investment strategy will also be watched including sectoral investments, financial position of the investee firms as well as equity profit booking.

The final valuation of LIC, which is now estimated to be valued at Rs 10 lakh crore, will depend on the kind of investment decisions it takes. Whether it is participation in government's divestment programmes, IPO investment, or buying fresh stocks in companies it is already invested in.WEBINAR: Tune in to find out how term insurance can provide risk protection during tough times. Register Now!