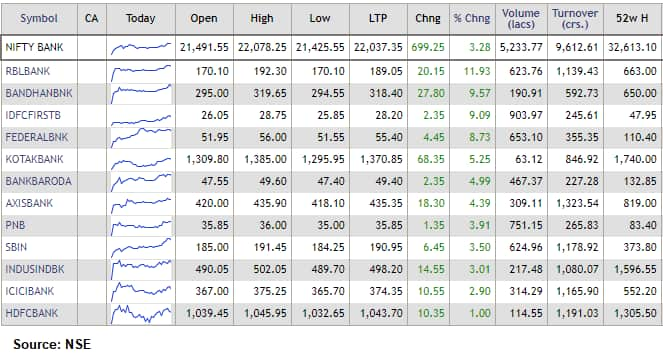

RBL Bank jumped 12 percent hitting upper circuit of Rs 185.60 per share on the BSE followed by IDFC First Bank, Bandhan Bank, Kotak Mahindra Bank, Federal Bank and Axis Bank.

The Indian stock market continues trading in the green largely helped by banks and financials with Sensex is up 398.71 points or 1.15% at 35130.44, and the Nifty up 127.60 points or 1.25% at 10372.

The banking index is up over 3 percent led by RBL Bank which jumped 12 percent hitting upper circuit of Rs 185.60 per share on the BSE. The other gainers included IDFC First Bank, Bandhan Bank, Kotak Mahindra Bank, Federal Bank and Axis Bank.

IDFC First Bank was one of the most active stocks on NSE in terms of volumes with 7,69,83,855 shares being traded followed by RBL Bank where 6,15,07,669 shares were being traded.

The PSU Bank index jumped over 4 percent intraday on June 22 with Indian Bank surging 15 percent followed by Canara Bank, Bank of Baroda, Union Bank of India, Punjab National Bank and State Bank of India.

Punjab National Bank share price was up despite the PSU bank reporting fall in its standalone net loss at Rs 697.20 crore in the quarter ended March 2020, compared to Rs 4,749.64 crore of loss in the corresponding quarter of the previous fiscal year. The asset quality of the bank improved as the Gross Non Performing Assets (NPA) was at 14.21 percent for the quarter ended March 2020 versus 15.50 percent, YoY.

PNB shares among the PSU banking names were one of the most active stocks on NSE with 7,37,14,492 share sbeing traded followed by Federal Bank (6,41,60,585 shares) and State Bank of India (6,10,91,749 shares).

Howvere, Fitch Ratings on June 22 revised the outlook on State Bank of India, ICICI Bank, Axis Bank, and six other banks to Negative from Stable in line with rating changes to India's sovereign outlook due to the coronavirus impact.

The rating agency revised the outlook for Export-Import Bank of India (EXIM), SBI, Bank of Baroda, Bank of Baroda (New Zealand), Bank of India, Canara Bank, Punjab National Bank, ICICI Bank, Axis Bank while affirming their ratings.

"The rating actions follow Fitch's revision of the outlook on the 'BBB-' rating on India to negative from stable on June 18, 2020, due to the impact of the escalating coronavirus pandemic on India's economy," it said in a statement.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.WEBINAR: Tune in to find out how term insurance can provide risk protection during tough times. Register Now!