Profit in the full year FY20 jumped 35.3 percent to Rs 387.14 crore and revenue grew by 3.1 percent to Rs 3,937.4 crore compared to previous year.

The shares of Ashoka Buildcon gained 6 percent intraday on June 17 as brokerage houses retained bullish view on the stock after the company's March quarter earnings.

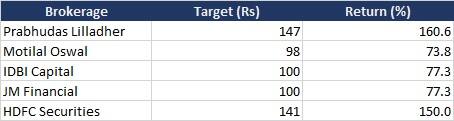

Brokerages feel the stock has an upside potential of 74-161 percent from the current levels. The stock was quoting at Rs 58.80, up 4.26 percent, on the BSE in afternoon on June 17.

"We retain our estimate with an unchanged target of Rs 100 based on 5x FY22E standalone EPS and Rs 49 per share for equity investment in HAM and BOT assets. Catalyst for stock performance a) Pick up in execution in H2 b) Conclusion of the asset sale where Macquarie has a stake. Maintain buy," said IDBI Capital.

Motilal Oswal raised its FY21/FY22 EBITDA estimates for the company by 3/11 percent due to strong orderbook. "Standalone EPS estimate revision looks higher at 32/36 percent owing to better-than-expected balance sheet improvement. Maintain buy with revised target of Rs 98 (prior: Rs 92) as we factor in lower toll collection in the BOT portfolio."

Ashoka Buildcon has reported a 67.6 percent year-on-year increase in Q4 standalone profit at Rs 164 crore and 20 percent rise in EBITDA at Rs 264 crore, while revenue from operations (or EPC revenue) for the quarter fell 4 percent to Rs 1,254.75 crore compared to year-ago.

Profit in the full year FY20 jumped 35.3 percent to Rs 387.14 crore and revenue grew by 3.1 percent to Rs 3,937.4 crore compared to previous year.

"Ashoka Buildcon Q4FY20 EBITDA/EPS was 31 / 56 percent higher than our estimate. Beat is driven by a) higher EBITDA margins at 18 percent (estimates was 13 percent), b) Lower tax rate at 23 percent (estimates of 33 percent)," IDBI Capital said.

For FY21, Ashoka Buildcon expects pick-up in execution post monsoon and has guided to maintain revenue run rate of FY20 in FY21.

"The company received Rs 3,900 crore of new orders in FY20 and is targeting opportunity of Rs 4,000-5,000 crore in FY21. Current order book of Rs 8,379 crore provides it with revenue visibility (2.1x TTM revenue)," said the company.

The company's current EPC order backlog including HAM Tumkur – Shivamoga-III order is Rs 8,981 crore.

"Of the total order book, contribution from roads HAM and roads EPC is 51.6 percent and 28.6 percent, respectively, power T&D & others is 8.3 percent, railways is 10.8 percent and CGD contributes the rest," said Ashoka Buildcon.

Motilal Oswal said the company continued to surprise on its performance in the EPC business, with past 3-year revenue/adjusted PAT/free cash flow (FCF) CAGR of 24/28/27 percent.

"While we have factored in the weak execution in first half of FY21 due to the COVID-19 related issues, we expect the company to ramp up execution next year owing to its strong balance sheet position," the brokerage added.

The company's gross debt declined by Rs 370 crore during the year as net working capital cycle improved to 20 days from 51 in FY20. Thus, net D/E improved to 0.1x from 0.4x last year.

Prabhudas Lilladher also remained positive on the company given a) its excellent blend of diversified EPC orders and asset ownership (23 road assets and 3 city gas distribution assets), b) stable EPC margins and c) healthy order book and its foray into new verticals- Railways (11 percent of order book) and smart cities.

While maintaining buy rating on the stock with a SoTP based target of Rs 147, the brokerage said Ashoka Buildcon reported strong performance in Q4 with healthy execution in its key projects leading to meagre around 4 percent YoY (PL estimates: -35 percent YoY) fall in revenues, despite nationwide lockdown.

Post relaxations in lockdown almost all projects have commenced operations and are currently operating at around 60 percent efficiency levels.

Further, "the company has not witnessed any delays in payments from Central authorities (including NHAI & Railways) in Q4FY20 as well as during April & May 2020. Labour availability (ranging from 50-65 percent across projects) would be the next key monitorable for pickup in execution pace," said Prabhudas Lilladher.

"With a strong orderbook and completed HAM financial closure (FC), Ashok Buildcon is well poised to deliver growth in FY22 while FY21 OI will add visibility for FY23 and beyond. Even after factoring the overhang of BoT asset sale and potential pay-out to Macquarie SBI, we find Ashoka Buildcon inexpensive trading at 4.6x FY22 P/E for its core EPC business," said JM Financial while maintaining buy call with a target of Rs 100.

While retaining buy rating on the stock, HDFC Securities raised its FY21/FY22 EPS estimates by 6/34 percent and increased target to Rs 141 per share (versus Rs 134 per share earlier).

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Join the Moneycontrol Rule the New Normal powered by Lenovo webinar on the 18th of June. REGISTER NOW!