Alibaba has put money in payments company Paytm and food-delivery service Zomato; Chinese internet giant Tencent has backed car-hailing app Ola, Swiggy and Byju’s (PTI)

Alibaba has put money in payments company Paytm and food-delivery service Zomato; Chinese internet giant Tencent has backed car-hailing app Ola, Swiggy and Byju’s (PTI)

AS New Delhi plans its next military and diplomatic steps to deal with the unprecedented LAC standoff with China which cost the lives of 20 Indian Armymen Monday, on its table will be a factor that could also weigh in: the rising appetite of Chinese investors in Indian technology start-ups over the last five years.

While China may not be a big investor in the traditional sense, and business relations are viewed more in terms of the trade deficit that India suffers, it is the new economy and start-up space where China has increased its influence.

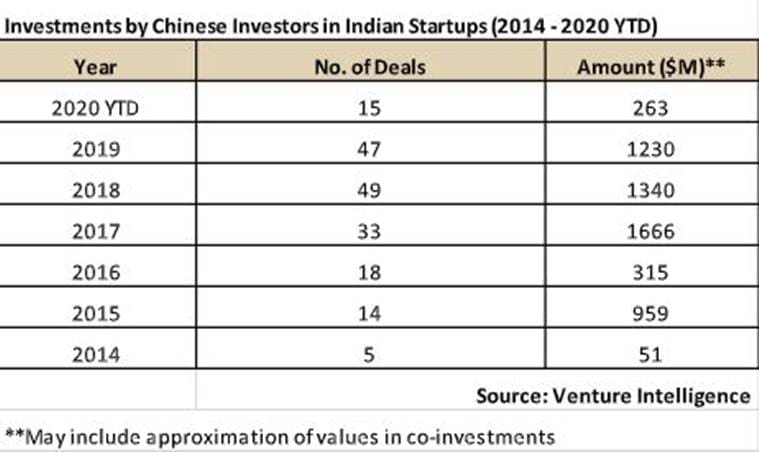

Over 2015-19, Chinese investors including Alibaba, Tencent, TR Capital and Hillhouse Capital, have invested over $5.5 billion in Indian start-ups, according to Venture Intelligence that tracks private equity, venture capital, M&A transactions and valuations, in India.

“We have been talking about Chinese investments in the tech space for some time now… My concern has always been: Are businessmen in their quest for capital aware of the political consequences? I mean, it comes with strings attached,” said Jabin T Jacob, a Chinese studies researcher and currently Associate Professor, Department of International Relations and Governance Studies, Shiv Nadar University.

In purely FDI terms, China figures way down at 18th place on India’s FDI charts below Hong Kong, the UAE and Cyprus. But over the last five years, Alibaba, Tencent, Barings Asia and few other Chinese investors, have emerged as one of the biggest funding blocs for start-ups in India, joining well-established investors like Japan’s SoftBank and the US-based Sequoia.

“If you look at Chinese capital, there is really no private sector in China… The Chinese haven’t really parked money in India. The Indian market is big, there is a deal to be made,” said Jacob. Much of their investments are also in companies riding the Indian consumer boom. Private consumption demand has been the mainstay of the Indian economy, accounting for almost 60 per cent of the GDP.

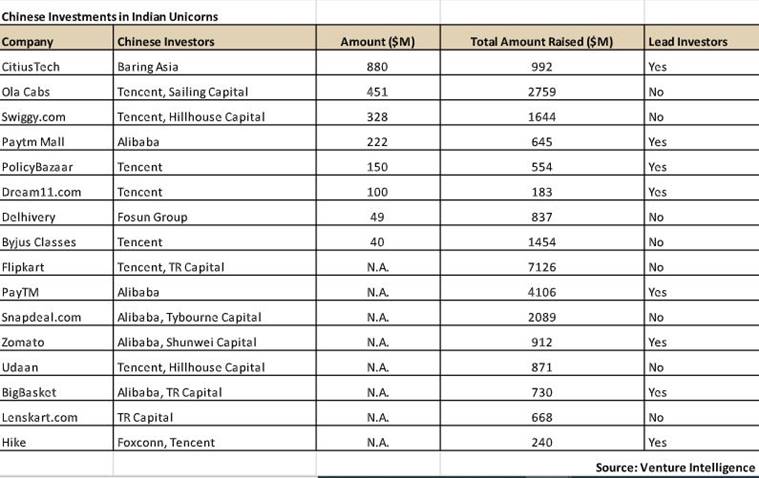

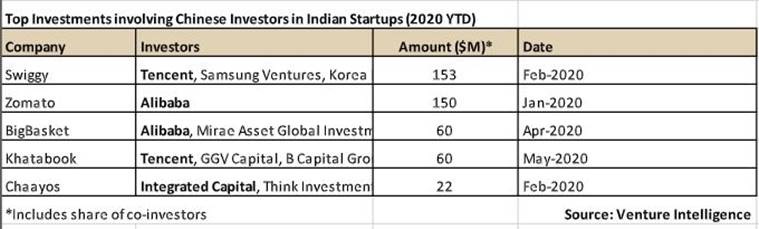

Alibaba has put money in payments company Paytm and food-delivery service Zomato; Chinese internet giant Tencent has backed car-hailing app Ola, Swiggy and Byju’s. Shunwei Capital and Morningside Ventures are among other active funds, having invested in start-ups that include Bangalore-based Rapido and ShareChat respectively.

In fact, Venture Intelligence data shows that at least 16 of the 29 unicorns (start-ups valued at more than $1billion now) have at least one Chinese investor.

In at least eight, the Chinese firm is the lead investor.

Said former Commerce Secretary Rajiv Kher: “So far, we have been lacking a very specific China-centric policy. Our policy boiled down to anti-dumping duty, safeguards and trade barriers. It’s only now, in post-Covid times, that we are looking at specific policies in at least a few sectors: mobile manufacturing, active pharmaceutical ingredients and medical devices.”

Chinese smartphones like Oppo and Xiaomi lead the Indian market with an over 70 per cent share, way ahead of Samsung and Apple in the branded cellphone market.

Also, while the number of cellphone and accessories manufacturing units has gone up from just two in 2014 to over 260 in 2019, turning India into a major manufacturer and assembler of cellphone, this industry has only now started to diversify into component manufacturing.

“If we are importing components worth Rs 90,000 crore, we are also domestically manufacturing Rs 1 lakh crore worth components. Indian exports have touched Rs 26,000 crore now,” said Pankaj Mohindroo of the Indian Cellular and Electronics Association. The Production Linked Incentive scheme to boost domestic manufacturing has the potential to make a difference, he said.

On the bilateral trade front, while India-China trade has grown exponentially (from $3 billion in 2000 to $95.54 billion in 2018), it has, from India’s perspective, resulted in the biggest single trade deficit that New Delhi runs with any country.

In 2018, the trade deficit was pegged at $57.86 billion. India was the seventh largest export destination for Chinese products in that year, and the 27th largest exporter to China.

Kher said India must link trade policy to industrial policy. “The trade policy cannot be seen in isolation. The industrial policy must have strategic objectives. We need to expedite this… key sectors, where we depend on Chinese imports such as drugs and pharmaceuticals, need to be identified… and domestic capacities built,” he said.

The government has already moved in the direction with a plan to revive state-owned drug companies to domestically produce APIs.

While India’s DPIIT pegs FDI inflows from China to India at a paltry $2.38 billion, or just 0.51 per cent of total FDI inflows into India between April 2000 and March 2020, a Brookings report in March estimates that Chinese investments in India as having risen sharply since 2014 until when net investment was just $1.5 billion. The Brookings report uses Chinese Ministry of Commerce numbers to record that net investments have risen from $1.5 billion to $8 billion over the three years since 2014.