Key support level for the Nifty is placed at 9,679.48, followed by 9,386.07. If the index moves up, the key resistance levels to watch out for are 10,131.18 and 10,289.47.

Indian equity benchmarks ended in the green on the last trading session on Jue 12, enduring bouts of volatility.

The Sensex ended Friday's session with a gain of 243 points, or 0.72 percent, at 33,780.89. The Nifty settled 71 points, or 0.72 percent, higher at 9,972.90.

However, on a weekly basis, Nifty retreated 1.67 percent while Sensex slipped 1.48 percent.

"It all started with the US Fed statement that the US economy would take longer than expected to recover which impacted the sentiments world over. However, the recovery in the market shows that participants are still buoyant on the growth prospects. Considering the present scenario, we advise not to go overboard and maintain a balanced approach," said Ajit Mishra, VP - Research, Religare Broking.

The volatility index India VIX climbed nearly 4 percent to end at 30.82 levels on Friday. Although we have seen some spike in volatility index, it is still hovering at lower levels, thus not hinting at any major downside move in the near-term.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for the NiftyAccording to pivot charts, the key support level for the Nifty is placed at 9,679.48, followed by 9,386.07. If the index moves up, the key resistance levels to watch out for are 10,131.18 and 10,289.47.

Nifty BankThe Nifty Bank closed 0.63 percent higher at 20,654.55. The important pivot level, which will act as crucial support for the index, is placed at 19,871.23, followed by 19,087.87. On the upside, key resistance levels are placed at 21,092.83 and 21,531.07.

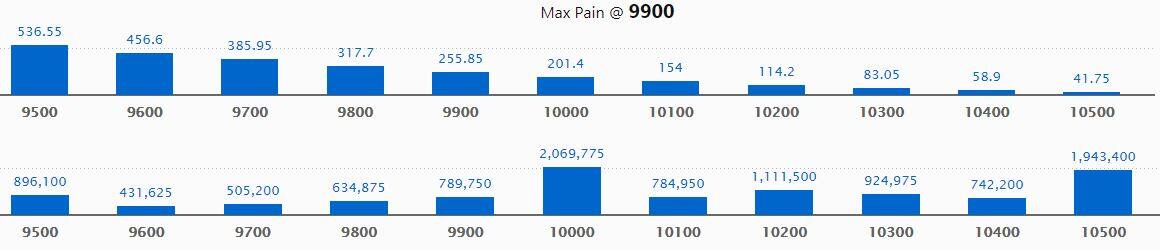

Call option dataMaximum call OI of 20.7 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 10,500, which holds 19.43 lakh contracts, and 10,200 strikes, which has accumulated 11.12 lakh contracts.

Significant call writing was seen at the 9,700, which added 3.18 lakh contracts, followed by 9,900 strikes that added 3.11 lakh contracts.

Call unwinding was witnessed at 10,500, which shed 70,125 contracts, followed by 10,300 strikes, which shed 21,675 contracts.

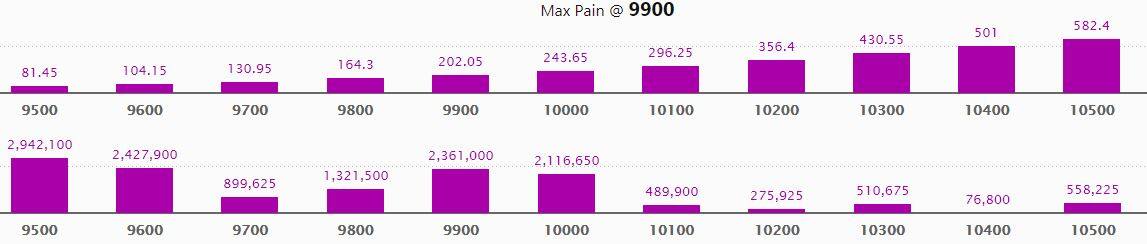

Maximum put OI of 29.42 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 24.28 lakh contracts, and 9,900 strikes, which has accumulated 23.61 lakh contracts.

Significant put writing was seen at 9,600, which added 1.54 lakh contracts, followed by 9,700 strikes, which added 1.27 lakh contracts.

Put unwinding was seen at 9,900, which shed 2.13 lakh contracts, followed by 10,500 strikes, which shed 1.82 lakh contracts and 10,000 strikes, which shed 1.81 lakh contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

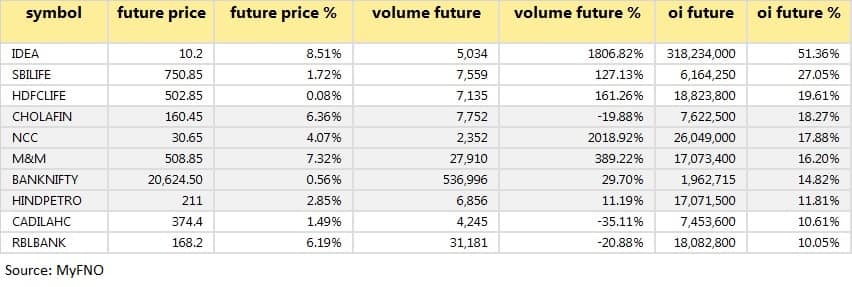

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

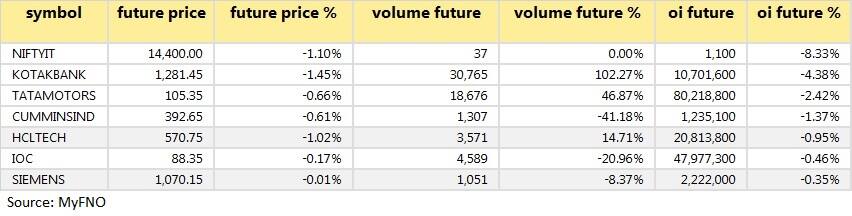

7 stocks saw long unwinding

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

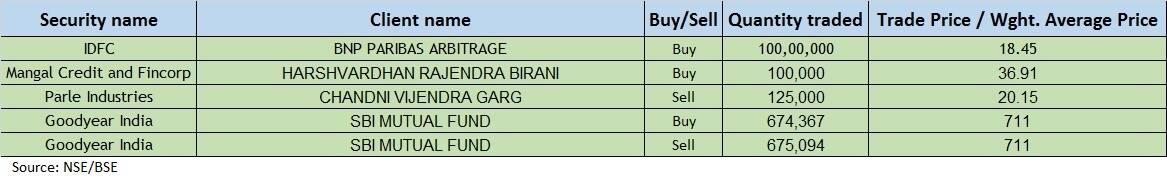

Bulk deals

(For more bulk deals, click here)

Results on June 15

Tata Motors, Ashoka Buildcon, CSB Bank, JK Tyre, Narayana Hrudayalaya, Pfizer, Satin Creditcare Network, Shilpa Medicare, Shoppers Stop, Action Construction Equipment, Can Fin Homes, CCL Products, Electrosteel Castings, Intellect Design Arena, Meghmani Organics, Tamilnadu Petroproducts

Stocks in the news

Aarey Drugs: Elara India Opportunities Fund sold another 1,50,000 shares in the company at Rs 17.26 per share.

IDFC: BNP Paribas Arbitrage acquired 1 crore shares in the company at Rs 18.45 per share.

Cox & Kings Financial: Dharm Prakash Tripathi bought 7,35,300 shares in the company at Rs 0.65 per share.

Cadila Healthcare: Zydus signed a non-exclusive licensing agreement with Gilead Sciences Inc., to manufacture and market Remdesivir.

Castrol India Q1: Profit at Rs 125.2 crore versus Rs 185 crore in the year-ago period, revenue at Rs 688 crore versus Rs 976.2 crore.

IOL Chemicals Q4: Profit at Rs 90.26 crore versus Rs 101.65 crore in the year-ago period, revenue at Rs 441.46 crore versus Rs 422.3 crore.

Godrej Properties: ICRA assigned 'AA/Stable' rating for the proposed Rs 1,000 crore NCD programme of the company.

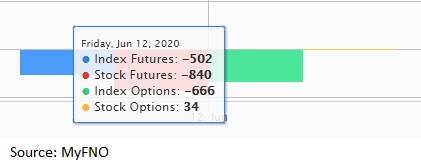

Fund flow

Foreign institutional investors (FIIs) sold shares worth Rs 1,311.49 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,945.15 crore in the Indian equity market on June 12, provisional data available on the NSE showed.

Stock under F&O ban on NSEFive stocks - Adani Enterprises, BHEL, Vodafone Idea, Just Dial and PVR - are under the F&O ban for June 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.