The metal index traded in the red dragged by Tata Steel and JSW Steel which shed over a percent each. These are followed by MOIL,Vedanta, SAIL and Hindalco Industries among others.

The Indian equity market continues trading in the red with Sensex is down 257.34 points or 0.75% at 33989.71, and the Nifty down 22.10 points or 0.22% at 10094.10.

Metal stocks are under pressure with the index down half a percent as a sober economic outlook from the US Federal Reserve dented broader risk appetite.

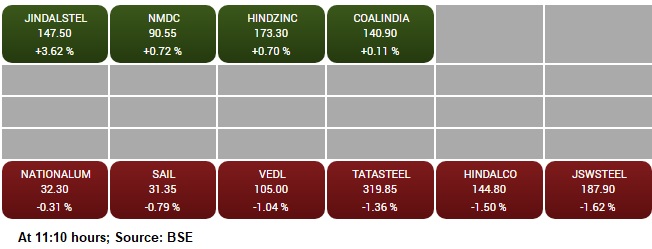

The metal index traded in the red dragged by Tata Steel and JSW Steel which shed over a percent each. These are followed by MOIL,Vedanta, SAIL and Hindalco Industries among others.

S&P BSE Metal is also trading in the red buy JSPL share price jumped over 3 percent while NMDC and Hindustan Zinc are the other gainers.

"Metal sector is struggling with over-supply, lower demand, thus leading to low prices of metals and continuously rising inventories. Now that the lockdown is being lifted in a phased manner, there is a possibility of revival in coming few quarters," said Gaurav Garg, Head of Research at CapitalVia Global Research Limited – Investment Advisor.

"However, prices are expected to remain on the muted side until there is a major surge in demand or sharp off-loading in inventory volume. This has put a heavy toll on the stocks and metal index corrected around 65 percent from 2018 highs and made its bottom in March 2020. Stocks like Tata Steel, Hindalco and Mishra Dhatu Nigam (MIDHANI) are positioned at attractive valuations and might give good returns over the time," he added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.