Noida: The real estate industry in Noida has received significant financial relief from the government, days after developers’ association Naredco promised jobs at construction sites for 2.5 lakh migrant workers, many of them carried home by the massive waves of reverse migration that unfolded across India over the past weeks.

The relief is three-pronged, led by lower interest rates on payment for land dues, a moratorium scheme till September 30, waiver of compound interest that is charged in case of payment defaults as well as conditional waiver of simple interest.

The proposals were part of recommendations made by the Noida, Greater Noida and Yamuna Expressway industrial development authorities that the government accepted. Nearly 400 Noida-based developers, which form the lion’s share of the real estate industry in UP, will benefit from the relief measures.

Officials said UP is the first state to offer such a relief to developers. Credai, the other major developers’ association, said it would write to chief ministers of other states to extend similar relief. Several Noida-based developers have projects in other states.

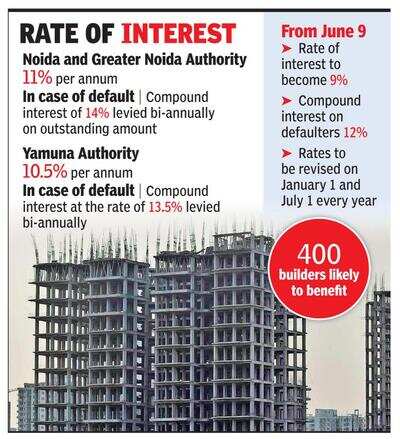

Effective June 9, interest levied by the three authorities on land instalment payment will be linked to State Bank of India’s three-year marginal cost of funds-based lending rate (MCLR). The authorities will charge an additional 1% over the benchmark MCLR and round it off to the nearest .5%. The three-year SBI MCLR on June 9 stood at 7.55%. On the basis of this, the authorities can charge 9% (7.55 + 1 = 8.55, rounded off to 9). So far, the annual interest rate on regular payments being charged by Noida and Greater Noida was 11%, which increased to 14% for defaults. The amount was compounded biannually. For the Yamuna Expressway authority, the rates were 10.5% and 13.5%.

Principal secretary (infrastructure and industrial development) Alok Kumar said for the period between March 22 and September 30, compound interest would not be applicable under any payment head. But in case a developer is unable to pay up the amount along with simple interest within this period, compound interest would be applicable for the entire period.

Relief for the moratorium period is graded. For the period from March 22 to June 30, developers don’t need to pay any interest if they make the payments by June 30. Those who avail of the moratorium for the entire period (up to September 30) will have to pay simple interest.

Manoj Gaur, managing director of the Gaurs group and chairman of real estate association Credai’s affordable housing committee, said, “We welcome the decision of the Yogi government. The developers were already suffering due to the cash crunch and the Covid crisis broke their backs further. We will request other states to offer similar exemptions and write to them this week.”

Developers, however, pointed out that they had urged the government to look into the accumulation of huge dues, with the interest exceeding the principal, that was making projects unviable, and the government’s relief measures were silent on that.

Vice-president of Credai (west UP) Amit Modi said, “We are happy with the development as our voice has been heard. However, we will write to the government again to ask them to reduce the interest rate retrospectively. The outstanding amount of some developers has exceeded the original land cost.”

The relief is three-pronged, led by lower interest rates on payment for land dues, a moratorium scheme till September 30, waiver of compound interest that is charged in case of payment defaults as well as conditional waiver of simple interest.

The proposals were part of recommendations made by the Noida, Greater Noida and Yamuna Expressway industrial development authorities that the government accepted. Nearly 400 Noida-based developers, which form the lion’s share of the real estate industry in UP, will benefit from the relief measures.

Officials said UP is the first state to offer such a relief to developers. Credai, the other major developers’ association, said it would write to chief ministers of other states to extend similar relief. Several Noida-based developers have projects in other states.

Effective June 9, interest levied by the three authorities on land instalment payment will be linked to State Bank of India’s three-year marginal cost of funds-based lending rate (MCLR). The authorities will charge an additional 1% over the benchmark MCLR and round it off to the nearest .5%. The three-year SBI MCLR on June 9 stood at 7.55%. On the basis of this, the authorities can charge 9% (7.55 + 1 = 8.55, rounded off to 9). So far, the annual interest rate on regular payments being charged by Noida and Greater Noida was 11%, which increased to 14% for defaults. The amount was compounded biannually. For the Yamuna Expressway authority, the rates were 10.5% and 13.5%.

Principal secretary (infrastructure and industrial development) Alok Kumar said for the period between March 22 and September 30, compound interest would not be applicable under any payment head. But in case a developer is unable to pay up the amount along with simple interest within this period, compound interest would be applicable for the entire period.

Relief for the moratorium period is graded. For the period from March 22 to June 30, developers don’t need to pay any interest if they make the payments by June 30. Those who avail of the moratorium for the entire period (up to September 30) will have to pay simple interest.

Manoj Gaur, managing director of the Gaurs group and chairman of real estate association Credai’s affordable housing committee, said, “We welcome the decision of the Yogi government. The developers were already suffering due to the cash crunch and the Covid crisis broke their backs further. We will request other states to offer similar exemptions and write to them this week.”

Developers, however, pointed out that they had urged the government to look into the accumulation of huge dues, with the interest exceeding the principal, that was making projects unviable, and the government’s relief measures were silent on that.

Vice-president of Credai (west UP) Amit Modi said, “We are happy with the development as our voice has been heard. However, we will write to the government again to ask them to reduce the interest rate retrospectively. The outstanding amount of some developers has exceeded the original land cost.”

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

Jyotiraditya Scindia and his mother test positive for Covid-19, admitted to Delhi hospital

Jyotiraditya Scindia and his mother test positive for Covid-19, admitted to Delhi hospital  Umar Khalid's aide Khalid Saifi taken under police custody for his role in Delhi anti-Hindu riots

Umar Khalid's aide Khalid Saifi taken under police custody for his role in Delhi anti-Hindu riots  Mumbai: 55-year-old senior BMC officer dies of Covid-19

Mumbai: 55-year-old senior BMC officer dies of Covid-19  All students to be promoted, Tamil Nadu Class 10 board exams cancelled

All students to be promoted, Tamil Nadu Class 10 board exams cancelled

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Kerala Coronavirus Helpline NumberHaryana Coronavirus Helpline NumberUP Coronavirus Helpline NumberBareilly NewsBhopal NewsCoronavirus in DelhiCoronavirus in HyderabadCoronavirus in IndiaCoronavirus symptomsCoronavirusRajasthan Coronavirus Helpline NumberAditya ThackerayShiv SenaFire in MumbaiAP Coronavirus Helpline NumberArvind KejriwalJammu Kashmir Coronavirus Helpline NumberSrinagar encounter

Get the app