The deals have taken place despite the global economy hobbling due to the coronavirus outbreak.

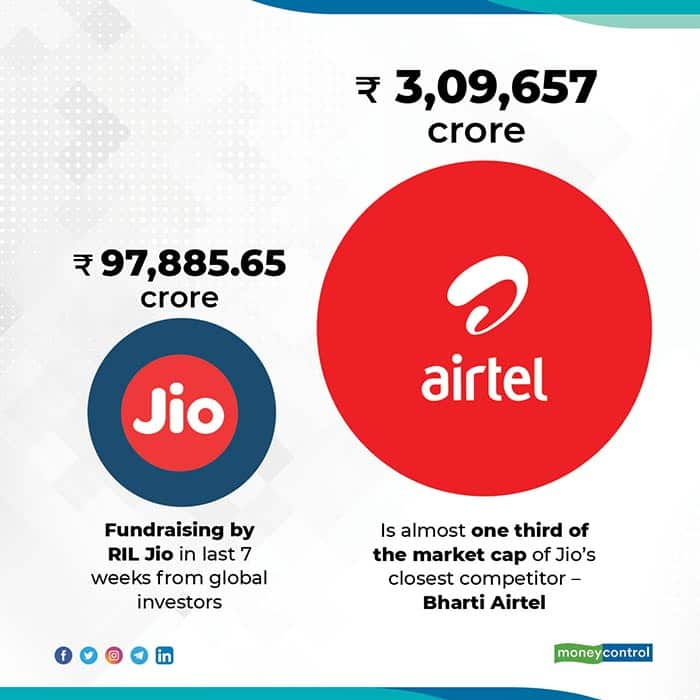

In less than seven weeks, Jio Platforms has managed to seal eight massive deals. Through these fundraising transactions, the digital unit has amassed Rs 97,885.65 crore from some of the world's top leading global investors like Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala and ADIA.

The flurry of deals marks the largest continuous fundraising activity by a company in the world.

The deals have taken place despite the global economy hobbling due to the coronavirus outbreak.

The headline-grabbing combined amount raised by Jio is equivalent to some of the important economic activities in India.

Below are some comparisons that offer context to the significance of Jio's dealmaking prowess:

- The total money raised by Jio is almost equal to Foreign Institutional Investor, or FII, investment in the Indian equity market in 2019 — Rs 1,01,122 crore.

- More than total foreign direct investment (FDI) in India in the March quarter 2020: Rs 95,549 crore.

- It is comparable to FII outflow from the Indian debt and equity market in 2020 so far - Rs 1,11,878 crore.

- It is nearly 50 percent of FDI in the Indian telecommunication sector in the past 20 years - Rs 2,19,189 crore.

-It is more than 1/4th of total FDI in India in FY 2020 - Rs 3,53,558 crore.