CLSA is of the view that Sun Pharma's EBITDA contribution of specialty is likely to rise to 15 percent from nil by FY22 while specialty business in US comprising of nine products is at an inflexion point.

Sun Pharma share price jumped almost 4 percent intraday on June 9 after CLSA maintained buy call on the stock with target of Rs 560 per share.

The stock price jumped over 28 percent in the last 3 months and was quoting at Rs 507.85, up Rs 18.90, or 3.87 percent at 10:00 hours. It touched an intraday high of Rs 508.20 and an intraday low of Rs 491.05. It was also one of the most active stocks on NSE in terms of value with 64,94,547 shares being traded and was also the top index gainer.

CLSA has reiterated buy rating on the stock, according to a report by CNBC-TV18. The firm is of the view that Sun Pharma's EBITDA contribution of specialty is likely to rise to 15 percent from nil by FY22 while specialty business in US comprising of nine products is at an inflexion point.

Sun Pharma is estimated to witness 32 percent CAGR to USD 675 million over FY20-22, CLSA said.

The drug firm's strong execution of specialty portfolio could drive a PE re-rating, it added.

Sun Pharmaceutical Industries on May 27 reported a consolidated profit of Rs 399.8 crore for quarter ended March 2020, declining 37.1 percent YoY due to one-time loss of Rs 260.6 crore.

Consolidated revenue during the quarter rose 14.3 percent year-on-year to Rs 8,184.9 crore, which was ahead of the average of estimates of analysts polled by CNBC-TV18 which pegged at Rs 8,015.8 crore.

"Despite the leading market position of many of our products, we continue to face a challenging US generic market. In the short-term, even as we commercialize recently approved products, we expect operations and profitability to be temporarily impacted as a result of the COVID-19 pandemic," Uday Baldota, Taro's CEO said.

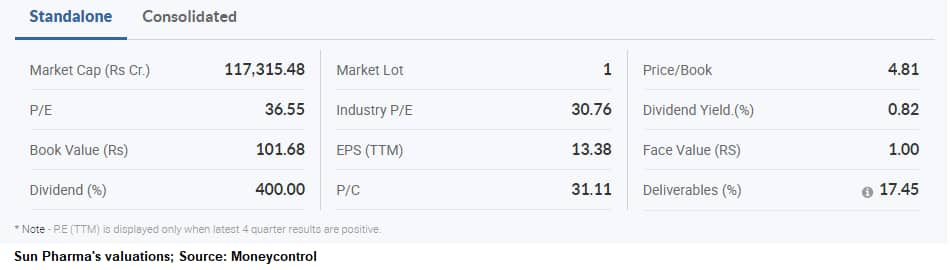

According to Moneycontrol SWOT Analysis powered by Trendlyne, Sun Pharma's annual net profits is improving for last two years with promoters increasing shareholding. Moneycontrol technical rating is very bullish with technical indicators and moving averages being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.