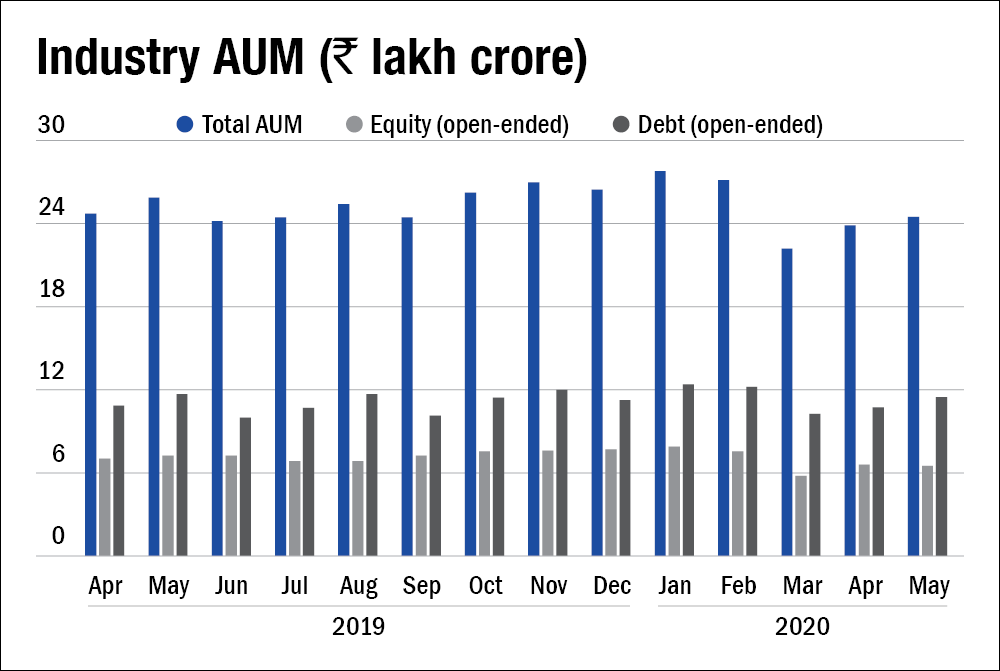

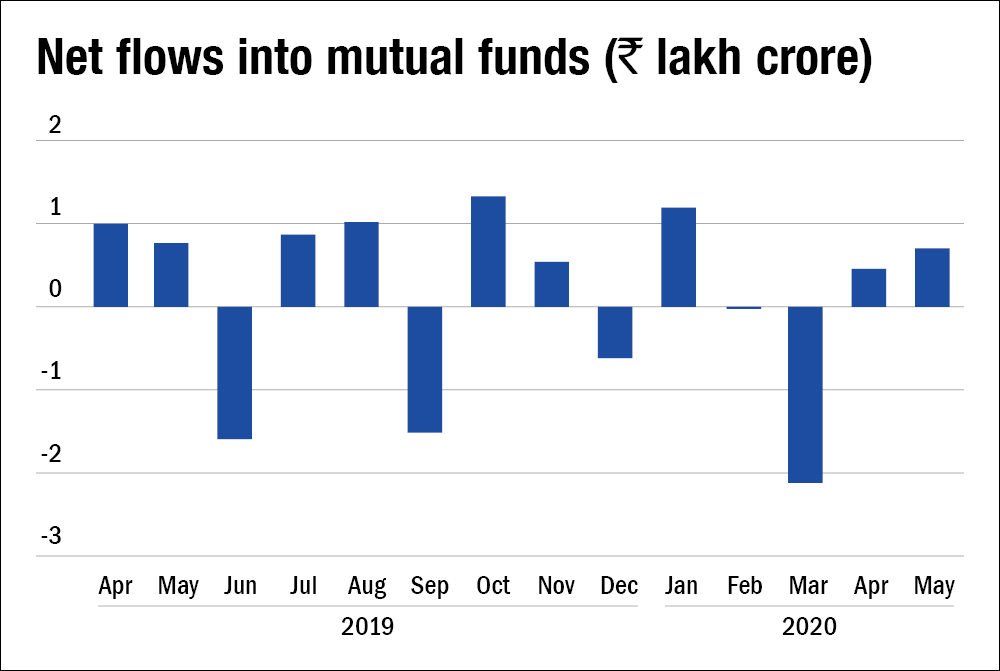

As revealed by AMFI's monthly data for May on mutual fund flows, the industry seems to be on the path to recovery after bearing the brunt of massive outflows in March. Although the total assets managed by the industry increased marginally, net inflows for May were up 54 per cent from the previous month at Rs 70,813 crore.

Debt funds - Giving a reason to cheer

In May, the volume of net inflows in fixed-income funds raised the spirit of investors, with net inflows standing at Rs 63,666 crore - an increase of over 46 per cent over the previous month. More importantly, unlike the previous two months, as many as 12 of the 16 debt fund categories experienced inflows on a net basis.

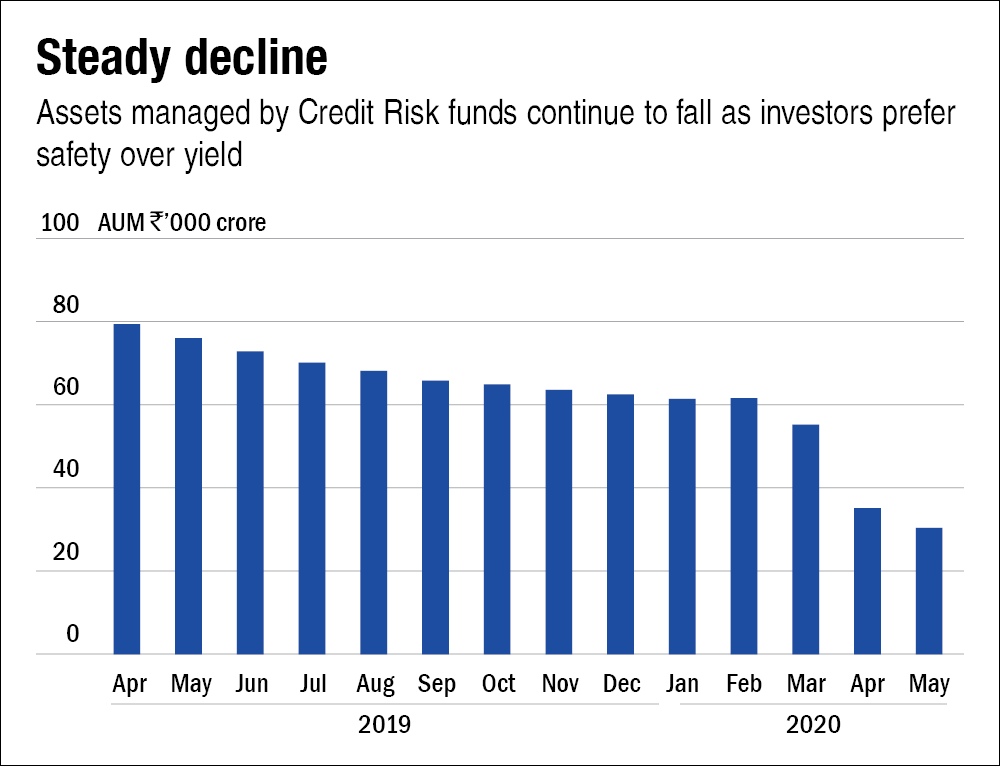

However, investors continued exiting from credit risk funds. Although the quantum of outflows in credit risk funds reduced as compared to the previous month when the net outflows spiked to over Rs 19,000 crore, the category still experienced elevated outflows of Rs 5,173 crore. Given this, over the past one year, the assets managed by the category have reduced by over 60 per cent to Rs 30,468 crore in May 2020 from Rs 76,305 crore in May 2019.

The continued risk aversion was also visible in the preference for Banking and PSU funds, which saw net inflows of close to Rs 8,900 crore. Among the categories suitable for the core fixed-income allocation, this category is generally considered to be the safest in terms of credit risk.

Short duration funds also witnessed an inflow of over Rs 2000 crore in May after observing outflows in the past two months. On the other hand, in view of the falling interest rates in the debt fund market, some investors are getting attracted to long-duration funds. Together, the categories of long duration funds and gilt funds with 10-year constant duration saw net inflows of Rs 426 crore, by far the highest they have witnessed recently.

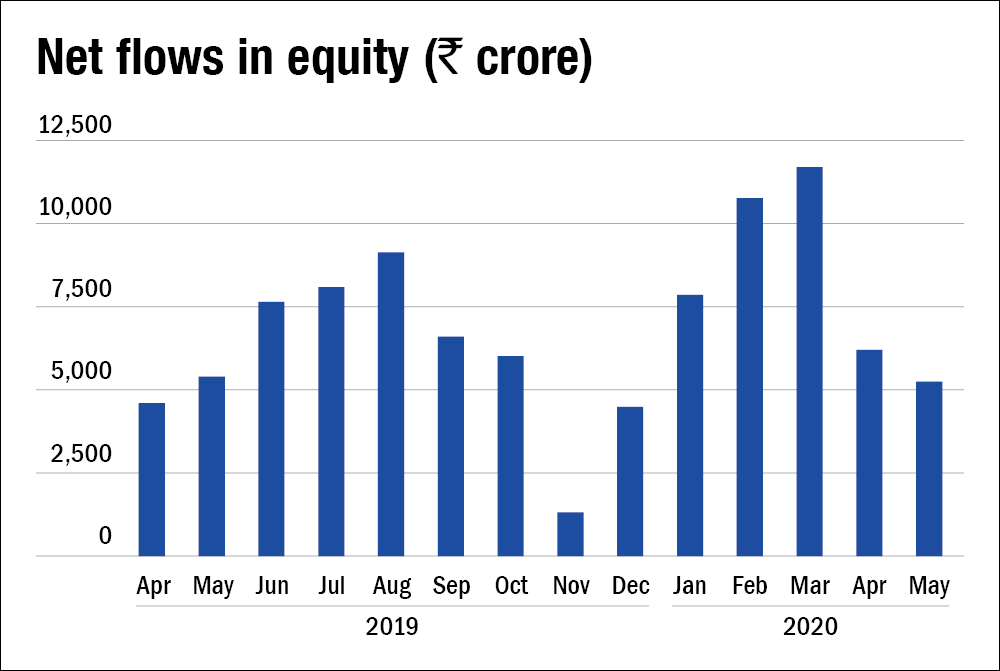

Equity funds witness a moderation in net inflows

Net flows into open-ended equity schemes declined by over 15 per cent over the previous month to Rs 5,200 crore. All equity fund categories, except large & mid cap funds, saw a slight decline in the net inflows as compared to the previous month. The highest inflows were observed in large cap funds (Rs 1,555 crore). However, investors continued to desert dividend yield funds, the only category in the equity segment to witness net outflows.

The SIP investments, although decreased marginally over the previous month, still stay above the Rs 8,000-crore mark.

Gold and arbitrage funds shine

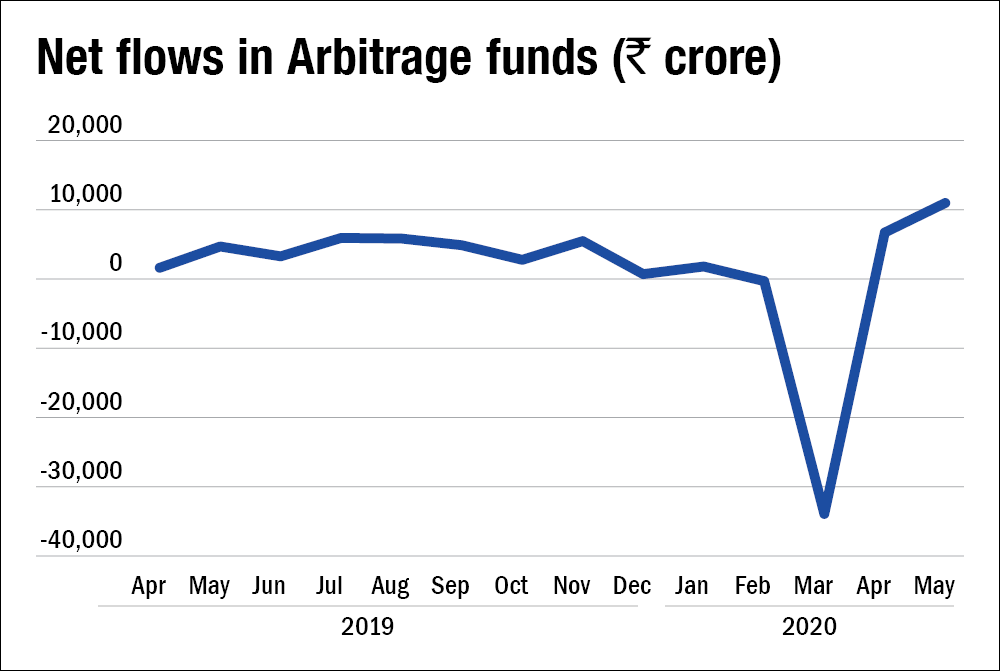

Arbitrage funds witnessed a large inflow to the tune of Rs 10,800 crore. This comes after a massive redemption of over Rs 33,000 crore in the month of March, when many of these funds reported negative returns for a few days amid the rising market volatility.

Gold funds continue to attract investors, adding another Rs 815 crore to their rising asset base. The assets managed by these funds have also increased by over two folds to Rs 10,000 crore over the past one year.