The promoters will now purchase additional shares from the open market within the overall regulatory limit prescribed for promoter equity holding cap, the bank said citing the communication received from promoters.

IndusInd Bank share price jumped over 7 percent in morning trade on June 8 after promoters said they would buy additional shares from the open market.

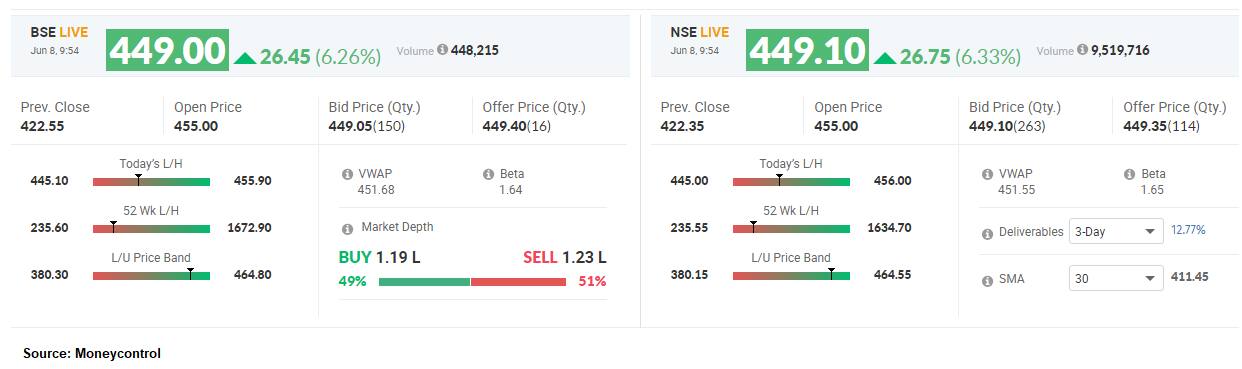

The stock was the top index gainer in both Sensex and Nifty. It was quoting at Rs 453.60, up Rs 31.05, or 7.35 percent at 09:46 hours. It has touched an intraday high of Rs 455.90 and an intraday low of Rs 445.10.

The stock price jumped 30 percent in the last 15 days and was one of the most active stocks on NSE in terms of value with 84,80,547 shares being traded at 09:49 hours.

The promoters, IndusInd International Holdings Ltd. and IndusInd Ltd., presently hold 14.68 percent of the paid-up share capital of the bank. The promoters will now purchase additional shares from the open market within the overall regulatory limit prescribed for promoter equity holding cap, the bank said citing the communication received from promoters.

According to Moneycontrol SWOT Analysis powered by Trendlyne, IndusInd Bank's book value per share has been improving for the last two years with rising net cash flow and cash from operating activity. Moneycontrol technical rating is very bullish with technical indicators and moving averages being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.