Some profit booking is expected this week and experts have advised caution amid the rising number of COVID-19 cases and geo-political tensions.

Benchmark indices registered 6 percent gains as the bulls continued to dominate for the second consecutive week that ended on June 5. This was despite rising number of COVID-19 cases in the country and Moody's downgrading India's sovereign rating.

It was in addition to the 6 percent rally seen in the previous week, all together, taking the total recovery from March's lows to over 33 percent.

The sentiment was boosted by hefty buying in banking and financials on hopes of industrial activity resuming as the nationwide lockdown was eased in non-containment zones. Higher-than-expected tractor sales in May, positive global cues amid optimism over reopening of economic activities, FIIs' consistent buying and stimulus measures by global central banks also helped the rally.

After a surprise rally of around 12 percent in benchmarks as well as the broader markets for two consecutive weeks backed by liquidity, experts expect some profit booking and have advised caution given the rising number of confirmed COVID-19 cases and geo-political tensions. However, the sentiment may remain positive.

"Currently, there seems to be a disparity between the markets and the economy while valuations are also getting heated since the expected recovery is still not showing up in the numbers. Simmering geopolitical tensions may also affect the global markets which will have an impact on ours as well. Caution is advised and stock-specific accumulation may be continued," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Here are 10 key factors that will keep trader busy this week:

Reopening of the economy

The Centre has been allowing gradual reopening of economic activities (including agriculture, industries, shops in green and orange zones) from May with a lot of precautions amid social distancing norms. However, offices, shopping malls, hotels, restaurants and worship places will be allowed to reopen in non-containment zones starting from June 8. These establishments will have to follow social distancing norms and other guidelines.

The market has already reacted positively ahead of the reopening of economic activities. However, experts feel that actual economic data and numbers will decide the market's direction.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

COVID-19 cases rising

Economic activity will resume from June 8 but rapidly rising number of confirmed COVID-19 cases remains a major concern for the stock markets. The cases of COVID-19, the disease caused by the novel coronavirus, are not not showing any signs of stabilising. In fact, India is close to the 10,000-mark in terms of cases being reported on a daily basis.

India has reported over 2.3 lakh confirmed cases, including more than 6,600 deaths. A large part of these cases have been reported in Maharashtra, Tamil Nadu, Delhi and Gujarat. India's tally has crossed that of Italy and Spain to become the fifth worst-hit nation by the pandemic. Globally, there have been over 68.9 lakh confirmed cases of COVID-19. At least 3.9 lakh people have died so far.

However, India's recovery rate is now around 48 percent.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

Earnings

As we enter the second week of June, around 110 companies are expected to declare their March quarter earnings. So far, the quarterly earnings season was largely on expected lines due to the nationwide lockdown which started in March. Yet, management commentaries will be key.

Important earnings to watch out for in coming week would be Titan Company, Hero Motocorp, Eicher Motors, Hindalco Industries, Mahindra & Mahindra, BHEL, Chalet Hotels, Gujarat State Petronet, PVR, Bombay Dyeing, Graphite India, MRPL, TeamLease Services, Century Textiles, Indian Hotels, Mahanagar Gas, Shriram Transport Finance, Dixon Technologies, Redington, Sundram Fasteners, Westlife Development and Vinati Organics, among others.

FOMC meeting outcome

Globally, all eyes will be on Federal Reserve's commentary in its two-day policy meeting which will be concluded on June 10. This would be first meeting after Fed Chairman Jerome Powell in April said United States' economy would see the impact of lockdown over one year period. Hence any change in Fed's stance will be closely watched.

Economists and market experts expect the Fed to announce additional bond-buying programs to support the economy and any hint from the commentary about the major pain related to COVID-19 crisis is behind.

FIIs

Foreign institutional investors (FIIs) poured in Rs 13,927.52 crore in cash markets (equity) in the first week of June, which was higher than Rs 13,914.49 crore invested in entire May.

Hence, liquidity was one of key reasons for rally in the market in last two straight weeks and the same will be keenly watched going ahead given the trillions of dollars of stimulus and liquidity measures announced by global central banks.

"Going ahead, it would be important to watch out for how liquidity percolates in global financial markets. This dispersal of liquidity may hint at a possible long-term direction for the Indian markets as well. This signal will aptly be depicted by FPIs and hence their behaviour will have to be observed to understand liquidity flows into India," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

GST Council meet

The 40th meeting of the GST Council, headed by Union Finance Minister Nirmala Sitharaman and comprising her state counterparts, will be held via video conferencing on June 12.

They will be discussing the impact of the pandemic on revenues of the Centre and states and ways to bridge the revenue gap, news agency PTI quoting unnamed sources as saying.

The Council may also discuss ways to garner funds to compensate states for the revenue loss due to Goods and Services Tax (GST) implementation, the report added.

The meeting is important to watch out for, especially after the government refrained from releasing the monthly GST revenue collection data for April and May as collection was dismal and the deadline for filing returns had been extended due to the lockdown.

Technical view

The Nifty50 gained 1.1 percent on June 5 and nearly 6 percent during the week, forming small and large bullish candles, respectively. But volatility in last couple of sessions indicated that the market could be feeling of exhaustion after consistent rally.

Hence, experts feel the market could see some breather in coming days. But the overall mood remains positive, and 10,200 mark and movement in Bank Nifty would be key to watch out for.

"If Nifty crosses and manages to sustain above 10,200 levels which is the key resistance, then we can expect a continuation of a current pullback towards 10,400 levels," Nilesh Ramesh Jain, Derivative Analyst - Equity Research at Anand Rathi told Moneycontrol.

"The momentum oscillator MACD has provided fresh buy crossover on the weekly scale and RSI has started making a higher top and higher bottom formation which hints that we can expect some moderate upmove in the coming week as well. However, the index is not out of the woods yet and we are witnessing mere extension of a pullback rally. So one should refrain from creating an aggressive long position at the higher levels and focus on stock-specific action," he said, adding that immediate support is now placed at 9,800.

F&O cues

Options data indicates that the maximum Put base is placed at 9,800 followed by 9,500 strike. Fresh Put writing was seen in 9,900 and 10,000 strikes, which are likely to act as a support zone.

The Call writers were active in 10,300 strike, which holds the highest open interest.

"So continuous Call writing at 10,300 hints that Nifty may find it difficult to surpass the same in the coming week. The options data indicates a broader range of 9,800 to 10,300. Based on the data, we are expecting some broader consolidation in the coming week," Nilesh Jain said.

The volatility index India VIX fell 5.6 percent to end near 28.5 levels. "The cooling off in the volatility is giving comforts to the bulls and thus, we can expect some stability and pullback in the coming week," Jain said.

Corporate action and macro data

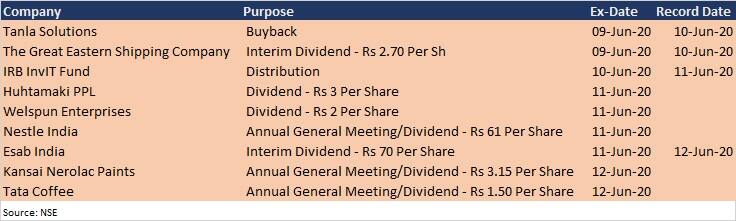

Here are key corporate actions taking place this week:

On the macro front, industrial production for April and CPI inflation for May, and foreign exchange reserves data for the week that ended on June 5 will be released on June 5.

Given the steep fall in manufacturing and services PMI, and Eight Core Industries in April, there could be sharp contraction in industrial production in April due to complete nationwide lockdown.

Global cues

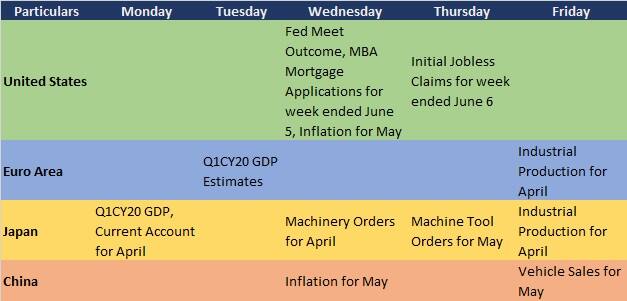

Here are key global data points to watch out for this week: