Company intends to utilise the net proceeds from this rights issue towards repayment of all or a portion of certain borrowings (including commercial papers of Rs 16,350 crore, non-convertible debentures Rs 36,213 crore).

Reliance Industries, owned by the billionaire Mukesh Ambani, successfully closed its biggest ever Rs 53,124-crore rights issue on June 3 after getting overwhelming response from existing shareholders.

The 42,26,26,894 partly paid-up equity shares issue received applications worth Rs 84,000 crore and was subscribed 1.59 times.

The issue was priced at Rs 1,257 per share, out of which investors paid first instalment of Rs 314.25/share till June 3, the last day for rights issue subscription.

The company intends to utilise the net proceeds from this rights issue towards repayment of all or a portion of certain borrowings (including commercial papers of Rs 16,350 crore, non-convertible debentures Rs 36,213 crore).

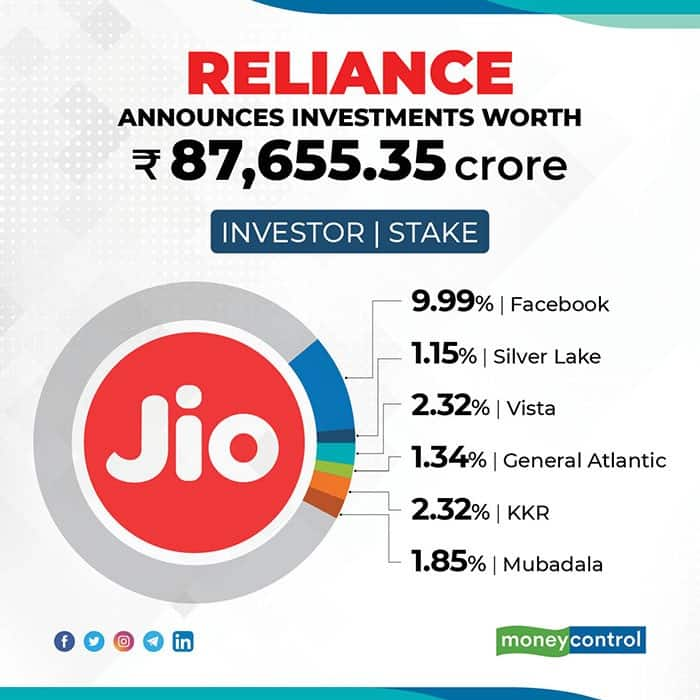

To achieve the goal of debt-free company by March 2021, the conglomerate announced six deals in past six weeks.

With the latest investment, Jio Platforms has raised Rs 87,655.35 crore from leading global technology and growth investors including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR and Mubadala in less than six weeks, said RIL in its BSE filing.

JM Financial and Kotak Mahindra Capital Company are global co-ordinators as well as lead managers for the rights issue. Other lead managers are Axis Capital, BNP Paribas, DSP Merrill Lynch, Citigroup Global Markets India, Goldman Sachs India Securities, HDFC Bank, HSBC Securities and Capital Markets India, ICICI Securities, IDFC Securities, JP Morgan India, Morgan Stanley India and SBI Capital Markets. Kfin Technologies is the registrar to the issue.

Since the stock has been in the news for a while and a lot has transpired in the company. Investors are now wondering what is coming their way next.

Here is what to watch out for next with respect to mega rights issue:

1> Basis of Allotment: The company will finalize the basis of allotment of rights issue shares on or about June 10, 2020.

a> Full allotment will be made to those eligible equity shareholders who have applied for their Rights Entitlements of rights equity shares either in full or in part and also to the renouncee(s) who has or have applied for rights equity shares renounced in their favour, in full or in part.

b> Eligible equity shareholders whose fractional entitlements are being ignored and eligible equity shareholders with zero entitlement, would be given preference in allotment of one additional Rights equity share each if they apply for additional rights equity shares. Allotment for these shareholders will be considered if there are any unsubscribed rights equity shares after allotment under (a) above.

c> In case of application for additional rights equity shares by eligible equity shareholders, allotment will be at the sole discretion of the board in consultation with the Designated Stock Exchange.

d> In case of application for additional rights equity shares by renouncees, allotment will be made if there is surplus available after making full allotment to eligible equity shareholders.

2> Transfer of Rights issue shares: The Rights equity shares will be credited to the demat account of eligible shareholders and renouncees on or about June 11.

3> Refund: In case of non-allotment or partial allotment, surplus application money will be refunded to the investor after finalization of basis of allotment in consultation with Designated Stock Exchange.

4> Listing of Partly Paid Up Rights issue shares: The rights shares credited to shareholders are called partly paid-up rights shares as shareholders made only part payment (first instalment of Rs 314.25 out of total issue price of Rs 1,257 per share) against these shares. These shares will be separately listed on bourses on June 12 with a separate ISIN ID.

The closing price before listing these shares would be intrinsic value + first instalment (Rs 314.25). Intrinsic value is the difference between rights issue price (Rs 1,257) and Reliance Industries current market price (June 11th's closing price).

5> Second Instalment Due: Eligible shareholders will have to make a payment of second instalment of Rs 314.25 in May 2021. The company will inform the relevant date for the same. These partly paid up rights shares will continue trading under separate ISIN and on ex-date (which will be decided company later) the second instalment of Rs 314.25 will be added in partly paid-up rights share price.

6> Third Instalment Due: The balance payment or last instalment of Rs 628.50 will be paid in November 2021.

7> Merger with Existing Reliance Shares: On payment of the final call (last instalment) in respect of the partly paid-up rights equity shares, such partly paid-up rights equity shares would be converted into fully paid-up equity shares which will be merged with existing fully paid-up equity shares of Reliance Industries and listed under the existing ISIN of Reliance Industries.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol