A recent poll conducted by Moneycontrol with 13 experts last week highlighted that almost 54 percent of them favour large and select midcaps as their preferred bets for the next one year.

Want to invest but not sure where to invest for the long term? If you are an investor, especially who has a horizon of more than a year then it is always a constant struggle to find the right stock(s) that could generate wealth.

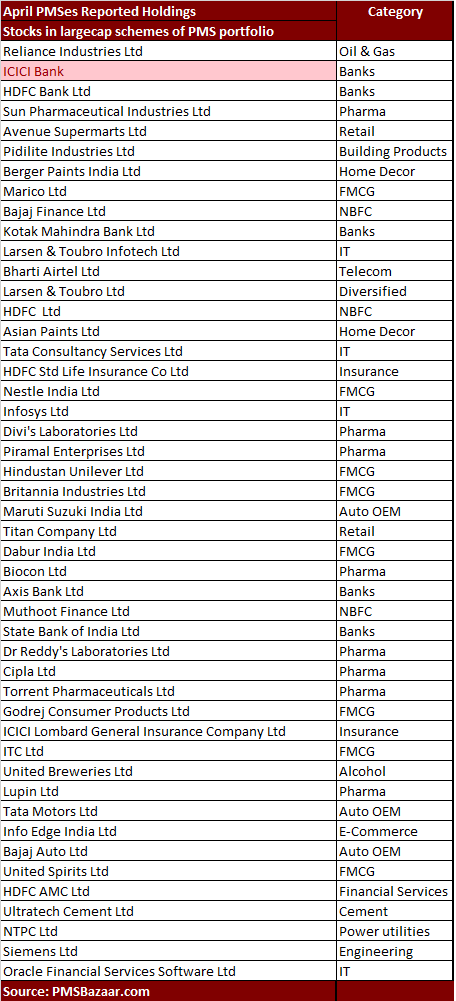

Well, a sneak peek into the portfolio of PMS schemes across 120 strategies reveals there are nearly 50 stocks in the large and midcap space in which fund managers have allocated more than 5 percent of the scheme's AUM, according to data collated by PMSBazaar.com, an online portal used for PMS comparison, showed.

Portfolio Management Services cater to wealthy investors with portfolio sizes exceeding Rs 50 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

There are as many as 47 largecaps in which fund managers have allocated more than 5 percent of the scheme AUM, including RIL, ICICI Bank, HDFC Bank, Sun Pharma, Pidilite Industries, Bajaj Finance, Kotak Mahindra Bank, and Bharti Airtel etc. among others.

Experts are of the view that largecap stocks and select Midcaps have a better chance of surviving this COVID-19 storm.

A recent poll conducted by Moneycontrol with 13 experts last week highlighted that almost 54 percent of them favour large and select midcaps as their preferred bets for the next one year while the rest 38 percent are of the view that only largecaps are a safer bet.

“Large caps are a good investment option currently due to declines in the range of 20-30% and it provides a level of safety and protection against volatility,” Vijay Kuppa, co-founder, Orowealth told Moneycontrol.

The lockdown which extended for more than 2 months now has already resulted in job losses, India sovereign downgrade, severe pain in government fiscal math, as well as a slowdown in economic activity.

The economic growth fell sharply in the January-March quarter to 3.1 percent (lowest in 44 quarters) and for the full year to 4.2 percent (lowest growth in 11 years). Growth was 6.1 percent in 2018-19.

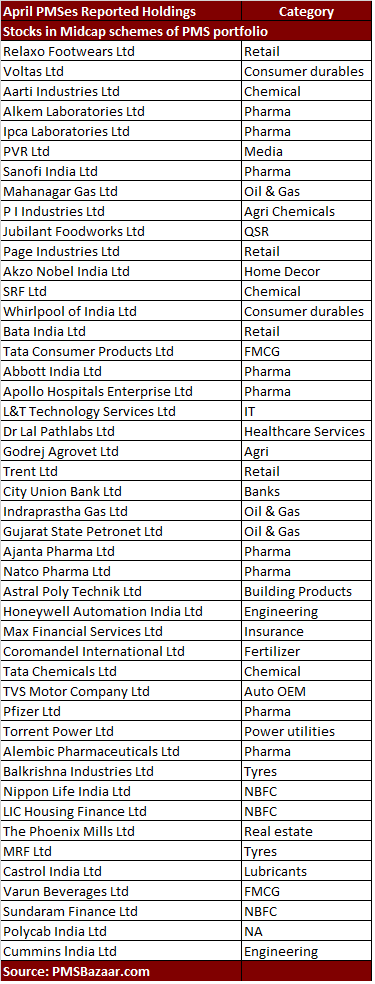

Midcap space:

There are as many as 46 midcaps stocks in which fund managers of top PMS schemes have allocated more than 5 percent stake of the scheme portfolio. Stocks are filtered from a pool of 120 strategies, according to data compiled by PMSBazaar.com.

Facebook-BCG report suggests these measures for businesses to unlock the changing consumer behaviour in the current pandemic. Read More!