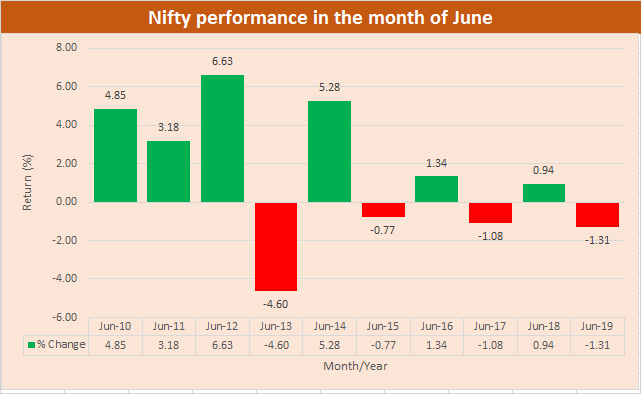

Historically, bulls have controlled the D-Street in the last six out of ten years in the month of June. Of those six instances, Nifty50 jumped 6% in June 2012, 5% in June 2014, and nearly 5% in June 2010.

‘Sell in May and go away’ turned out to be true this year and now all eyes are on June. Anecdotal evidence suggests that bulls managed to get an upper hand over bears in the last 10 years in the month of June.

Historically, bulls have controlled the D-Street in the last six out of ten years in the month of June, data from AceEquity showed.

Of those six instances, Nifty50 jumped 6 percent in June 2012, 5 percent in June 2014, and nearly 5 percent in June 2010 — three of the biggest gains.

On the other hand, bears have dominated the market on four instances —2013 (Nifty down 4.6 percent), 2019 (Nifty down 1.3 percent), 2017 (Nifty down 1.08 percent), and 2015 (Nifty down 0.7 percent).

Benchmark indices have rallied more than 20 percent from the low of 7,500 recorded in the month of June, but the Nifty50 is facing resistance near 9,600-9,800 levels.

Nifty50 picked up momentum in the last week of May, but it failed to close above 9,600 towards the close of the month. But, strong rollovers for the June series suggest that the index could have a touch and go moment with 10,000.

However, it is unlikely that the momentum will sustain largely on account of the rise in COVID-19 relation infections which are on the rise across the world, as well as the US-China trade dispute.

But, reopening of the economic activities to a certain extent, as well as hopes of a stimulus package from central banks across the world could lend support. Analysts still remain divided on the direction the market would take.

“The winner from the Bull Vs Bears tussle for June will depend on India’s policymakers and if they continue to extend the lockdown,” Umesh Mehta, Head of Research, Samco Securities told Moneycontrol.

“Opening of the lockdown in a phased manner could lead to some stabilization, and benchmark indices will experience a relief rally. However, investors should not buy into this rally as it can be very short-lived and risky,” he said.

Mehta further added that a decisive break of the range of 9900-10000 still looks difficult and another round of equity sell-off cannot be ruled out unless we surpass this range

On the weekly charts, the Nifty formed a bullish candle which indicates that for the short term Nifty might move to the next resistance levels at 9,700 and 9,850 and on the downside 9,400 and 9,350 will be the support levels.

“The June series has started well with a positive note but the ongoing conditions like US-China diplomatic issues, ending of the lockdown 4.0, and India-China border tension may keep the market volatile,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited – Investment Advisor told Moneycontrol.

“India is in a phase where the number of cases has been increasing continuously and in the last week we had seen the highest spike in the number of cases in a single day,” he said.

Garg further added that at the same time lockdown 4.0 is ending on 31st May, and how the government reacts to the present conditions may keep the investors busy throughout the series.

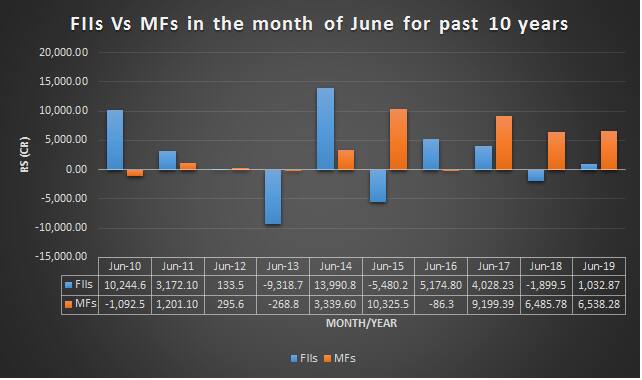

Institutional Activity:

Foreign institutional investors (FIIs) have been net buyers in June in seven out of the last 10 years, according to data from AceEquity.

In the rest of the instances - they pulled out more than Rs 9,000 crore in 2013, Rs 5,000 crore in 2015, and around Rs 2,000 crore in 2018 for the month of June.

DIIs were also mostly net buyers in June in seven out of the last 10 years. They poured in more than Rs 10,000 crore in 2015, Rs 9199 crore in 2017, and over Rs 6000 crore just last year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Facebook-BCG report suggests these measures for businesses to unlock the changing consumer behaviour in the current pandemic. Read More!