CHANDIGARH: The Punjab government on Monday decided to impose Covid cess on liquor from June 1. The move will help the state mop-up an additional revenue of Rs 145 crore in the current fiscal for combating the coronavirus.

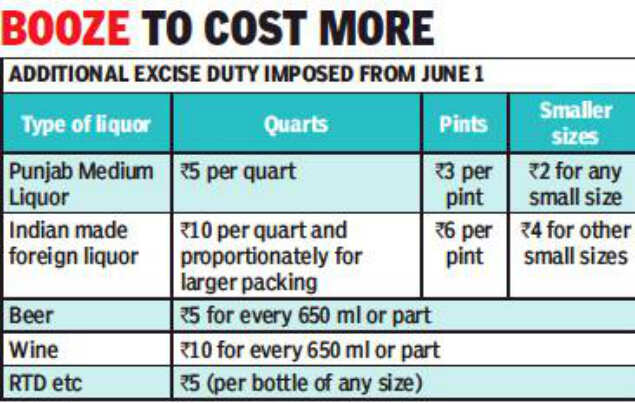

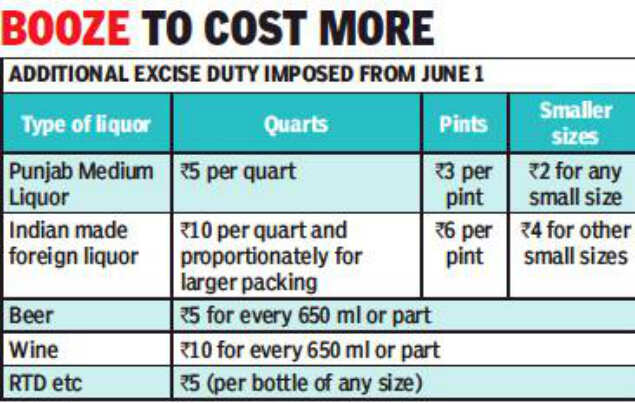

Making an announcement about the Covid cess, chief minister Amarinder Singh tweeted, "We have decided to levy additional excise duty & assessed fee in lieu of Covid cess on liquor with effect from 1 June 2020. These would range from INR 2 to INR 50 depending on type and size of the item sold. The amount collected will be utilised for #Covid19 related expenditure."

Dipping excise revenue in the state has become a political issue ever since Punjab insisted on opening liquor vends after the lockdown. A section of ruling party MLAs have also demanded an inquiry into the shortfall in meeting excise targets.

An official spokesperson said the state is facing a revenue shortfall of Rs 26,000 crore, which is 30% of the total budget revenue estimates for FY 2020-21, necessitating some "tough measures" to generate additional revenue.

Amarinder has accepted the recommendation of the group of ministers (GoM) constituted on May 12, to levy additional excise duty and additional assessed fee on liquor during the current financial year. The proceeds of the additional levy will be utilized for Covid-related expenditure, said Amarinder, directing the department of excise and taxation to charge the cess, at the time of issuance of permits for transportation of liquor from L-1/L-13 (wholesale licences).

Additional assessed fee on imported foreign liquor

Amarinder had earlier asked the group of ministers, comprising the finance, education, urban development and forests ministers, to examine the proposal regarding levy of special cess/ Covid cess on the sale of liquor, to partially recover some of the revenue losses amid this unprecedented crisis.

In line with GoM’s recommendations, the department of excise and taxation has decided to impose additional assessed fee on imported foreign liquor and imported beer, and additional excise duty on other types of liquor.

There were indications that Punjab too planned to follow other states in imposing Covid cess at the pre-Cabinet meeting on May 9 that had two ministers walking out in protest after a tiff with chief secretary Karan Avtar Singh.

To factor in the lockdown period, the state government is set to announce relief for liquor contractors soon. Sources said the demand from contractors to reduce minimum guaranteed quota (MGQ) by 30% till July is likely to be accepted, besides waiving off licence fee for April, before the vends reopened in May first week. The contractors have already put up the demand before the group of ministers looking into the issue.

Meanwhile, reacting to imposition of Covid tax, liquor contractors said the rate was not as high as other states. “Contractors will have no option but to pass it on to consumers and the amount of increase in price for the end buyers could be a bit more,” said one.

With the state government keen to get its unauctioned vends sold, it has decided to reduce prices by 10%-15%. The remaining vends include those surrendered by liquor contractors apprehensive of poor business. But the contractors are still not unexcited. “Two months have already been lost and not many would pay the quoted price for the remaining period, especially when the migrant labourers are missing,” said a contractor from Jalandhar.

Making an announcement about the Covid cess, chief minister Amarinder Singh tweeted, "We have decided to levy additional excise duty & assessed fee in lieu of Covid cess on liquor with effect from 1 June 2020. These would range from INR 2 to INR 50 depending on type and size of the item sold. The amount collected will be utilised for #Covid19 related expenditure."

Dipping excise revenue in the state has become a political issue ever since Punjab insisted on opening liquor vends after the lockdown. A section of ruling party MLAs have also demanded an inquiry into the shortfall in meeting excise targets.

An official spokesperson said the state is facing a revenue shortfall of Rs 26,000 crore, which is 30% of the total budget revenue estimates for FY 2020-21, necessitating some "tough measures" to generate additional revenue.

Amarinder has accepted the recommendation of the group of ministers (GoM) constituted on May 12, to levy additional excise duty and additional assessed fee on liquor during the current financial year. The proceeds of the additional levy will be utilized for Covid-related expenditure, said Amarinder, directing the department of excise and taxation to charge the cess, at the time of issuance of permits for transportation of liquor from L-1/L-13 (wholesale licences).

Additional assessed fee on imported foreign liquor

Amarinder had earlier asked the group of ministers, comprising the finance, education, urban development and forests ministers, to examine the proposal regarding levy of special cess/ Covid cess on the sale of liquor, to partially recover some of the revenue losses amid this unprecedented crisis.

In line with GoM’s recommendations, the department of excise and taxation has decided to impose additional assessed fee on imported foreign liquor and imported beer, and additional excise duty on other types of liquor.

There were indications that Punjab too planned to follow other states in imposing Covid cess at the pre-Cabinet meeting on May 9 that had two ministers walking out in protest after a tiff with chief secretary Karan Avtar Singh.

To factor in the lockdown period, the state government is set to announce relief for liquor contractors soon. Sources said the demand from contractors to reduce minimum guaranteed quota (MGQ) by 30% till July is likely to be accepted, besides waiving off licence fee for April, before the vends reopened in May first week. The contractors have already put up the demand before the group of ministers looking into the issue.

Meanwhile, reacting to imposition of Covid tax, liquor contractors said the rate was not as high as other states. “Contractors will have no option but to pass it on to consumers and the amount of increase in price for the end buyers could be a bit more,” said one.

With the state government keen to get its unauctioned vends sold, it has decided to reduce prices by 10%-15%. The remaining vends include those surrendered by liquor contractors apprehensive of poor business. But the contractors are still not unexcited. “Two months have already been lost and not many would pay the quoted price for the remaining period, especially when the migrant labourers are missing,” said a contractor from Jalandhar.

Coronavirus outbreak

Trending Topics

LATEST VIDEOS

City

Watch: Video proof of Pak diplomat spying with a decoy sent by the Indian Intelligence Agency

Watch: Video proof of Pak diplomat spying with a decoy sent by the Indian Intelligence Agency  Unlock 1.0: Non-subsidized LPG gas price hiked by Rs 11.50 in Delhi

Unlock 1.0: Non-subsidized LPG gas price hiked by Rs 11.50 in Delhi  Covid-19 crisis and lockdown: Delhi CM Arvind Kejriwal seeks public suggestions

Covid-19 crisis and lockdown: Delhi CM Arvind Kejriwal seeks public suggestions  India unlocks: Guidelines issued to taxi services operating to and from Delhi Airport

India unlocks: Guidelines issued to taxi services operating to and from Delhi Airport

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Kerala Coronavirus Helpline NumberHaryana Coronavirus Helpline NumberUP Coronavirus Helpline NumberBareilly NewsBhopal NewsCoronavirus in DelhiCoronavirus in HyderabadCoronavirus in IndiaCoronavirus symptomsCoronavirusRajasthan Coronavirus Helpline NumberAditya ThackerayShiv SenaFire in MumbaiAP Coronavirus Helpline NumberArvind KejriwalJammu Kashmir Coronavirus Helpline NumberSrinagar encounter

Get the app