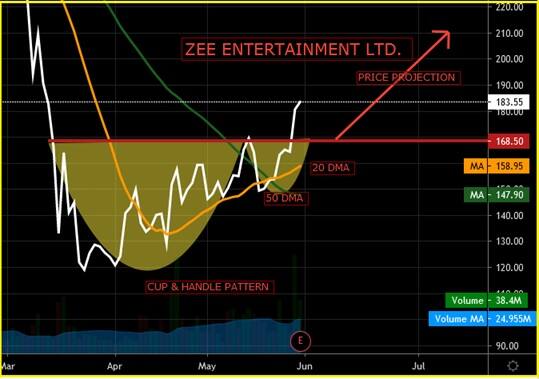

We recommend buying Zee Entertainment Enterprises around Rs 170 with a stop loss of Rs 148 for higher targets of Rs 210.

Shabbir Kayyumi

What is Cup & Handle Pattern?

The Cup & Handle chart pattern is popular and easy to spot pattern. The Cup & Handle pattern is believed to be one of the most reliable & popular patterns among traders community. In technical analysis, a Cup & Handle pattern describes a specific chart formation that projects a bearish-to-bullish trend reversal.

Why to Buy Zee Entertainment Enterprises?

A Cup & Handle reversal pattern forms after a down trend, and its completion marks a trend reversal to uptrend. Cup & Handle patterns are an integral part of technical analysis, but successful traders combine these techniques with technical indicators and other forms of technical analysis to maximise their odds of success.

In the standard Cup & Handle pattern, we connect the high after Cup with the high created after the handle. A trendline is drawn by connecting these highest points of the two peaks, which is called as 'Neckline'. This trendline is the most important component of Cup & Handle pattern.

Zee is having a strong resistance line standing around Rs 170 levels indicating strong bullish breakout only above these levels. Recent formation of Cup and Handle pattern has given a breakout on a close above Rs 170 mark which suggests buying in the stock on dip for higher targets of Rs 210. Volume can also add further insight while trading these patterns. Decent volume participation while giving breakout is also giving support to C & H pattern.

Figure.1. Cup & Handle pattern and buy signal on Zee Entertainment

Figure.1. Cup & Handle pattern and buy signal on Zee Entertainment

Buy Signal

1>. A close above neckline (Rs 170) of Cup & Handle pattern is indicating trend reversal to uptrend.2>. Short-term moving average 20 DMA (Rs 158) defines short-term trend is providing support to buyers as prices are sustained and trading around it.

3>. Mid- term moving average 50 DMA (Rs 148) defines mid-term trend is very well augur with bulls as prices are sustained and trading above it.

4>. Decent volume participation while pattern breakout will also give additional confirmation.

Profit Booking

Target as per Cup & Handle pattern is calculated by adding height of Cup to neckline which comes to Rs 220, however one can book profits near previous swing high which is around Rs 210.

Stop Loss

Entire bullish view negates on breaching of Handle on closing basis and one should exit from long position. In case of Zee, it is placed around Rs 148 levels.

Conclusion

We recommend buying Zee Entertainment Enterprises around Rs 170 with a stop loss of Rs 148 for higher targets of Rs 210 as indicated in above chart.

The author is Head - Technical Research at Narnolia Financial Advisors.

Disclosure: Narnolia Financial Advisors/Analyst (s) does/do not have any holding in the stocks discussed but these stocks may have been recommended to clients in the past. Clients of Narnolia Financial Advisors Ltd. may be holding aforesaid stocks. The stocks recommended are based on our analysis which is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.