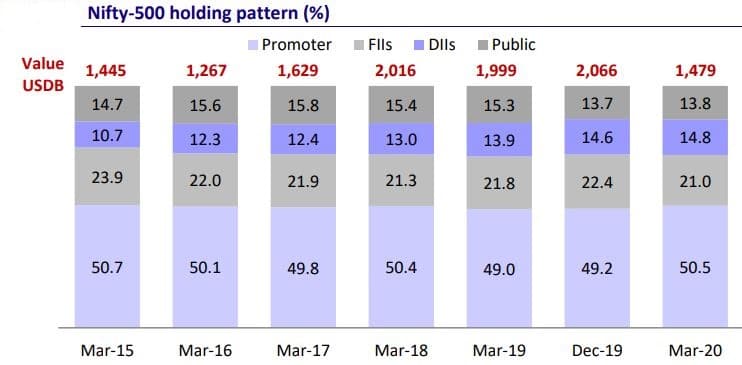

In Q4FY20, FII holdings in the Nifty500 hit a 5-year low, declining 140 bps quarter-on-quarter (QoQ) and 80 bps year-on-year (YoY) to 21 percent in Q4FY20, a report from brokerage firm Motilal Oswal Financial Services said.

The fourth quarter of the financial year 2020 witnessed strong capital outflow by the foreign Institutional Investors (FII).

Data from NDSL shows FIIs invested Rs 957 crore and Rs 8,970 crore in the Indian market in the month of January and February, respectively, but took out a whopping Rs 1,18,203 crore in March.

In Q4FY20, FII holdings in the Nifty500 hit a 5-year low, declining 140 bps quarter-on-quarter (QoQ) and 80 bps year-on-year (YoY) to 21 percent in Q4FY20, a report from brokerage firm Motilal Oswal Financial Services said.

As per the report, FIIs have reduced ownership in 67 percent of Nifty500 and 90 percent of Nifty50 companies QoQ.

However, a contrasting trend was observed on the front of domestic Institutional Investors (DIIs) holdings.

DII holdings in the Nifty500 were up 20 bps QoQ and 90 bps YoY to 14.8 percent in Q4FY20. DIIs increased stake in 61 percent of Nifty500 and 78 percent of Nifty50 companies QoQ, Motilal Oswal said.

Source: Motilal Oswal

Source: Motilal Oswal

Meanwhile, promoters took advantage of the sharp correction post the COVID-19 pandemic and raised ownership.

"Promoter holdings in the Nifty500 companies increased 130 bps QoQ and 150 bps YoY to 50.5 percent in Q4FY20. FII ownership as a proportion of free float of the Nifty500 declined 180 bps to 42.3 percent. DII ownership as a proportion of free float increased 90 bps QoQ and 260bp YoY to 29.8 percent," said Motilal Oswal.

Motilal Oswal highlighted that over the last five years, the incremental dominance of domestic capital savings has gone up with consistent and rising SIP investments along with a shift toward financial savings.The FII-DII ownership ratio in the Nifty500 is at a new low and has declined to 1.4 times from 2.2 times in the last five years.

In the last one year, an increase in the FII-DII ratio was recorded in the Insurance sector. Telecom, Real Estate, Private Banks, Cement, Healthcare, Automobiles, Retail and Technology were the other key sectors to see a decline, Motilal Oswal said.

In the Nifty500, FIIs have the highest ownership in Private Banks (44.6 percent), followed by NBFCs (35.6 percent), Telecom (21.7 percent), Oil and Gas (21.3 percent) and Real Estate (20.4 percent). DIIs have the highest ownership in Capital Goods (23.9 percent), Metals (21.2 percent), Private Banks (20.3 percent), Utilities (19.5 percent) and PSU Banks (17.8 percent), the brokerage added.

Sequentially, on a QoQ basis, FIIs have increased stake in Telecom (up 190 bps), NBFCs (up 110 bps), Insurance (up 50 bps), Retail (up 30 bps), Utilities (up 20 bps) and Oil and Gas (up 10bps). In contrast, Metals (down 200 bps), Autos (down 150 bps), Capital Goods (down 140 bps), Private Banks (down 120 bps), Healthcare (down 110 bps) and Cement (down 110 bps) have seen a reduction in FII stake, Motilal Oswal said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.